by Rinki Pandey January 12, 2026

Property management accounting is one of those things that people think is simple until they actually start doing it. On the surface, it feels like just collecting rent, paying some bills, and giving the owner a report at the end of the month. But once you are inside a real property management business, you quickly realize it is a whole different world. You are handling other people’s money. You are responsible for keeping tenants, owners, vendors, and sometimes even government auditors happy. And one small mistake in property management accounting can quickly turn into a huge problem.

What makes property management accounting different from regular business accounting is the trust element. You are not just tracking your income and expenses. You are also holding funds that belong to property owners and, sometimes, tenants in special trust accounts. These funds must be handled very strictly. You cannot mix them with your own business money. You cannot spend them on your own needs. And you must always be able to show exactly where every dollar came from and where it went.

Learning property management accounting correctly is essential. Errors can lead to legal trouble, lost clients, or license loss. Done properly, it becomes a business strength. Owners trust you, reports make sense, and you truly know your business health.

This guide breaks property management accounting down practically, not as a textbook. We’ll discuss how money flows through a company, how trust accounts work, how rental income is tracked, and how this supports the financial reports owners rely on. The first part covers the foundation, because nothing else makes sense without it.

Property Management Accounting Starts with Trust Accounts

Property management accounting starts with trust accounts. Without understanding trust accounts, the rest remains confusing. A trust account holds money not owned by your company funds belonging to property owners or tenants. You simply manage this money.

Tenant rent and security deposits are placed in a trust account. Owner funds for repairs or reserves also go into a trust account. The operating account, where management fees are deposited, is separate. Mixing these accounts is one of the biggest mistakes new property managers make.

Strict rules govern trust accounts to ensure compliance with legal and ethical standards. Many states require that owner and tenant funds remain separate from business funds. Accidentally spending trust money, even briefly, can be misappropriation—a serious matter.

In real life, rent goes into the trust account. Later, you transfer your management fee to your operating account. The remaining funds stay in trust until used for expenses, such as maintenance, utilities, or owner distributions.

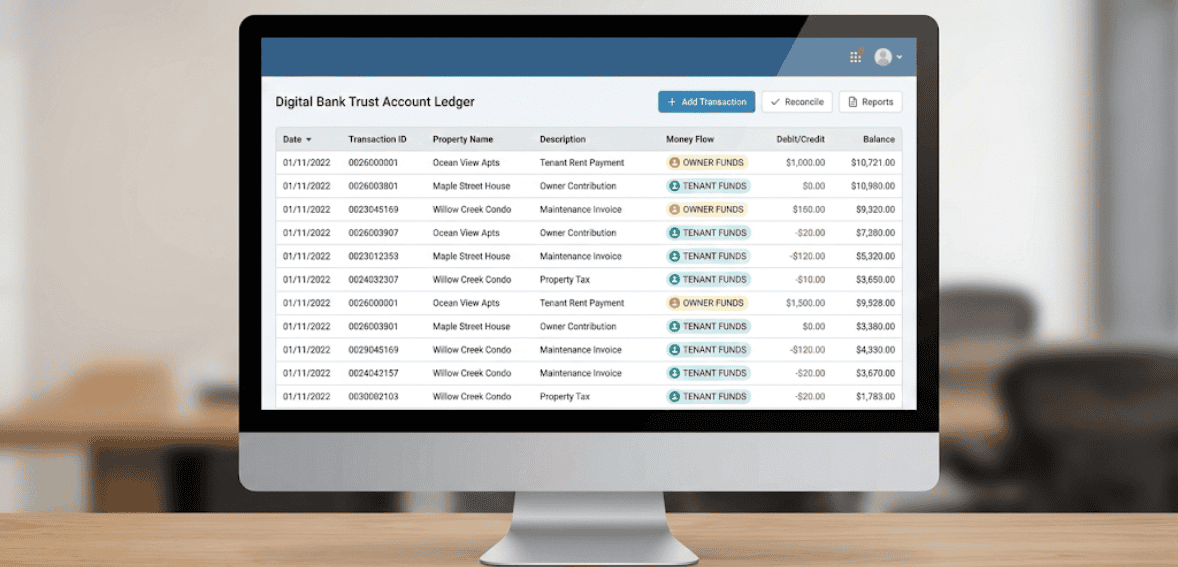

Property management accounting systems track trust balances, not just income. You must always know how much belongs to each owner or property. This isn’t just an organization; it protects you and your clients.

Done right, trust accounting lets you instantly see money available for repairs, each owner’s balance, and security deposit reserves. That clarity keeps your business smooth.

How Rental Income Tracking Works in Property Management Accounting

Rental income tracking is critical because rent is typically a property’s primary source of income. Tracking rent means not only recording payments, but also following where that money goes, when it’s earned, and how it affects trust balances.

When a tenant pays rent, that payment is recorded in the system and deposited into the trust account. But in property management accounting, that money is not fully available right away, as many people think. Some of it may be allocated to the owner, some to future expenses, and some to your management fee.

Let’s say a tenant pays $1,000 in rent. Maybe $100 is your management fee. Maybe two hundred is set aside for upcoming maintenance. The rest belongs to the owner. Good rental income tracking makes sure that every part of that thousand dollars is assigned correctly.

This is where many small property managers get into trouble. They see money in the bank and assume it is all free to use. But in property management accounting, bank balance and available balance are not the same thing. You might have fifty thousand dollars in the trust account, but only ten thousand might actually be available for spending, because the rest belongs to owners and tenants.

Rental income tracking also helps you spot problems early. If one tenant is always late, you can see that pattern. If a property is not producing enough income to cover its expenses, you can see that too. Without proper tracking, these issues stay hidden until they become serious.

This is also why modern property management accounting software is so important. Spreadsheets can work for a very small number of properties, but once you grow, you need a system that automatically tracks rent, allocates it correctly, and keeps your trust balances accurate.

Why Trust Accounting Is the Backbone of Property Management Accounting

Trust accounting is more than a feature it’s the foundation. Every report, payment, and transfer relies on accurate trust accounting.

At its core, trust accounting is about accountability. You are responsible for money that is not yours. Owners trust you to handle it properly. Tenants trust you to return their deposits. Vendors trust you to pay them on time. And regulators trust you to follow the rules.

This is why trust reconciliation is important. A reconciliation is when you compare your trust account bank statement to what your property management accounting system says you should have. They must match. If they do not, something is wrong. Maybe a payment was entered incorrectly. Maybe a transfer was missed. Or maybe someone made a serious mistake.

Regularly doing trust reconciliations is not optional. It is how you catch problems early before they grow. A small error this month is easy to fix. A six-month-old error can be a nightmare.

Good trust accounting also makes financial reporting much easier. When your trust balances are correct, your owner statements make sense. Your cash flow reports are accurate. And you do not have to guess where the money went.

Many property managers think accounting is just paperwork. But in property management accounting, it is actually about control. Control over your money, your risks, and your reputation.

How Property Management Accounting Connects to Financial Reporting

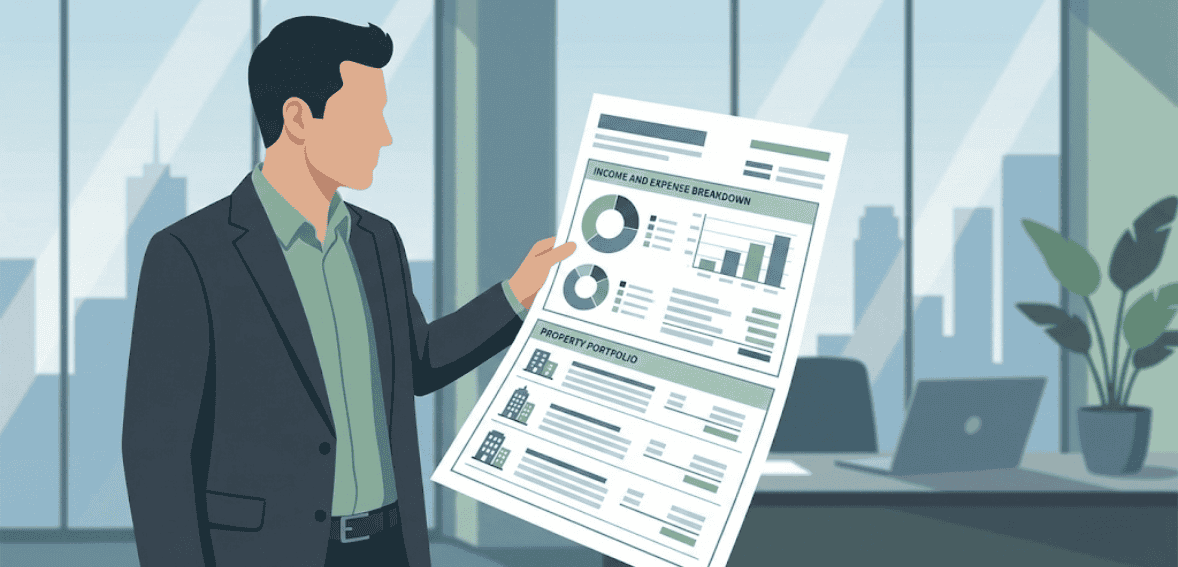

Everything we talked about so far leads to one thing: financial reporting. Financial reporting is where all your work in property management accounting finally becomes useful. This is what owners see. This is what helps them decide whether to keep a property, sell it, or invest more money.

When your rental income tracking is clean and your trust accounting is accurate, your financial reporting becomes powerful. You can show owners exactly how much money came in, how much went out, and what their net income really is. You can also show them where their trust balance stands, so they know how much cash is available to them.

Financial reporting in property management is not only about profit and loss but also about transparency. Owners need to see that their money is managed properly to build confidence in your services.

This is also where you protect yourself. If an owner ever questions a payment or a balance, you have the records to back it up. Your property management accounting system becomes your proof.

In the next part, we will go deeper into financial reporting itself, owner statements, expense tracking, and how all of this turns into real-world decisions. That is where property management accounting really shows its value.

How Property Management Accounting Handles Expenses and Vendor Payments

Once rental income starts coming in, the next big thing property management accounting has to deal with is expenses. This is where things can get messy if the system isn’t set up correctly. Every property has expenses. Repairs, cleaning, utilities, landscaping, insurance, taxes, and emergency fixes. All that money usually comes out of the trust account because it belongs to the property owner, not the management company.

So when a vendor sends an invoice, property management accounting must check a few things before paying it. First, is the expense actually for this property? Second, is there enough money in that property’s trust balance to cover it? Third, has the owner approved it, if approval is required? Only after these items are confirmed should the payment be issued.

This is where many managers make mistakes. They pay bills first and worry about balances later. That is dangerous. If you pay a vendor using money that belongs to a different owner or property, you are breaking trust accounting rules. Even if you plan to fix it later, it is still a violation.

In a good property management accounting setup, every expense is tied to a specific property and owner. The system automatically reduces that property’s trust balance when the bill is paid. That way, you always know exactly how much money is left for that property.

Vendor payments must also be properly recorded. You are not just paying a bill. You are creating a financial record that will appear in the owner’s financial reporting. If a plumber fixed a leak, the owner will see that cost in their statement. If the amount is wrong or missing, it creates confusion and mistrust.

This is why property management accounting is not just data entry. It is a process of checking, verifying, and recording so that everyone involved can trust the numbers.

Owner Statements and Financial Reporting in Property Management Accounting

Owner statements are one of the most important outputs of property management accounting. This is where everything comes together. Rent collected, expenses paid, management fees, and remaining trust balances all appear in this one document.

A good owner statement tells a clear story. It shows the amount of rental income received during the period. It shows what was spent and why. It shows the fees the management company charged. And it shows how much money is left for the owner. When property management accounting is done right, the owner can review that statement and understand what happened without having to call and ask questions.

Financial reporting is not just one statement. It includes reports such as profit and loss statements, cash flow summaries, and trust balance reports. These help owners see trends over time. Maybe property is doing better this year than last year. Maybe maintenance costs are rising. Maybe rental income tracking shows vacancies increasing. All this information comes from property management accounting.

For the management company, financial reporting is also a way to measure performance. You can see which properties are profitable, which ones are high-maintenance, and which ones might not be worth keeping as clients.

The key is that financial reporting only works if the underlying data is correct. Bad trust accounting leads to bad reports. And bad reports lead to bad decisions.

Why Reconciliations Keep Property Management Accounting Honest

Reconciliation is one of those words that sounds boring but is actually very powerful in property management accounting. It simply means checking that your records match reality. In this case, it means ensuring that your trust account balance in the bank matches what your accounting system shows it should be.

This should be done regularly, usually every month. You take the bank statement for the trust account and compare it line by line with your property management accounting records. Every deposit, every payment, and every transfer should match.

When they do not match, it means something is wrong. Maybe a payment was entered twice. Maybe a deposit was not recorded. Or maybe money was moved without being documented. These are not just small issues. In trust accounting, even a small mismatch is serious.

Reconciliations are what protect you. They catch mistakes early. They also protect owners because their money is being checked and verified. In many places, regulators can seek these settlement reports. If you cannot provide them, you can face penalties.

So even though reconciliations feel like extra work, they are actually what keep property management accounting clean and safe.

How Property Management Accounting Supports Better Business Decisions

When property management accounting is done properly, it becomes more than just compliance. It becomes a business tool. You can see which properties are making money and which are struggling. You can see where expenses are going. You can see how much cash is sitting in trust and how much is flowing out.

This helps you make smarter decisions. Maybe you see that one property has constant repair costs and low rental income. That tells you something. Maybe another property has a strong trust balance and steady rent. That tells you something else.

Owners also use this information to make decisions. They might decide to raise rent, sell a property, or invest in improvements based on the financial reporting you provide.

This is why property management accounting is not just bookkeeping. It is about giving everyone a clear picture of what is really happening.

Conclusion

Property management accounting is the foundation of a successful property management business. It starts with trust accounts, flows through rental income tracking, and ends with financial reporting that owners rely on. When it is done right, it creates transparency, builds trust, and helps everyone make better decisions. When it is done wrong, it leads to confusion, legal risk, and unhappy clients.

By understanding trust accounting, correctly tracking rental income, handling expenses carefully, and producing clear financial reporting, you turn property management accounting into a strength rather than a headache.

FAQs

What makes property management accounting different from regular accounting?

Property management accounting involves trust funds belonging to owners and tenants, not just the company, so it has much stricter rules and tracking requirements.

Why is trust accounting so important?

Trust accounting ensures that owner and tenant funds are kept separate and protected, as required by law in most jurisdictions.

How does financial reporting help property owners?

Financial reporting shows owners how much money their property is generating, what has been spent, and how much cash is available, helping them make better decisions.

How often should trust accounts be reconciled?

Trust accounts should be reconciled at least once a month to catch errors early and protect owner funds.

What if property management accounting is done incorrectly?

Mistakes can lead to legal issues, unhappy property owners, and even the loss of a license, because trust money must be handled very strictly.