by Rinki Pandey November 21, 2025

Property managers in 2025 are dealing with a new reality. Renters have more pets than ever, regulations are evolving, and compliance mistakes can lead to severe liability. The days of simple “pet rules” written casually into leases are over. Today’s renters expect clear policies, transparency, digital processes, and fair handling of deposits, fees, and monthly charges. At the same time, property owners expect protection from pet-related damage, compliance with HUD rules, and accurate accounting.

Because of these pressures, pet deposit management software and structured pet policies are becoming essential, not optional. With increasing demand for pet-friendly housing, property managers must understand the differences between pet deposits, pet fees, and pet rent. And they must follow the laws that govern each. The challenge is balancing legal compliance, operational clarity, and fair treatment while still protecting the property’s financial interests.

In 2025, pet policies affect lease compliance, risk management, revenue growth, tenant satisfaction, and even insurance coverage. The industry is moving away from informal pet agreements and toward standardized digital systems that handle registration, tracking, deposits, documentation, and ongoing compliance in a clean, automated workflow.

Before discussing automation and software, property managers need to understand the fundamental distinctions among pet-related charges and the legal responsibilities attached to each. Too many managers still treat deposits, fees, and rent as interchangeable terms. They aren’t. And misunderstanding these terms can lead to Fair Housing complaints, state-level violations, and costly legal consequences.

Let’s break these distinctions clearly and carefully.

Understanding the Legal Distinctions Between Pet Deposits, Pet Fees, and Pet Rent

One of the most significant sources of confusion in rental housing is the difference between a refundable pet deposit, a one-time pet fee, and ongoing monthly pet rent. While these may seem like minor variations in terminology, legally and operationally, they mean very different things. Mislabeling or misusing these terms can expose a property manager to compliance issues, especially under state deposit laws or HUD regulations.

A refundable pet deposit functions just like a security deposit, but exclusively for pet-related damage. It must be returned if the tenant leaves no pet damage behind. It cannot be spent unless actual repair costs exist. In many states, the deposit must follow strict rules: placed in trust accounts, returned within statutory timelines, and itemized when deductions are made. Some states limit the total deposit amount that can be charged. And for HUD-assisted housing, a pet deposit has its own federal rules, including maximum limits and allowance for gradual accumulation. This makes it critical for property managers to label deposits correctly and store them separately from fees or rent.

A pet fee, on the other hand, is non-refundable. It is a one-time charge that compensates the landlord for administrative overhead, general pet-related wear, or the additional turnover handling required for pet-friendly units. Because pet fees are non-refundable, they cannot be deducted from damages later any damages must still be deducted from a deposit or charged separately. Some states regulate non-refundable fees or require them to be clearly disclosed in lease documents.

Then there is pet rent, a recurring monthly charge that compensates for the incremental wear and tear caused by pets. Pet rent helps cover ongoing property costs: cleaning, maintenance of common areas, pest control, landscaping wear and tear, resurfacing, and long-term deterioration. Pet rent is included in the regular monthly rent amount and must be adequately accounted for in the rent ledger.

Many rental communities strategically combine these charges. Some use a refundable deposit plus monthly pet rent. Others use a non-refundable fee besides pet rent. Some states restrict combined totals. The best option depends on state law, market conditions, portfolio strategy, and insurance considerations.

For property managers, clarity matters. A vague or inconsistent pet policy is one of the fastest ways to trigger disputes. A clean, well-structured policy, supported by pet deposit management software, eliminates confusion by clearly labeling charges, applying rules consistently, and storing documentation digitally so there is no misunderstanding during move-out.

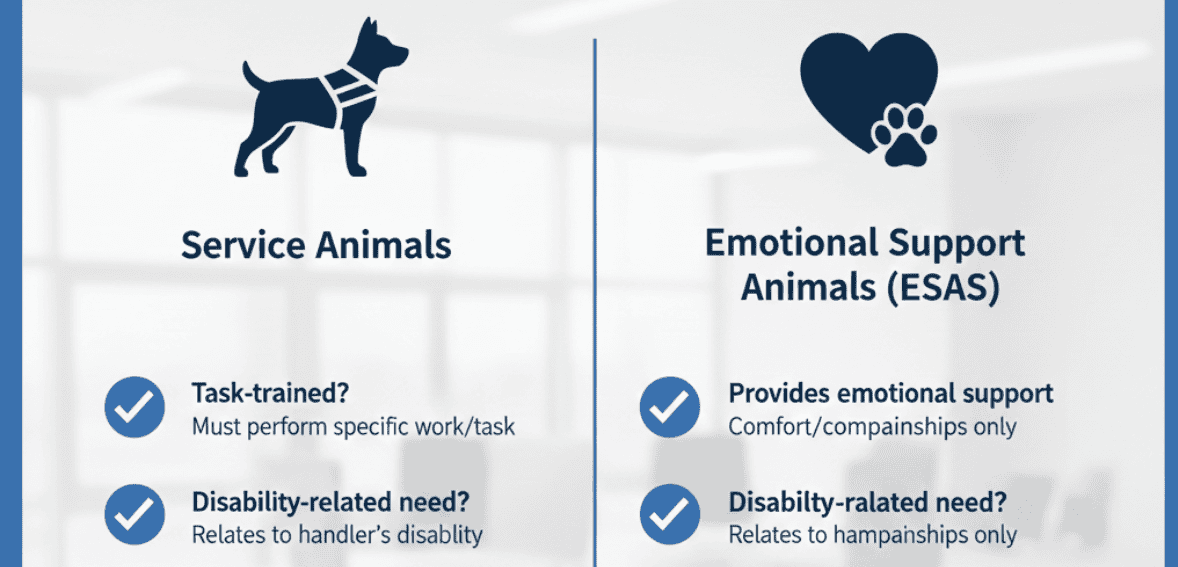

Assistance Animals vs. Pets: Where Property Managers Face the Highest Compliance Risk

There is no greater compliance risk in rental housing than mishandling assistance animal requests. The Fair Housing Act draws an absolute line between “pets” and “assistance animals.” A service animal or an emotional support animal (ESA) is not a pet. Charging fees, deposits, pet rent, or insurance requirements for these animals is illegal.

This is where property managers often get overwhelmed. Most are not trying to violate the law; they feel unclear about what documentation is allowed, what they can ask, or how to verify legitimate requests. The rise of online ESA letters and fraudulent documentation makes this even more complicated. Property managers must walk a tight line: honoring legitimate disability accommodations without enabling abuse of the system.

A legitimate assistance animal request requires reasonable verification, especially for ESAs. Managers cannot ask about the tenant’s disability. They cannot demand medical records. They cannot demand certification from a specific provider. But they can request reliable documentation if the disability or the disability-related need for the animal is not apparent.

The challenge is keeping this process compliant, consistent, and well-documented. This is where pet deposit management software and digital verification workflows help eliminate human error. The system ensures the manager requests only permitted information, applies the same steps to every applicant, logs each communication, and stores the documentation securely.

Once an assistance animal is verified, the landlord must waive all fees, deposits, and rent. The tenant may only be charged for actual damages at move-out precisely the same way a standard tenant would be charged for damage. The property manager cannot require pet insurance or impose breed, size, or weight restrictions. These limitations are often misunderstood, leading many managers into avoidable compliance problems.

A modern, documented, and standardized workflow protects both managers and residents. It prevents inconsistent decisions, reduces Fair Housing risk, and ensures that disability accommodations are handled with respect, accuracy, and in compliance with the law.

Automating Pet Registration and Compliance Tracking Across Your Portfolio

With more renters owning pets than ever before, manual systems for tracking pet documentation are no longer realistic. Lost vaccination records, missing photos, outdated pet profiles, handwritten notes, and scattered paperwork create a significant risk. Unauthorized pets slip into units undetected. Property managers forget to update charges. Renewals happen without updated documentation. And during move-out, managers lack the evidence needed to document or dispute damage.

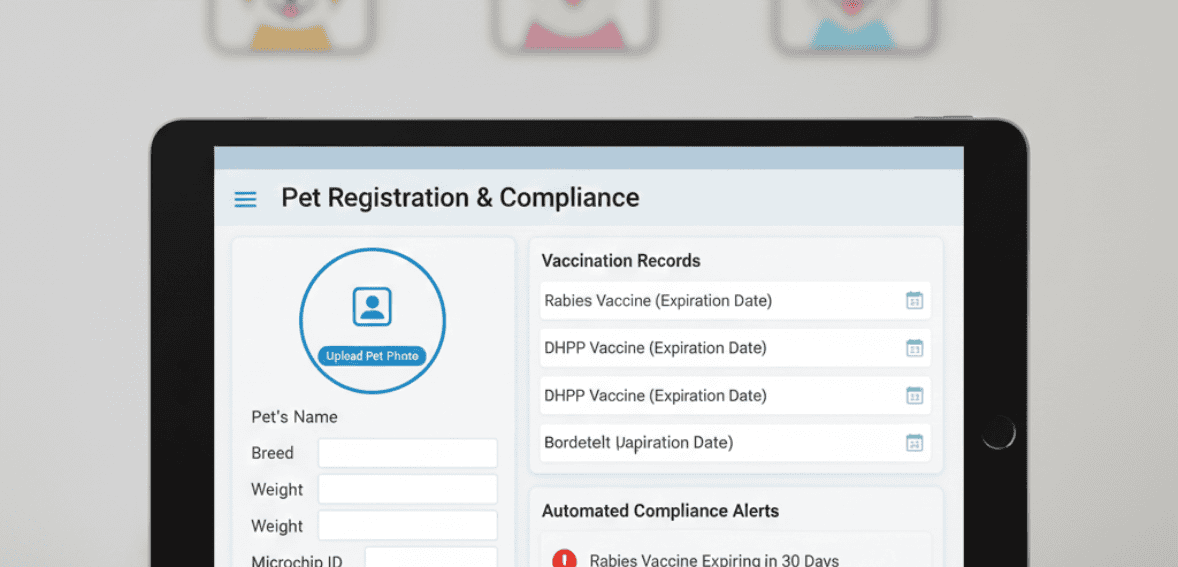

This is why automation has become standard in 2025. Modern pet deposit management software gives property managers digital control over every pet-related detail without extra administrative labor.

Automation improves the following areas:

Pet registration during application: Applicants upload photos, breed details, vaccination records, emergency contacts, spay/neuter status, and behavioral notes directly within the system. Managers review and approve within minutes.

Tracking multi-pet households: Some tenants have two dogs, a cat, or multiple small animals. Software calculates correct charges automatically based on property rules.

Billing pet rent and deposits: Instead of manually adding charges to the ledger, the system calculates pet rent monthly, posts pet fees, and records deposits accurately for compliance.

Compliance alerts: If vaccination records expire, required documents are missing, or pet profiles need updates, the system notifies both the manager and the tenant instantly.

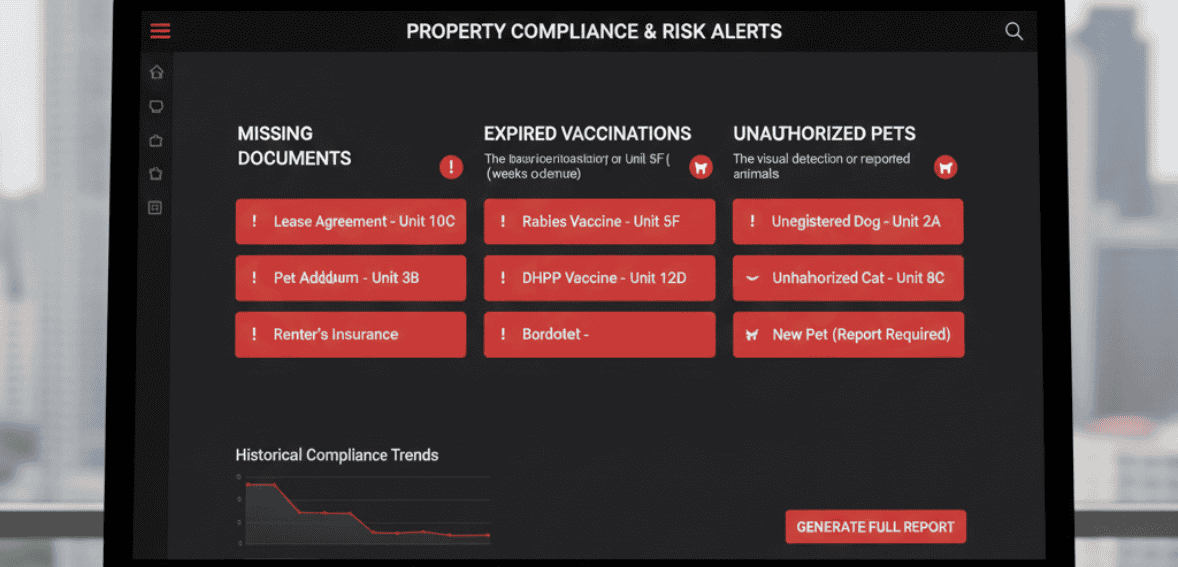

Unauthorized pet detection: Regular inspections, resident reporting tools, and automated registration workflows help identify unapproved animals. When discovered, retroactive pet rent or deposits can be charged and violations documented.

Portfolio-level visibility: For managers overseeing multiple properties, software provides complete oversight showing which pets belong to which units, which documents are missing, which deposits are held, and which units have unauthorized pets.

Digital systems don’t replace fairness; they support it. Tenants know what is required, managers stay compliant, and properties remain protected. With clear records and consistent rules, disputes decrease significantly.

This is the future of pet policy management organized, automated, fair, and thoroughly documented.

Why Compliance Matters More in 2025 Than Ever Before

Pet ownership is growing at a historic rate, dramatically shaping the rental housing market. Renters today expect flexibility, transparency, and digital processes when it comes to pets. At the same time, property owners expect protection against risk, especially rising pet-related maintenance costs, turnover expenses, and legal exposure.

This is why the modern property manager must strike a careful balance. An excellent pet policy isn’t about being strict or lenient, it’s about being transparent, lawful, and consistent. The worst problems in rental pet management arise not from pets themselves, but from unclear rules, inconsistent enforcement, and missing documentation.

By 2025, compliance is more critical than ever because:

- HUD rules around elderly and disabled housing are being enforced more aggressively.

- Assistance animal fraud complaints are increasing.

- Insurance carriers are updating pet coverage terms.

- Tenants are more aware of their rights and more likely to complain.

- State deposit laws are becoming stricter, especially regarding refundable vs. non-refundable charges.

- Pet-friendly housing is now an expected amenity, and unclear policies push renters away.

The most competent property managers are moving toward property management systems that minimize errors. A firm policy, supported by pet deposit management software, ensures that the manager consistently treats similar situations protecting the property, complying with regulations, and maintaining fairness.

Inconsistent enforcement is one of the biggest hidden risks. If one tenant is charged a fee and another is not, or if one assistance animal request is handled differently from the next, the property manager becomes vulnerable to claims of discrimination or unfair treatment. A digital system eliminates that danger by applying rules uniformly and preserving timestamped records.

This shift isn’t just operational, it’s part of the broader movement toward transparency and accountability in rental housing. Tenants want to know precisely what they’re paying for, why charges are being applied, and how they can stay compliant. Software enables managers to provide tenants with clear documentation, structured rules, automated reminders, and a transparent breakdown of pet-related charges.

How Modern Pet Policies Strengthen Tenant Satisfaction and Reduce Turnover

Pet-friendly rentals consistently show higher occupancy rates, longer tenancies, and stronger renewal patterns. When people feel their pets are welcomed not merely tolerated they treat the property with more respect and form a deeper connection with the community.

A transparent, well-managed pet policy:

- Makes high-quality renters stay longer

- Attracts a larger applicant pool

- Eliminates confusion about deposits and fees

- Reduces arguments at move-out

- Improves trust between tenants and management

Tenants love clear rules. They want to know how much pet rent is, whether the deposit is refundable, what they need to submit, and how to stay compliant. When the pet onboarding experience is smooth and digital, renters perceive the entire management team as more professional.

Strong policies do not push responsible pet owners away; poorly communicated policies do. The modern renter expects the same transparency they see in other industries: online payment portals, real-time updates, clear charge breakdowns, clean documentation, and digital processes. Property managers who provide this experience using organized systems gain a competitive advantage.

How Automation and Digital Tracking Reduce Risk for Property Managers

Pet damage can be expensive. Unauthorized pets even more so. Missing documentation creates enormous liability, especially when insurance is involved. Inconsistent handling of assistance animals can cause costly Fair Housing disputes.

Yet most of these risks can be controlled with a single shift: moving away from manual tracking and embracing automated Compliance in Property Management.

Automation reduces risk by:

- Tracking pet charges with perfect accuracy

- Ensuring no illegal fees are added to assistance animal accounts

- Documenting all communication for Fair Housing compliance

- Maintaining proof that the property followed the required procedures

- Identifying unauthorized pets quickly through inspection logs

- Creating a digital audit trail that protects owners in disputes

- Tracking expiration dates for vaccines, breed information, and other requirements

Without automation, policies fall apart slowly: one missed document here, one forgotten fee update there, one unverified ESA letter that accidentally violates compliance rules. These minor lapses accumulate until a conflict arises that could have been prevented.

But with pet deposit management software, the property manager’s job becomes smoother. Every charge is calculated automatically. Every compliance requirement is logged. Every document is stored. Every reminder is triggered. Every tenant knows precisely what is expected.

This kind of system doesn’t just protect properties, it protects relationships.

Conclusion

Pet-friendly housing is no longer a niche category it is the future of rental real estate. But with more pets come more risks, more regulations, and more room for error. Understanding how to structure pet deposits, pet fees, and pet rent is essential for compliance and financial stability. Understanding assistance animals is vital to avoiding Fair Housing violations. And understanding how to automate pet management is critical for operational efficiency in 2025 and beyond.

Pet deposit management software gives property managers the tools to enforce rules consistently, thoroughly document actions, communicate clearly with tenants, and maintain full legal compliance. It reduces risk while increasing transparency. It brings structure to an area of property management that has historically been confusing and inconsistent.

The trends shaping 2025 point toward one clear answer: managers who adopt organized, automated, and fair pet policies will attract better tenants, reduce disputes, improve retention, and protect their properties far more effectively than those using outdated manual processes.

A smart pet policy is not only a compliance tool it is a business strategy. And in a competitive rental market, it is one of the strongest tools a property manager can have.

FAQs

What’s the difference between a pet deposit, pet fee, and pet rent?

A pet deposit is refundable and covers pet-related damage. A pet fee is a non-refundable one-time charge. Pet rent is a recurring monthly amount for ongoing wear and tear. Many properties use a combination based on state rules and revenue strategy.

Can I charge anything for emotional support animals?

No. Assistance animals including ESAs are not pets under federal law. You cannot charge deposits, fees, or pet rent. You may charge for actual damage caused by the animal, just as you would with any tenant.

What are the federal limits for pet deposits in HUD-assisted housing?

HUD caps pet deposits at one month’s rent for eligible units and allows gradual accumulation. Deposits must be held separately and refunded if no pet damage exists.

Should I remove breed and weight restrictions?

Many properties are removing restrictions to increase occupancy, but managers should check their insurance coverage. A better approach is structured screening, vaccination rules, documentation, and appropriate rent/deposit levels.

How do I track unauthorized pets effectively?

Use digital pet registration, routine inspections, lease clauses, and compliance alerts. Software helps identify missing documents and allows you to apply retroactive charges consistently across your portfolio.