by Rinki Pandey November 24, 2025

Renters’ insurance has become one of the most essential tools for compliance and protection in modern rental housing. It shields tenants from financial risk after unexpected events like fire, theft, or water damage and it protects landlords too. When renters have liability coverage, the property owner is not left to pay for accidental damage caused by a tenant. From kitchen fires to burst washing machine hoses, these incidents can cost thousands of dollars if there is no insurance in place.

That’s why nearly all large rental housing operators now require renters’ insurance.

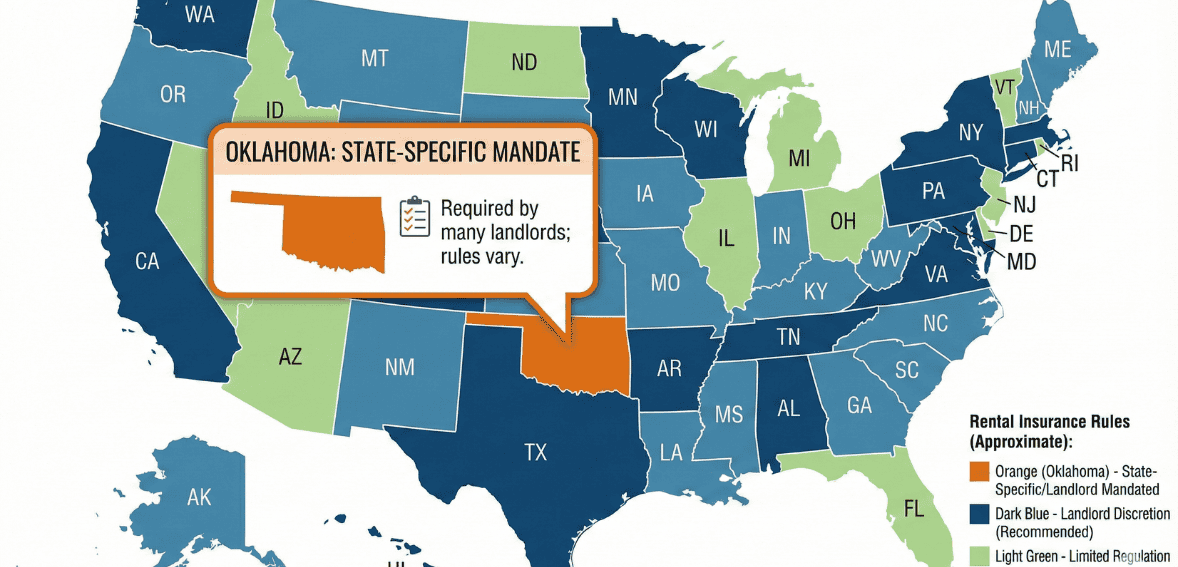

However, the legal framework varies across jurisdictions, and the rules governing how property managers enforce these requirements are evolving rapidly. Some states impose limits on liability coverage amounts. Some housing programs restrict whether insurance can be required. And in one state Oklahoma landlords are not allowed to require renters’ insurance.

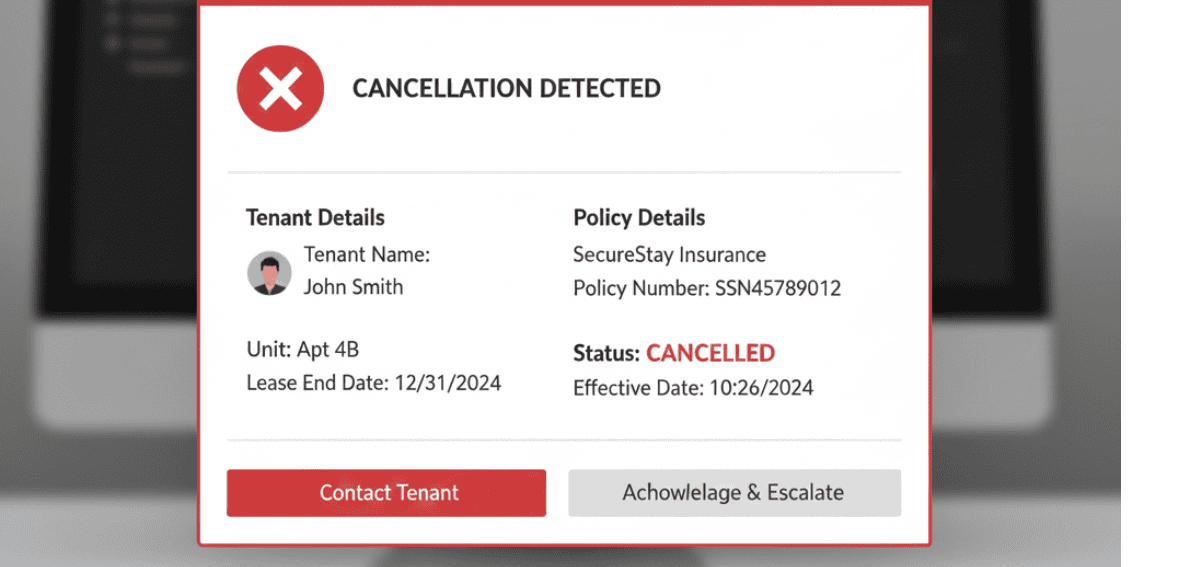

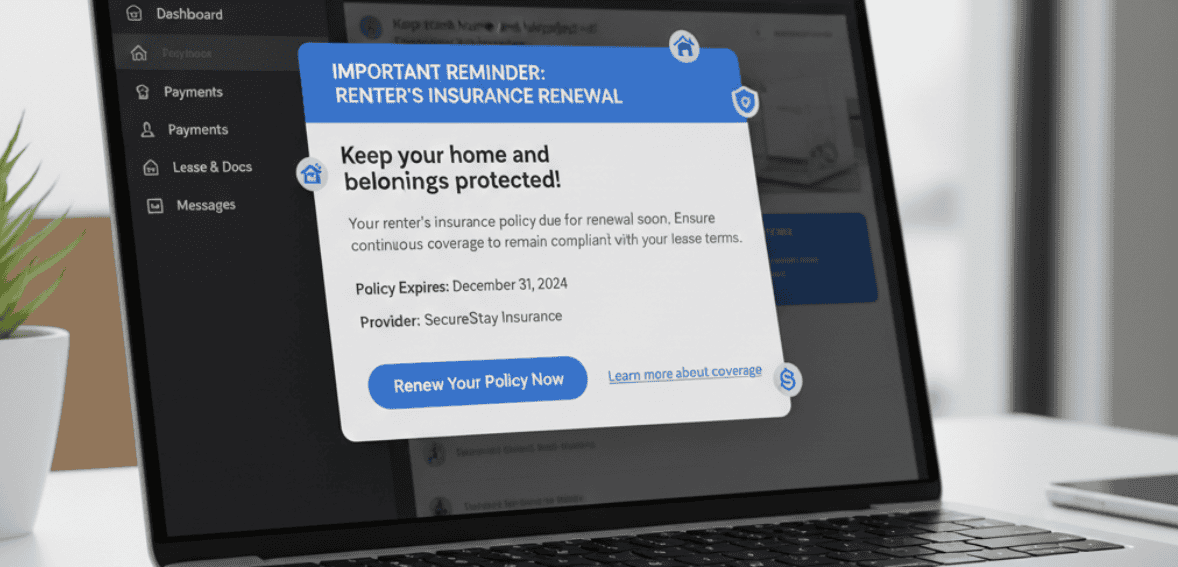

Verification is becoming a bigger challenge. Many tenants purchase a policy on move-in day only to cancel it within weeks. That puts the property and everyone in the building at risk. To remain compliant, property managers must not only collect proof of insurance but also continuously verify that coverage remains active.

As 2025 unfolds, property managers are turning to renters insurance verification software to automate monitoring, avoid licensing violations, and protect themselves from legal risk. Manual tracking is no longer enough; missed cancellations can expose landlords to significant liabilities.

This guide breaks down the crucial laws, compliance responsibilities, and risk-management strategies that every landlord and property manager needs to understand to stay protected.

Understanding Renters Insurance Legality in All 50 States

There is no federal law requiring tenants to carry renters’ insurance. Instead, rules are determined at the state level and the vast majority support landlord-required coverage as long as it is disclosed in the lease.

In all 49 states, landlords can require renters’ insurance as a condition of tenancy. As long as the lease is clear, landlords may:

- Set minimum liability coverage amounts

- Require proof of ongoing insurance

- Enforce non-compliance as a lease violation

However, Oklahoma is the exception. It uniquely prohibits landlords from requiring renters’ insurance as a condition of renting. Tenants may be asked to provide coverage voluntarily, but refusal cannot be used as grounds for denial, eviction, or fees.

Another important state-level rule exists in Oregon, where coverage is allowed but regulated very strictly:

- Liability maximum capped at $100,000

- Landlord cannot be the policy beneficiary

- Requirements must be applied fairly and equally

Some additional restrictions apply in subsidized or public housing programs. Most government-assisted rentals prohibit requiring insurance because tenants cannot be forced to incur extra housing costs beyond approved limits. However, landlords may still recover costs for tenant-caused damage if it occurs.

The legal foundation is clear: almost everywhere, landlords can require insurance but they must understand local limitations and communicate requirements consistently to avoid discrimination claims.

Defining Standard Coverage for Rental Properties in 2025

Modern renters’ insurance policies include two critical components:

Personal Property Coverag

Protects a tenant’s belongings (furniture, electronics, clothing) from fire, theft, and certain types of water damage.

Liability Coverage

Protects against accidental damage or injuries caused by the tenant the key protection for landlords.

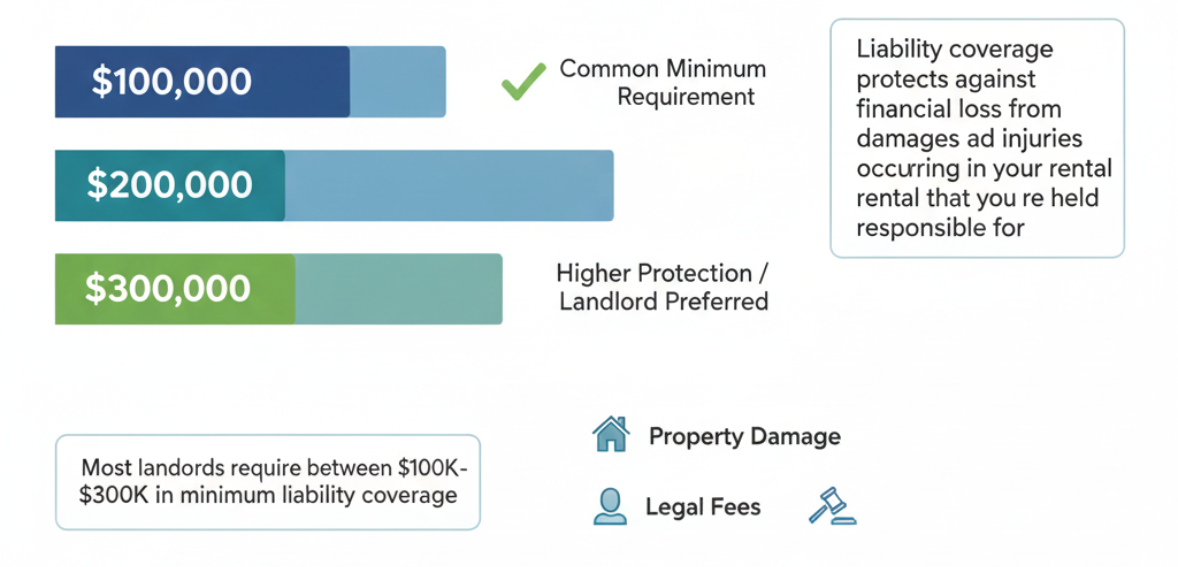

Industry standards in 2025 generally require:

- $100,000 minimum liability

- $300,000 recommended for higher-risk properties

Why liability matters most: If a tenant’s candle starts a fire that damages multiple units, that liability pays for the repairs saving the landlord from tens of thousands of dollars in expenses.

Another growing focus is loss-of-use coverage, which helps Rental Property Payments of tenants pay for temporary housing after significant damage. While not usually mandatory, it prevents displacement issues that can complicate recovery efforts after an incident.

Coverage levels should reflect property type:

- High-density multifamily → higher liability

- Older buildings with risk factors → stronger requirements

- Luxury assets → require personal property coverage that aligns with tenant lifestyles

Clear expectations ensure both parties understand their protection from day one.

The Policy Lapse Problem and Why Verification Systems Are Now Essential

The biggest challenge in renters insurance enforcement is not the initial requirement, it is what happens afterward. Many property managers check proof of coverage only at move-in. But data inside the industry shows: Over one-third of tenants cancel their policy after providing proof. They do it to save money assuming nothing will go wrong.

That means:

- Property managers lose protection

- Landlords unknowingly assume high risk

- Legal obligations are not maintained

- Incident response becomes chaotic and expensive

Without tracking policy renewals and expiration dates, landlords are blind to risk and this exposes them legally if they claim to enforce coverage.

Renters insurance verification software solves this by:

- Automating policy tracking

- Detecting cancellations instantly

- Alerting managers when coverage lapses

- Updating compliance in real time

- Keeping documented proof in case of disputes

In 2025, software tracking is rapidly replacing manual methods like paper files and spreadsheets. Too much can be overlooked when operators are juggling hundreds of active leases. Automation protects both sides and supports consistent enforcement.

The Critical Distinction: “Additional Interest” vs. “Additional Insured”

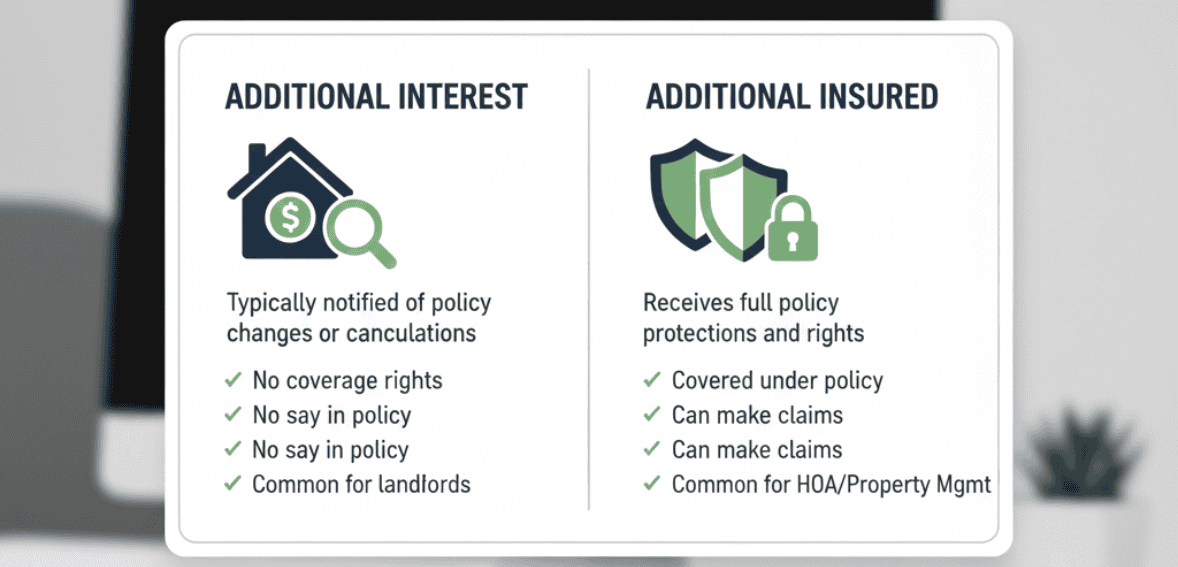

One of the most misunderstood aspects of renters insurance compliance is correctly designating the landlord or property management company on the tenant’s policy.

Here’s the difference:

Additional Interest

- Receives notifications when the policy lapses or changes

- Offers visibility but no coverage benefits

- Most common requirement in multifamily properties

Additional Insured

- Extends liability coverage to the landlord

- Stronger protection, especially after major damage

- Slightly raises tenant premium

Inconsistent enforcement leads to serious challenges:

- No cancellation notice = no visibility

- Missed lapses = unprotected buildings

- Selective enforcement = possible discrimination claims

Most properties adopt this standard rule:

“Landlords must be listed as Additional Interest on the renters’ insurance policy and must receive policy updates and cancellation notices.” This provides the compliance oversight needed while minimizing tenant costs.

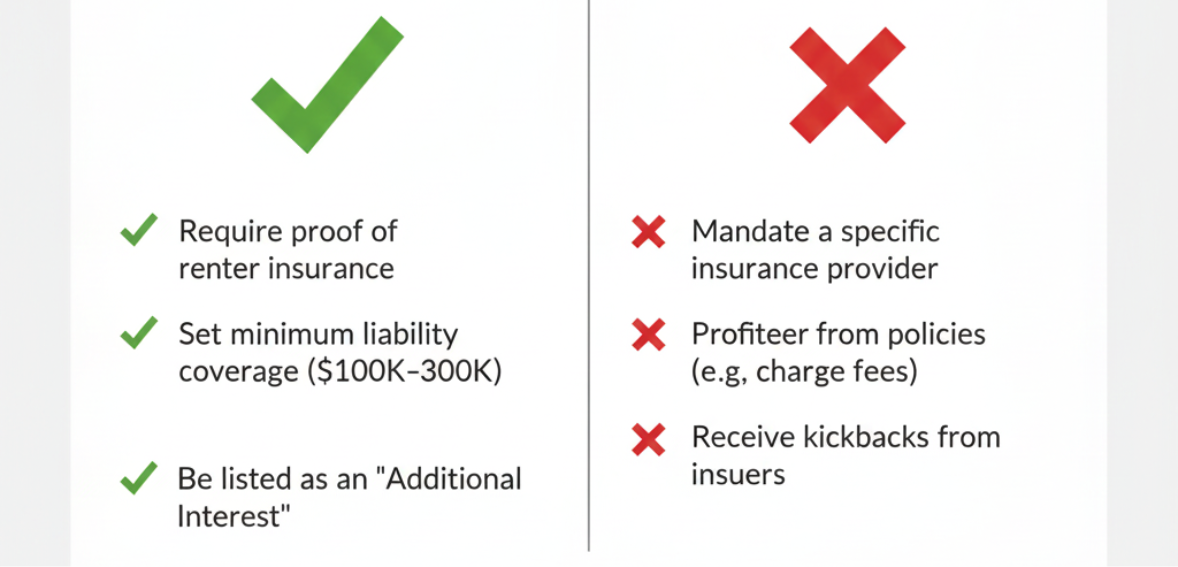

Regulatory Compliance: Avoiding Insurance Licensing Violations

The moment a property manager becomes involved in offering insurance options, the rules change. Many states treat even basic guidance as a regulated insurance activity, which requires licensing.

Property managers can enforce insurance requirements

but MUST avoid:

- Selling insurance policies

- Explaining coverage specifics as advice

- Handling or collecting insurance premiums

- Creating marketing materials for a policy

Doing any of the above without proper licensing can cause significant regulatory penalties.

The safest compliance approach:

- Require insurance only as a lease term

- Provide neutral language about coverage expectations

- Allow tenants to shop at any licensed provider

- Use automated verification instead of manual handling

- Partner only with licensed insurance entities if offering program options

The goal is protection, not accidental entry into the insurance business.

Enforcing Insurance Requirements Fairly to Avoid Legal and Conflict Risks

Requiring renters insurance is not only about protection it is also about fairness. If some tenants are held to the policy while others are not, landlords open themselves up to discrimination claims or lease enforcement disputes. Housing laws require equality: identical rules for identical situations.

That means:

- The requirement must be written in the lease

- Enforcement must apply to everyone covered under that lease

- Documentation must be handled consistently

- Tenants must have a clear timeline to comply

- Follow-through must be documented for every violation

If a property manager says renters’ insurance is required but fails to verify coverage every time, the rule becomes inconsistent. Courts view inconsistency as unfair treatment, especially if certain tenants are disciplined while others are overlooked.

To prevent this, managers need clear workflows:

- Require proof before move-in

- Track expiration dates

- Receive automated lapse notices.

- Send reminders quickly

- Document every enforcement action.

This is where renters’ insurance verification software transforms compliance. It applies the same rules automatically, no favorites, no forgetfulness, no hidden bias. Every policy status update and every reminder is recorded. That data protects managers in court and prevents unjustified enforcement claims.

Fair enforcement isn’t just about following the rules; it protects trust inside the community. Tenants want to know they are treated exactly like everyone else. Transparency builds cooperation, not conflict.

Managing Unauthorized Pets, Roommates, and Coverage Mismatches

Renters’ insurance can become complicated when tenants’ circumstances change mid-lease. Many compliance gaps happen silently:

- A new pet appears in the unit

- A roommate moves in without notice

- The insured address doesn’t match the lease address

- Tenants switch providers and coverage drops below the minimum required

- A tenant gets divorced, and the named insured no longer occupies the home

Without real-time visibility, any of these changes can leave the landlord exposed.

Renters insurance verification software helps catch these mismatches early by:

- Matching tenant names with policy names

- Confirming correct addresses

- Tracking changes in liability coverage

- Ensuring all occupants are correctly listed

- Alerting managers when coverage requirements are no longer met

The real benefit? The manager no longer discovers these issues after a disaster occurs by then it’s too late.

Even something as small as a missing additional interest designation can mean the landlord receives no notification when the policy is cancelled. Automated cross-checks prevent that oversight and keep compliance clean.

In buildings where pets, roommates, and relationship changes are common, this type of monitoring is no longer optional; it is a core part of operational risk management.

Integrating Renters Insurance with Risk Prevention and Resident Education

Renters insurance works best as a partnership not a punishment. Many tenants only buy coverage because they are forced to. They do not truly understand what the policy protects, or how much financial damage a simple accident can cause.

Education reduces stress, improves cooperation, and prevents conflicts when claims occur.

Clear messaging should be part of onboarding:

- Why insurance protects the tenant first

- How liability prevents sudden large bills

- What happens if a guest is injured

- What coverage doesn’t include (maintenance issues, wear and tear)

- Why keeping coverage active benefits both sides

Instead of presenting insurance as a requirement to avoid penalties, the conversation shifts to:

“This protects you from unexpected financial trouble and ensures we can fix problems quickly if they occur.”

Modern software enhances this by:

- Sending reminders before expiration

- Providing simple tutorials on how to upload proof

- Showing tenants their current compliance status

- Reducing landlord-tenant arguments about missing documents

- Offering clear, automated notifications rather than rushed phone calls

When tenants understand purpose, compliance naturally improves. They feel safer living in a well-protected community. And managers spend less time chasing paperwork or handling disputes.

Insurance becomes part of resident satisfaction not resentment.

Conclusion: Why 2025 Demands Smarter Compliance and Tracking

The rental housing industry has entered a new era. Risk is rising from accidental fires, plumbing failures, extreme weather and litigation. At the same time, tenants are more mobile, insurance costs fluctuate more often, and manual paperwork can no longer keep up.

Renters insurance requirements are now standard across nearly all U.S. rental communities. But requirements alone do not keep buildings safe. Consistent verification does.

In 2025 and beyond, the landlords and property managers who protect themselves best will prioritize:

- Legal compliance in every state where they operate

- Clear lease language with transparent requirements

- Proper designation as additional Interest

- Continuous verification not just move-in checks

- Fair enforcement with zero exceptions

- Digital systems replacing risky manual tracking

- Proactive communication and tenant education

Renters insurance verification software is at the heart of this evolution. It automates compliance, eliminates the risk of human error, ensures fairness, and protects the property every day of the lease, not just on paper.

The future of compliance means knowing coverage is active, not hoping it is.

Landlords who adopt smarter tracking now will save money, reduce disputes, minimize losses, and build stronger, safer housing environments for everyone living in them.

The rental industry trends in 2025 are seeing some significant changes amid economic shifts, rising demands, and technological advancements. Property managers and owners may face challenges adapting to these developments to remain competitive and meet the tenants’ expectations in 2025.

FAQs

In which states can landlords require renters’ insurance?

Landlords can require renters’ insurance in 49 states. The only exception is Oklahoma, where it is prohibited. In Oregon, landlords may need it, but liability caps apply. Subsidized housing programs usually restrict requirements to ensure affordability.

What is the difference between Additional Interest and Additional Insured?

Additional Interest gives landlords the right to be notified of cancellations or changes. An Additional Insured extends actual coverage protections but may increase tenant premiums. Most communities require at least an Additional Interest for ongoing compliance tracking.

How much liability coverage should tenant carry?

Most properties require a minimum liability of $100,000, while many recommend $300,000 especially in high-density buildings. Stronger coverage reduces the landlord’s financial exposure if tenant-caused damage affects multiple units.

How should landlords verify renters’ insurance?

Verification should be continuous, not one-time. Software systems automatically track coverage status, expiration dates, cancellations, and documentation helping prevent policy lapses that create risk.

Can landlords enforce renters’ insurance without being licensed to sell insurance?

Yes landlords can require insurance as a lease condition without licensing. However, they must not sell policies, collect payments, or provide insurance advice. Compliance is safe as long as enforcement stays structured and neutral.