by Rinki Pandey November 16, 2025

Most landlords start the same way: one property, one tenant, one small step into the world of rental income. Managing that first home feels exciting and manageable. You’re handling repairs, collecting rent, learning the basics sometimes by trial and error. But somewhere along the way, you start thinking about the next step. Maybe it’s after you realize the first property is cash-flowing well. Maybe it’s after you see appreciation rising in your market. Or maybe you simply want more stability than one rental can ever provide.

Whatever the reason, scaling from one single-family rental to a small portfolio is a major shift. It requires more planning, clearer goals, stronger systems, and a different mindset. Owning one rental is hands-on. Owning several becomes a small business.

The good news? Most landlords in the U.S. start exactly where you are. According to Pew Research, individuals own about 70% of rental properties; many own only one or two homes. That means the path from “just one” to a full portfolio is extremely common. The challenge is figuring out how to do it without becoming overwhelmed.

Laying the Foundation: Know Why You Want to Scale

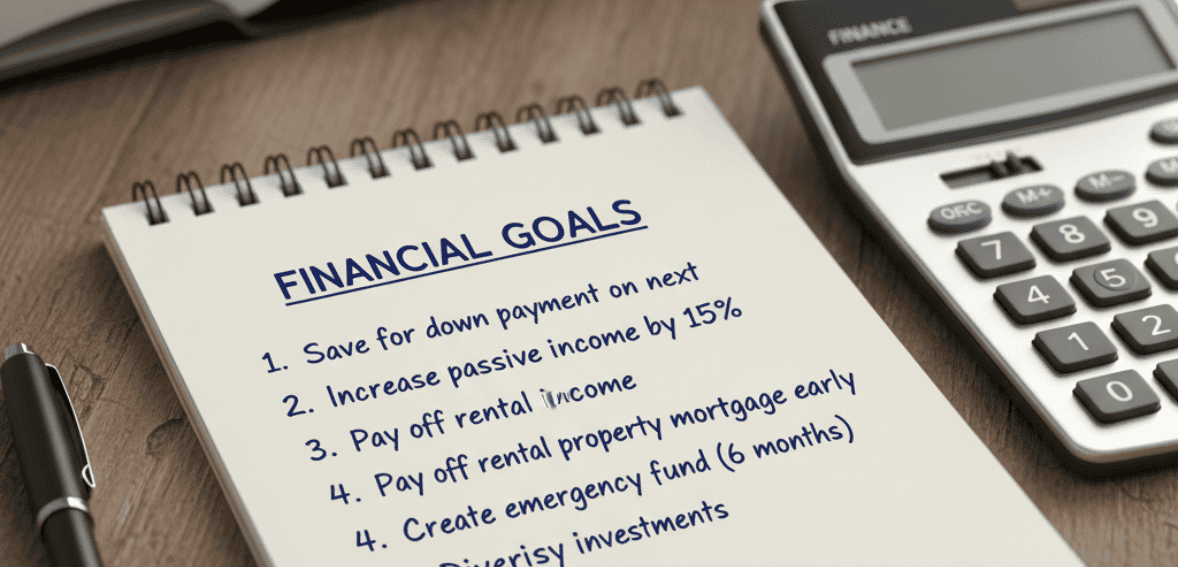

Before purchasing your second or third rental, take time to understand what you’re actually trying to build. “Scaling a rental portfolio” sounds impressive, but it means different things depending on your goals.

Ask yourself:

- Do you want long-term cash flow?

- Are you aiming for appreciation?

- Do you want a portfolio you’ll pass on to your family?

- Are you preparing for retirement income?

- Do you want to replace your 9–5 completely?

Your scale rental portfolio strategy depends on this clarity. Growing for the wrong reasons or without any real direction is one of the fastest ways to get stuck with properties that drain time, money, and energy.

When goals are clear, your decision-making becomes steadier. You’re no longer buying because a deal “looks good.” You’re buying because it actually aligns with what you want the portfolio to become.

Financing Your Growth Intelligently

Once you know where you’re headed, the next question is: How are you going to finance that growth? This is where smart landlords take advantage of tools available to them instead of relying on savings alone.

A few common strategies:

• Using Equity from Your First Property

If your existing home has appreciated, you can tap into that equity through a HELOC or cash-out refinance. Many landlords use appreciation from the first rental to fuel the purchase of the next one.

• The BRRRR Method

Buy, Rehab, Rent, Refinance, Repeat a strategy popular among small investors trying to move quickly. It rewards you for improving properties and recycling your capital. When executed well, it accelerates portfolio growth faster than traditional buying.

• Working With Local Lenders

Small landlords often do better building relationships with community banks or credit unions than relying solely on major lenders. Smaller institutions understand local markets better and are often more flexible with property-based lending.

• Keeping Cash Reserves Healthy

Scaling means more responsibility. Vacancies, repairs, and maintenance multiply with each property. Good landlords grow with a buffer, not by stretching themselves thin.

Good financing is not only about accessing money it’s about protecting yourself from risk while building steadily.

Managing Risk When You Grow from One Rental to Several

Growth multiplies opportunity, but it also multiplies exposure. A portfolio of five rentals will give you more income but also five roofs, five HVAC units, five sets of tenants, and five potential problems.

Before you scale, make sure you have systems in place to reduce risk:

- Strong screening standards

- A reliable emergency fund

- Clear lease agreements

- Scheduled maintenance routines

- Knowledge of landlord-tenant laws in your state

When you own just one property, it’s easy to “wing it.” But when you own several, that same approach becomes chaotic. Smart landlords build structure early, not later.

A stable portfolio isn’t built on aggressive buying, it’s built on repeatable systems that prevent small issues from turning into expensive surprises.

Operational Efficiency: The Point Where Most Small Landlords Struggle

Going from one rental to many seems exciting until the responsibilities start stacking. When you own one single-family rental, you can remember everything in your head. Rent due dates, tenant names, repair history it’s all manageable.

But once you hit two or three properties, the mental load grows fast.

This is usually the moment when landlords either:

- Burn out, or

- Become organized and efficient

And that’s where digital tools matter.

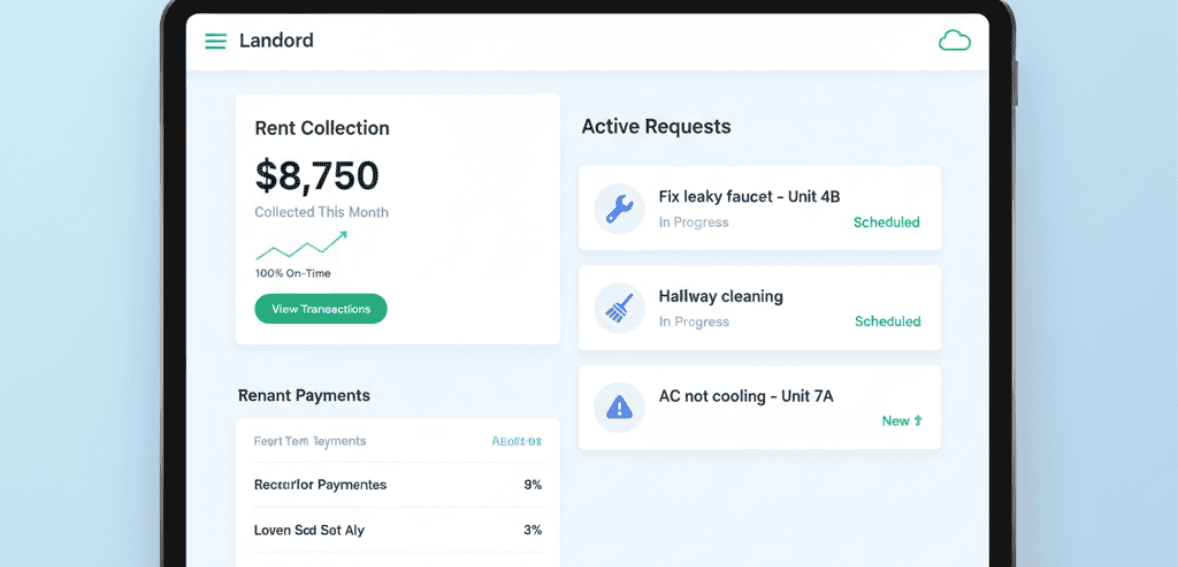

Modern portfolio owners use platforms for:

- Online rent collection

- Maintenance tracking

- Tenant screening

- Income and expense reports

- Lease management

- Reminders and documentation

Tools like CloudRentalManager are designed for this type of small landlord scaling workflow, helping owners stay organized instead of juggling emails, texts, spreadsheets, and paper leases.

This isn’t about “being high-tech.” It’s about staying sane.

The faster you adopt systems that reduce your day-to-day workload, the easier it becomes to grow without feeling overwhelmed.

Understanding Portfolio Performance: Which Properties Actually Deserve to Stay?

Growing a portfolio doesn’t mean keeping every property forever. Sometimes the house you start with isn’t the house that should stay in your long-term plan.

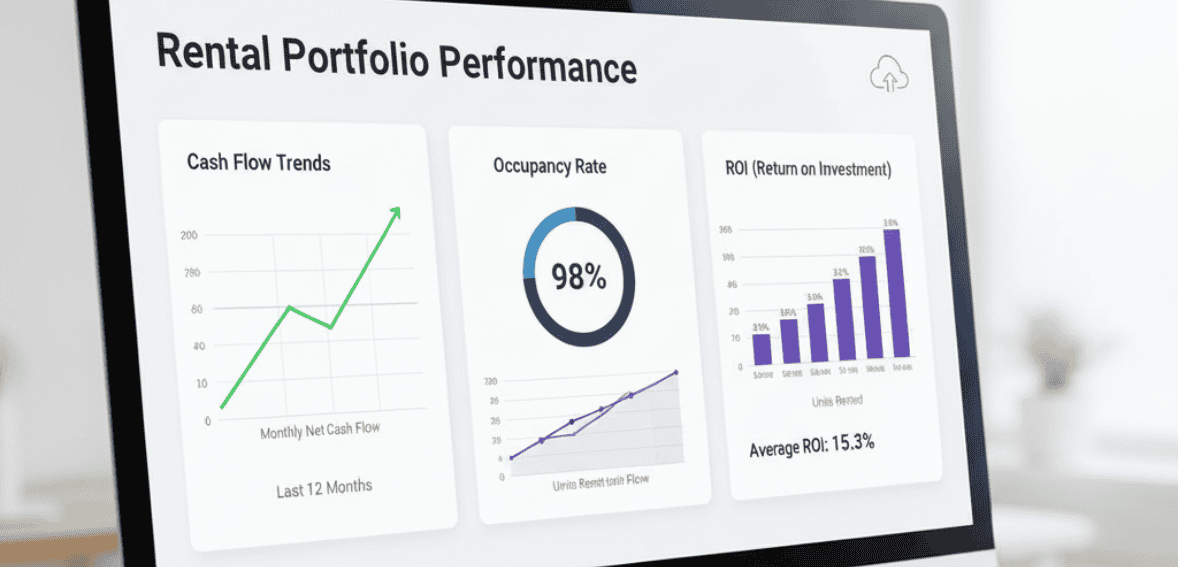

To know which rentals are worth scaling around, landlords track key metrics:

- Cash flow

- Cash-on-cash return

- Occupancy

- Rent growth

- Maintenance costs

- Appreciation over time

This is where small landlords become investors. Data replaces gut feeling.

Excalibur Homes, in their guidance for portfolio scaling, emphasizes reviewing every property regularly. It’s not unusual for landlords to discover that one unit consistently underperforms. Sometimes the best scaling move isn’t buying another house, it’s selling the wrong one.

Portfolio reviews, especially when supported by software analytics, help landlords make decisions based on performance instead of emotion or habit.

When Systems Replace Stress: Growing Without Burning Out

Most small landlords hit a wall at the same point: around the second or third property. The phone calls double. The repairs double. The reminders double. The paperwork doubles.

But the hours in your day? They stay exactly the same.

This is where efficiency becomes more important than enthusiasm.

A landlord managing one rental can do everything manually. Many do — texting tenants, keeping receipts in a drawer, noting lease dates on a calendar. But once you reach multiple units, the smallest inefficiency starts to snowball.

That’s why growth isn’t really about buying more houses. It’s about building systems that prevent you from drowning in tasks.

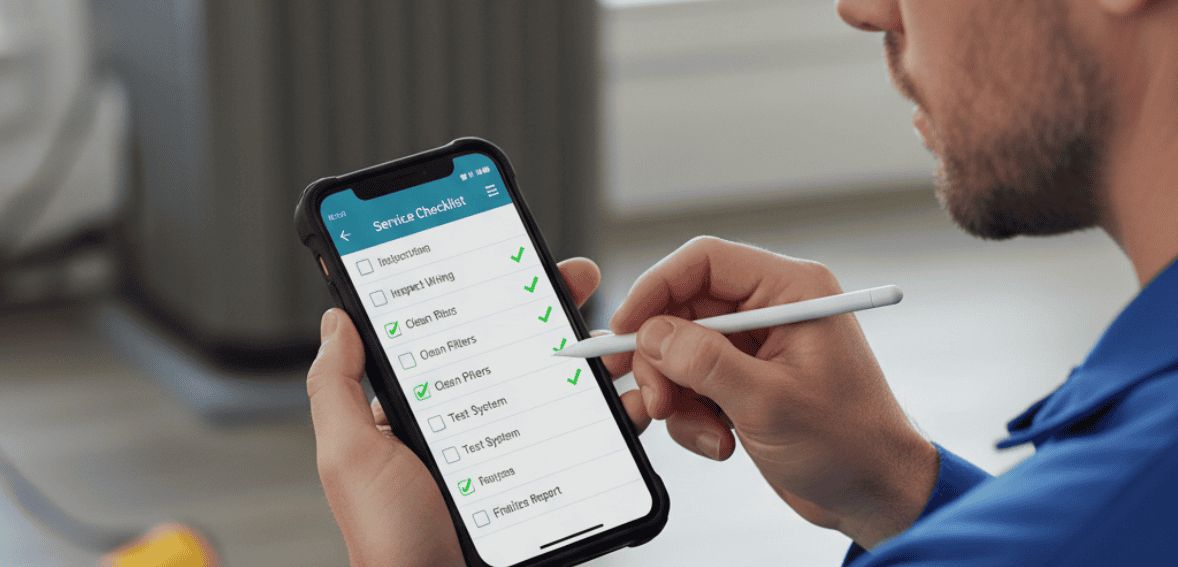

This includes:

- Automating rent reminders

- Storing documents digitally

- Setting maintenance schedules

- Keeping all communications in one place

- Tracking income and expenses without spreadsheets

None of this feels revolutionary. But when you add properties, these small changes determine whether you grow comfortably or collapse under the weight of minor details.

Scaling a rental portfolio is possible for anyone; the difference is whether you’re willing to build the operational backbone to support that growth.

Screening Tenants as You Scale: Consistency Saves You Later

One thing new landlords don’t always realize is that tenant selection becomes even more important as your portfolio grows. A single problem tenant is manageable when you only have one property. But when you’re juggling several, you can’t afford disruptions.

That’s why consistency in screening matters.

When you scale your single-family rentals, your screening process should be:

- Documented

- Repeatable

- Fair

- Compliant

- The same for every property

- The same for every applicant

A clear screening standard protects you and ensures long-term stability. You don’t want portfolio growth to be derailed by frequent turnovers or preventable issues.

Think of tenant screening the same way you think about financing or repairs: it’s part of the foundation of your scaling strategy, not an afterthought.

The Turning Point: When Should a Small Landlord Hire Help?

Many landlords assume “small investor” means “do everything yourself.” That works for a while until it doesn’t.

There are a few signals that tell you it’s time to consider support:

- You’re missing maintenance requests

- You’re struggling to track rent consistently

- You can’t keep up with communication

- Turnover feels chaotic

- Paperwork is everywhere

- You’re constantly reacting instead of planning

Support doesn’t have to mean hiring a full property manager. For many growing portfolios, help looks like:

- A virtual assistant for admin work

- A leasing agent during busy seasons

- A reliable handyman for recurring tasks

- Partnering with another investor

- Using software to automate the repetitive parts

There’s no “right” moment to ask for help. But there’s a wrong moment waiting until you’re overwhelmed.

Scaling becomes healthier when you stop trying to do everything alone. Growth requires capacity. Capacity requires support.

Knowing Your Metrics: The Numbers That Tell You When to Scale

If you want your rental business to be more than luck, you have to know your numbers. It’s the only way to see whether your properties are actually supporting your goals or just creating more work.

Some of the most important KPIs for scaling a rental property portfolio include:

- Cash flow: Is each property contributing, or is one consistently draining money?

- Occupancy: Are your properties staying filled, or are there quiet months?

- Cash-on-cash return: For every dollar you put in, what are you getting back?

- Maintenance ratios: How much does each home cost to keep in good shape?

- Rent-to-value ratio: Is rent keeping pace with property values?

- Appreciation trends: Is the neighborhood improving or plateauing?

Small landlords who want to become multi-property owners rely on data, not instinct. That’s also why portfolio tracking software matters: it helps you see which homes deserve more investment, which ones may need adjustments, and which ones aren’t carrying their weight.

The difference between a landlord and a long-term investor is simple: landlords react; investors measure.

When a Rental Doesn’t Fit Your Future Plan Anymore

Scaling isn’t only about adding more houses. Sometimes it’s about letting one go.

Many landlords discover that their first rental, the one that taught them everything, isn’t actually the right fit for the next stage.

Maybe:

- The cash flow isn’t strong

- The maintenance is too frequent

- The neighborhood is changing

- Appreciation has stalled

- The tenants churn too often

- Rent growth is slower than expected

Portfolio growth includes pruning. Selling one property to reinvest in a better one is a sign of a maturing investor not a mistake.

Excalibur Homes notes that landlords who regularly review performance are more likely to achieve steady long-term returns. Keeping an underperformer out of sentimental attachment slows everything down. When you scale rental portfolio operations, each property needs to contribute meaningfully.

Scaling is a strategy, not a collection.

When Should You Consider Professional Management?

At some point, the math becomes simple: The portfolio grows, but your time does not.

Some landlords hire property managers when they hit four units. Others wait until ten. Some never hire one at all because they prefer full control and enjoy the hands-on work.

There’s no universal rule but there are signs that your portfolio has reached the point where management support might help:

- Your phone is ringing more than your day job allows

- You’re responding to maintenance calls at inconvenient times

- You’re handling tenant disputes more than once a month

- You’re spending weekends doing paperwork

- You can’t remember which lease expires when

- Your portfolio income doesn’t match the time you’re spending

Professional management doesn’t mean leaving. It means stepping into the role of investor instead of daily operator.

And ironically, many landlords find that once they hire help, they scale faster, not slower because their time becomes available for strategy instead of stress.

Scaling Single-Family Rentals With Purpose

Going from one rental to many is not about buying quickly, it’s about building deliberately. A rushed portfolio is a fragile portfolio. A thoughtful one becomes passive income, long-term wealth, and a foundation for generational security.

Small landlords grow strongest when they:

- Start with clear goals

- Build systems early

- Automate what can be automated

- Stay disciplined about screening

- Review performance regularly

- Keep finances strategic, not emotional

- Know when to get help

- Track the metrics that matter

The first property teaches you the basics. The next teaches you who you are as an investor.

Your portfolio doesn’t need to be huge to be successful, it just needs to be intentional. Growth isn’t measured by how many doors you own. It’s measured by how well those doors support the life you’re trying to build.

Conclusion

Scaling a single-family rental portfolio isn’t a race, it’s a series of steady steps that build on each other. Most landlords start small, and there’s nothing wrong with that. What matters is how you grow, not how quickly you add doors. A second property feels almost identical to the first, but somewhere around your third or fourth home, everything changes. You stop thinking like a one-property owner and start thinking like someone building an actual business.

The landlords who scale successfully aren’t the ones who sprint; they’re the ones who stay organized, track their numbers, automate the repetitive parts, and keep their decisions tied to clear goals. They protect themselves with strong screening practices, healthy reserves, and simple systems that make day-to-day tasks manageable. They know when a property is helping their future and when it’s time to let one go.

If there’s one lesson worth holding onto, it’s this: growth should make your life better, not heavier. Adding rentals should create stability, not stress. And the sooner you build the structure that supports multiple properties, the sooner you can enjoy the freedom and financial security you set out to create in the first place.

From one rental to many, the path is open as long as you grow with intention.

FAQs:

What’s the first step to scaling a single-family rental portfolio?

The first step is to solidify your strategy and finances. This means setting a clear goal for how many properties or what income you want, and ensuring you have financing in place (savings, loans, or investment partners). Many small landlords start by leveraging equity from their first property or using the “Buy, Rehab, Rent, Refinance, repeat (BRRRR)” strategy to acquire additional rentals. Having a strong financial plan and cushion for vacancies or repairs is essential before scaling up.

How can I efficiently manage multiple rental properties as a single landlord?

Organization and technology are key. Using a property management software like CloudRentalManager can centralize rent collection, maintenance requests, and tenant communications across all your units, saving you time. Establish a routine for important tasks: e.g., conduct regular inspections, automate rent reminders, and have go-to contractors for repairs. Some landlords also create a standard workflow for tenant screening and lease signing (leveraging e-signatures and online applications) to keep processes consistent as they add properties.

What are common challenges when scaling from one property to many?

Common challenges include time management (more units mean more tasks and potential issues), maintenance coordination (keeping up with repairs across properties), and tenant management (handling multiple tenant relationships and inquiries). Financially, managing cash flow becomes trickier – you must budget for multiple mortgages, taxes, and upkeep. There’s also a learning curve in dealing with different local regulations or HOA rules for properties in various locations. Planning for these challenges by having systems (or hiring assistance) in place can mitigate growing pains.

At what point should I consider hiring a property manager?

If managing the day-to-day tasks begins to consume too much of your time or expertise, it may be time to consider professional management. A rule of thumb some landlords use is that beyond 3-5 properties (especially if they’re not geographically close), the workload can justify a property manager. Look at your profit margins too – if a management fee (often 8-10% of rent) is affordable and frees you to focus on acquiring more properties or your full-time job, it could be worthwhile. CloudRentalManager also offers solutions to automate many tasks, which might delay the need for a manager until your portfolio is larger.