by Rinki Pandey November 19, 2025

In the past, landlords relied heavily on instinct, experience, or basic bookkeeping to understand how their rental properties were performing. They looked at whether rent was paid on time, whether expenses seemed manageable, and whether the property remained occupied. And while intuition still plays a role, the modern rental industry has shifted toward a more reliable source: data. Today, the landlords who consistently outperform others are the ones who use property management KPIs to guide their decisions.

A KPI Key Performance Indicator is not just a number. It’s a measurement that tells a story about how efficiently a property is being run, how profitably it’s operating, and where improvements could be made. KPIs turn uncertainty into clarity. Instead of guessing whether turnover is too high, whether maintenance costs are rising, or whether cash flow is healthy, landlords can look at complex data and see the reality. This shift toward data-driven property management is transforming how rental businesses operate.

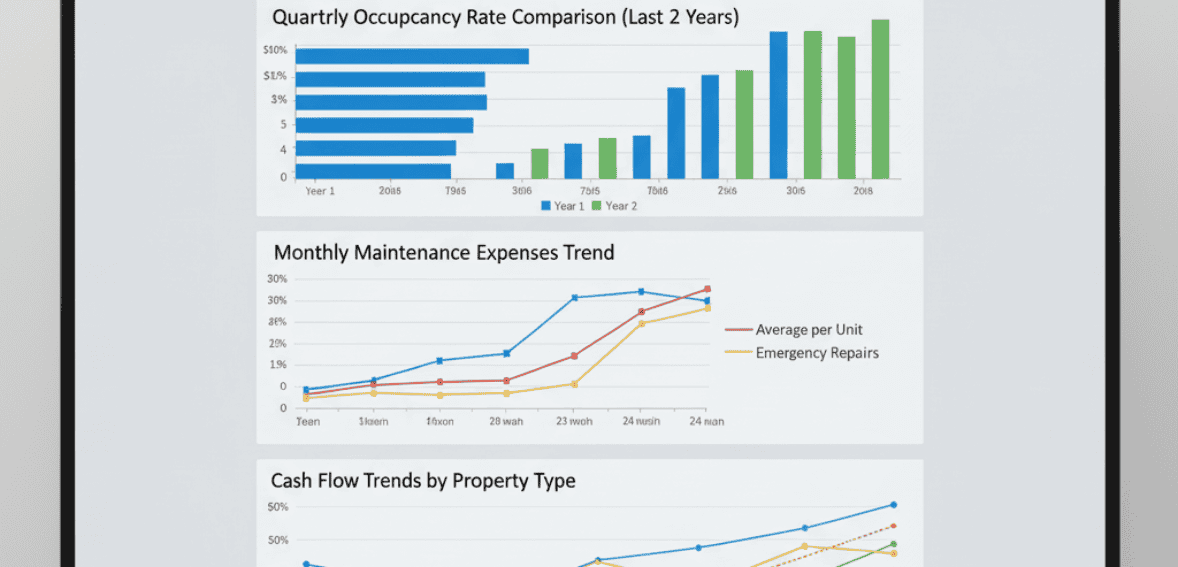

The idea is simple: what gets measured gets improved. When landlords consistently monitor rental property metrics occupancy trends, turnover rates, revenue patterns, and maintenance expenses they can spot issues early, optimize their strategy, and protect profitability. KPIs become a feedback loop that highlights what’s working and what isn’t. A property with high occupancy but low cash flow tells a very different story from one with high turnover and strong rent growth. Without data, both properties might “feel” the same. With data, landlords can act with precision rather than hope.

This shift doesn’t just benefit investors; it benefits tenants too. When landlords track maintenance response times, rent collection consistency, and renewal patterns, they improve service quality and reduce friction. A healthier rental operation creates a healthier tenant experience. And in the competitive rental market, better service often leads to better retention.

But to understand the power of KPIs, landlords first need to know why they matter and which ones actually influence ROI. Not every number deserves the same attention. Some metrics directly impact profitability, while others help diagnose deeper issues in the business. A savvy landlord learns to focus on the KPIs that reveal real performance.

Why Tracking KPIs Matters More Than Landlords Realize

Landlords who avoid data often do so because they feel their property is “doing fine.” Rent comes in, expenses get paid, and there’s no obvious crisis. But profitability is rarely apparent. Costs creep upward slowly. Vacancy gaps stretch a few days each year. Maintenance consumes more money than expected. And before a landlord even realizes it, the property is earning less than it should.

This is precisely why property management KPIs matter. They shine a direct light on performance. Instead of assuming a property is operating efficiently, KPIs confirm it or reveal the areas where profitability is slipping away.

For example, a landlord might believe their vacancy rate is normal. But when they calculate occupancy over the past year, they discover the property sits empty for nearly one month between tenants. That single month reduces annual income by more than 8%. Without tracking occupancy, that loss stays hidden.

Or consider maintenance spending. A landlord may not realize that repair costs have climbed year over year. But once they begin tracking rental property metrics, the trend becomes apparent. Rising maintenance costs could signal an aging system, deferred upkeep, or unreliable vendors. KPIs make those patterns visible.

Cash flow, a key performance indicator, often surprises landlords, too. Many think they’re earning more than they actually are because they don’t regularly review NOI (Net Operating Income). But when they finally measure income against expenses, they discover their property isn’t performing as they assumed. In some cases, ROI drops simply because expenses outpaced rent growth and the landlord didn’t notice the shift.

Data also removes emotion from decision-making. Instead of holding onto a property out of attachment, KPIs show whether it’s truly producing strong returns. Instead of blindly increasing rent, metrics show whether the local vacancy rate supports the decision. Instead of guessing whether to renovate a unit, KPIs clarify whether upgrades will materially improve ROI.

Most importantly, KPIs help landlords act early. An issue identified at the end of a quarter is easier to fix than one discovered after two years. When landlords track rental performance, they prevent ongoing losses and strengthen profitability before problems become expensive.

Research reinforces this mindset: property managers who rely on data outperform those who rely on intuition. They fill vacancies faster, reduce turnover, control expenses more effectively, and adapt their strategy based on real patterns not assumptions. And in a rental market where costs keep rising, these advantages matter.

Understanding the Core KPIs That Drive Rental Success

Even though dozens of KPIs exist, only a few fundamentally influence rental profitability. These are the metrics that every landlord whether they manage a single unit or an entire portfolio should monitor regularly. They reflect the heartbeat of the business: how often the property is rented, how efficiently tenants are retained, how much income remains after expenses, and how much return the property generates compared to the cash invested.

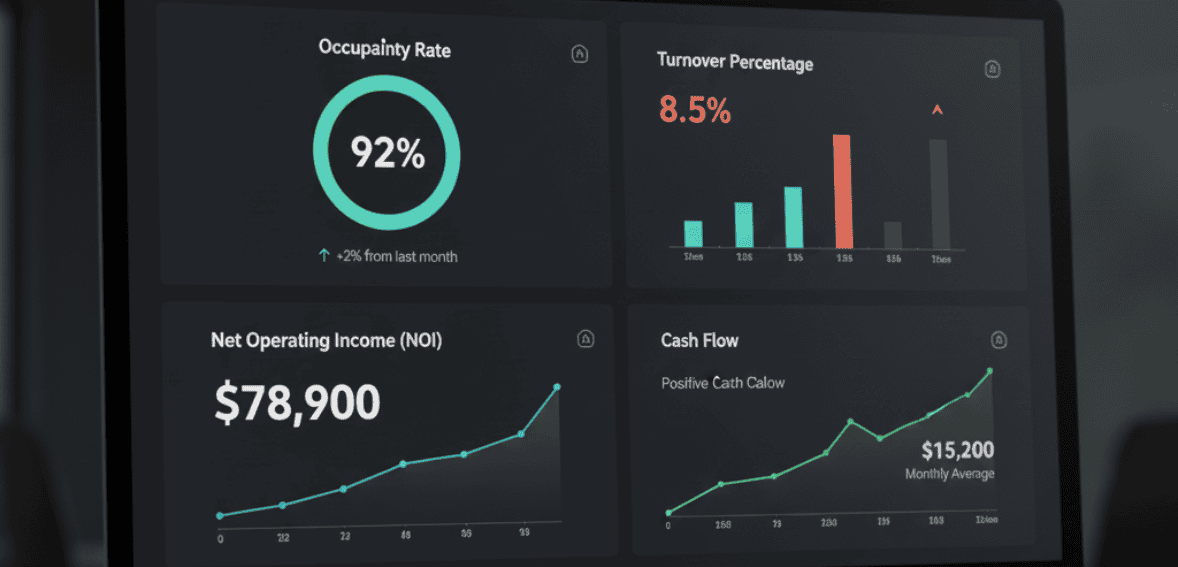

The first KPI is the Occupancy Rate. It reflects how often the property is filled rather than vacant. High occupancy signals strong demand, effective pricing, and good tenant relationships. Low occupancy usually indicates marketing issues, uncompetitive rents, slow maintenance response times, or poor listing visibility. Even a slight dip in occupancy has a noticeable effect on annual income, making this KPI one of the clearest indicators of rental health.

Closely tied to occupancy is the Tenant Turnover Rate. Every time a tenant moves out, costs rise, cleaning, repainting, repairs, marketing, showings, and lost rent during vacancy. Turnover is one of the most expensive parts of property management. A high turnover rate often reveals deeper operational issues, such as communication problems, maintenance delays, or dissatisfaction with policies. But when turnover drops, ROI naturally increases. Tracking this KPI helps identify whether tenant retention strategies are working.

Another essential KPI is Net Operating Income (NOI), which represents rental income minus operating expenses (excluding mortgage payments). It is a pure measure of property profitability. A rising NOI suggests the landlord is managing expenses efficiently or increasing income through strategic rent adjustments. A declining NOI signals the opposite: utilities rising, maintenance climbing, or administrative costs increasing. NOI serves as the foundation for analyzing long-term ROI and assessing the stability of the property’s profit margin.

Then there is Cash-on-Cash Return, one of the most valuable metrics for investors. It measures how much cash the property returns each year relative to the upfront investment. For example, an investor who earns $6,000 per year after investing $60,000 receives a 10% CoC return right within the healthy benchmark noted, which states that strong rental ROI generally falls between 8–12%. This KPI helps landlords compare the performance of their rental property with other investment opportunities, such as stocks or bonds.

Maintenance also deserves attention within KPI tracking. The Maintenance Cost Ratio shows the percentage of rental income spent on repairs and upkeep. If maintenance costs grow consistently, the landlord must investigate whether the property is aging, whether preventive maintenance is lacking, or whether contractors are overcharging. Without tracking this KPI, a property may continue quietly draining profits.

These metrics occupancy, turnover, NOI, cash-on-cash return, and maintenance ratio create a complete picture. They reveal whether a property is performing as expected, where profits are being lost, and which areas need closer attention. And because they are based on real numbers, they help landlords make confident decisions rather than hopeful guesses.

How KPIs Turn Raw Data Into Real ROI Gains

Understanding numbers is one thing, knowing how to use them is another. This is where many landlords underestimate the power of property management KPIs. These metrics aren’t just academic values on a spreadsheet. They are signals that guide specific decisions that directly influence rental ROI.

For example, imagine noticing that your occupancy rate has quietly fallen from 97% to 92% over the past year. Without tracking that data, you might not realize your units are sitting vacant longer after each move-out. But with KPIs telling the story, you can start investigating: Are asking rents too high? Is your marketing strategy outdated? Are maintenance issues delaying showings? A 5% drop in occupancy might not sound big, but it equals 18 days of lost rent yearly and that loss compounds across multiple units.

The same applies to tenant turnover. Turnover costs are often underestimated because they appear in pieces: cleaning costs here, painting costs there, a week of vacancy in between. But when a landlord calculates turnover as an accurate KPI, the financial impact becomes impossible to ignore. A slight improvement in tenant retention can save thousands annually. And the data tells you exactly where the weakness lies. Maybe tenants consistently leave after the first year, suggesting dissatisfaction early in the tenancy. Maybe they go after rent increases, suggesting pricing sensitivity. KPIs enable landlords to find patterns in the noise.

Net Operating Income (NOI) is the clearest financial indicator, and many landlords never calculate it consistently. They look at rent coming in and assume profit, but NOI reveals the truth. If it falls year over year, the cause might be rising utilities, aging appliances, or inefficient vendors. If NOI rises even when rents stay the same, it might be due to better expense control or more efficient property management.

NOI doesn’t lie, it distills the business down to what it earns versus what it spends.

Cash-on-Cash Return brings a broader investment perspective. It answers the question: Is this property worth it compared to other places I could have put my money? Investors use this KPI to evaluate whether a rental property outperforms other investments. If CoC return falls below the 8–12% benchmark, it may prompt a reassessment of rent, expenses, or long-term strategy. Without this KPI, landlords might continue operating a property that isn’t generating meaningful returns.

Maintenance cost tracking is another often-overlooked KPI that directly influences ROI. A property that becomes increasingly expensive to maintain year after year may signal that it’s time for capital improvements or system replacements.

Sometimes investing in a new HVAC or upgrading old plumbing reduces long-term maintenance far more than continually repairing aging systems. But these decisions only make sense when supported by data. KPIs help justify long-term upgrades by revealing spending patterns.

When all these metrics are viewed together, landlords can better understand their rental business. Instead of reacting to problems as they occur, they use data to prevent them from forming in the first place. They strategically adjust rents, improve tenant retention, schedule upgrades more effectively, and allocate budgets based on real patterns not guesswork. Over time, these improvements significantly increase rental ROI.

Tools That Make KPI Tracking Easier and More Accurate

While KPIs are powerful, tracking them manually can be challenging, especially for landlords with multiple units. Spreadsheets work for some, but they require discipline, accurate data entry, and frequent updates. A single typo can skew calculations, and the more properties a landlord manages, the more complicated the spreadsheet becomes.

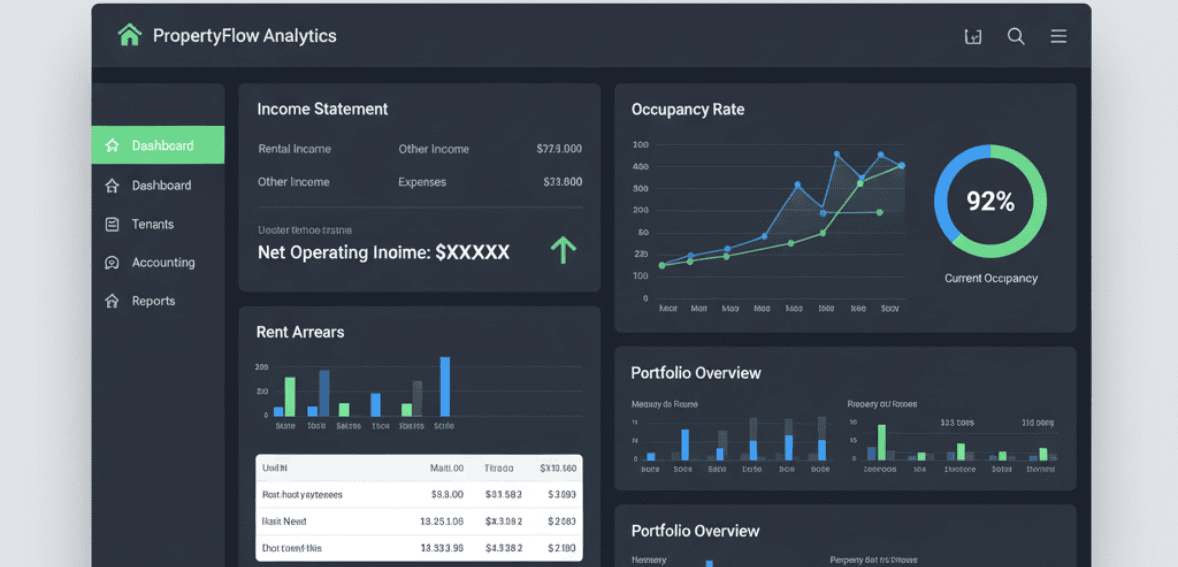

This is where property management software becomes an invaluable tool. Modern platforms offer built-in reporting features that make KPI tracking far easier. Instead of manually calculating occupancy or NOI, the software automatically calculates them based on stored income and expense data. Dashboards visualize trends, showing at a glance whether performance is improving or declining.

Cloud Rental Manager, for example, offers real-time occupancy tracking, rent arrears reports, income statements, expense breakdowns, lease expiration reminders, and dashboards that help landlords track rental performance without digging for data. If income drops, the system highlights it. If expenses spike, the system flags it. If tenants owe rent, the dashboard shows who and how long it’s been pending. These insights make KPI-driven decisions easier, faster, and more accurate.

For landlords who prefer a hybrid approach, spreadsheets can complement software-generated reports. Some landlords use software for core metrics, and spreadsheets for investment metrics such as cash-on-cash returns or long-term portfolio comparisons. The key is to choose a system that fits your comfort level and ensures consistency.

The most crucial part is accuracy. KPIs are only as powerful as the data behind them. If income or expense entries are incomplete, if rent rolls aren’t updated, or if turnover isn’t logged correctly, the metrics will be misleading. This is why many landlords lean on automated tools to reduce the chance of human error.

Whether using a simple spreadsheet or advanced software, the goal is the same: create a reliable routine for reviewing KPI data and making decisions based on real numbers. Over time, the landlord becomes more confident, more informed, and more prepared to respond to market changes.

Data Brings Clarity: Transforming Property Management From Reactive to Proactive

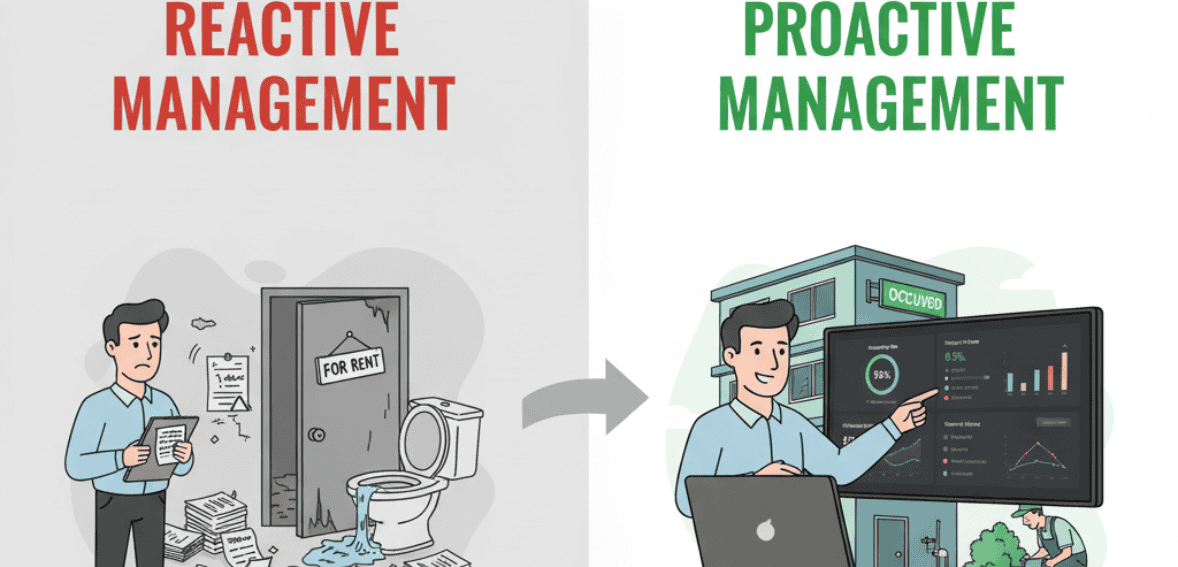

The most significant advantage of tracking property management KPIs is not that they offer information, it’s that they provide clarity. When landlords rely on instinct, decisions are reactive. They respond to problems only after they happen: a tenant leaves, a repair becomes urgent, cash flow tightens, or expenses suddenly spike.

But when landlords consistently use KPIs, they become proactive. They anticipate issues before they escalate. They see rent growth opportunities before competition does. They pinpoint inefficiencies that once seemed invisible. KPIs turn property management into a strategic operation rather than a series of fire drills.

For example:

- A landlord reviewing occupancy trends notes that units stay vacant longer during summer, prompting earlier marketing.

- Maintenance data reveals rising costs, prompting preventive upgrades instead of emergency fixes.

- Cash-on-cash returns begin to fall, prompting a deeper look at rental pricing or property improvements.

- Tenant turnover increases slightly, hinting at issues with communication or service quality.

None of these insights would surface without consistent KPI tracking.

This clarity becomes even more valuable as portfolios grow. What can be managed by memory with one property becomes complex with three, and overwhelming with ten. KPIs are the equalizer; they give landlords a structured way to compare properties, identify top performers, and focus attention where it’s needed most.

Ultimately, KPIs don’t just improve ROI they reshape how landlords understand their business. Each data point becomes a guidepost, each trend a clue, and each improvement a step toward stronger performance. Data creates stability, and stability creates profitability.

Conclusion

The rental industry is more competitive and more data-driven than ever. Landlords who rely solely on intuition risk falling behind, while those who embrace property management KPIs gain the clarity needed to maximize rental ROI. These metrics turn everyday operations into measurable, improvable systems. They highlight strengths, uncover weaknesses, and enable smarter decisions across every part of property management from marketing and leasing to maintenance and long-term investment planning.

Tracking KPIs is not about becoming a financial analyst. It’s about understanding your business accurately. Occupancy, turnover, NOI, cash-on-cash return, and maintenance ratios are the backbone of rental performance. When landlords track these indicators consistently, they gain control over profitability and reduce the guesswork that often leads to unnecessary losses.

With modern tools, from spreadsheets to software platforms like Cloud Rental Manager, KPI tracking has never been more accessible. But the real change happens when landlords review these numbers regularly and respond to what the data reveals. Over time, this leads to smoother operations, stronger financial health, and a rental business that grows with confidence rather than uncertainty.

In the end, KPIs provide what every landlord truly wants: visibility, stability, and a clear roadmap to higher ROI.

FAQs

What are KPIs related to rental property management?

KPIs are measurable indicators that show how well a rental property is performing. They turn operations into numbers such as occupancy, NOI, and turnover so landlords can evaluate and improve performance.

Which metrics should landlords prioritize?

Occupancy rate, turnover rate, NOI, cash-on-cash return, and maintenance cost ratio are typically the most important because they directly influence profitability and rental ROI.

How does tracking KPIs actually improve rental ROI?

KPIs reveal inefficiencies such as long vacancies, rising expenses, or high turnover so landlords can make targeted changes to increase income and reduce costs over time.

How often should KPIs be reviewed?

Most landlords review financial KPIs monthly or quarterly, while occupancy and collection metrics may be checked more often. Consistency is what makes the data meaningful.

What tools can help track rental KPIs?

Spreadsheets work for simple setups, but property management software provides automated reports, dashboards, and real-time data that make tracking easier and more accurate.