by Inez Kim October 16, 2024

Quicken, originally launched in 1983 as a simple financial management software, has grown significantly over the years. The software now offers multiple tiers of services, including specialized tools for managing rental properties. While Quicken is often recognized for its personal finance capabilities, it has expanded to serve the needs of property managers, landlords, and small business owners looking to streamline their financial tracking.

Quicken’s property management features can be found primarily in their Home & Business edition, which offers tools specifically designed to track rental property income and expenses. This addition to Quicken’s traditional suite makes it a dual-purpose software solution for users who require both personal financial management and rental property tracking.

In This Article

ToggleKey Features of Quicken Property Management Software

Quicken Property Management Software is a versatile tool that simplifies financial management for property managers, particularly those with a small portfolio. While it doesn’t offer the full scope of a dedicated property management system, it excels in tracking income, expenses, and tenant information, making it a strong contender for landlords managing a few rental units.

1. Expense and Income Tracking

A standout feature of Quicken is its ability to track all financial transactions in one place. For property managers, this includes the ability to categorize and track rent payments, maintenance costs, and property-specific expenses. Each transaction can be tagged to specific properties, ensuring accurate financial reporting.

This functionality allows landlords to monitor their income versus expenses and generate reports that can help make tax season easier. Being able to group expenses by property is a critical aspect for individuals managing multiple rental units.

2. Tenant Management

Quicken simplifies the process of tenant management by allowing users to record tenant details, including payment history and lease agreements. Additionally, users can automate rent reminders and track late payments.

While Quicken is not a fully-fledged property management platform like Buildium or AppFolio, it does offer enough tenant tracking tools to make life easier for smaller landlords with a few rental units.

3. Reporting and Financial Insights

Quicken provides an array of financial reports, including cash flow, profit/loss, and tax summary reports. These reports can be filtered to include rental property information, giving landlords insight into the performance of their properties.

The ability to generate rental property-specific reports is invaluable during tax preparation or when preparing documents for a lender. Quicken also integrates with TurboTax, streamlining tax filing for those who use both software.

4. Bill and Payment Management

Quicken’s Bill Manager feature allows users to set up online bill payments directly from their accounts, monitor due dates, and ensure timely payments. For landlords, this feature is helpful for tracking recurring expenses such as mortgage payments, utility bills, and repair costs.

However, some users have noted that while Bill Manager works well with standard bank accounts, they have encountered difficulties when trying to sync PayPal or other third-party accounts. This has led to minor frustrations, particularly for those who use alternative payment methods for managing their finances.

5. Cloud Sync and Mobile Access

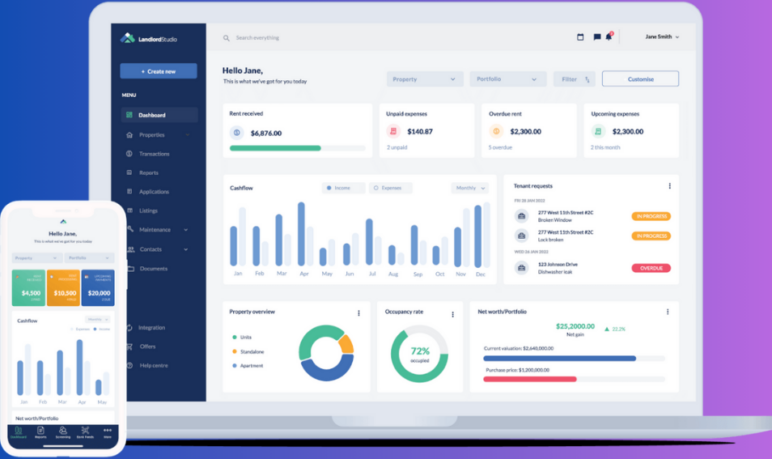

One of Quicken’s more recent upgrades is its cloud sync functionality. Users can now access their financial data across multiple devices, including smartphones and tablets. This is particularly useful for property managers who may need to access tenant information or financial reports while on-site at a rental property.

Although Quicken’s mobile app is not as robust as its desktop counterpart, it allows for viewing transactions, tracking expenses, and updating account balances on the go. For landlords who prefer managing their properties remotely, the mobile accessibility is a valuable addition.

6. Investment Tracking

Another feature that sets Quicken apart from other property management software is its robust investment tracking tools. For landlords who also have investment portfolios, Quicken allows for tracking stocks, bonds, and other investment assets in one place. This holistic view of both personal finances and property management can be appealing to individuals juggling multiple financial responsibilities.

Customer Reviews of Quicken Property Management Software

Following is the Quicken Property Management Software review.

Review 1: Best Desktop Accounting Software

This review praises Quicken’s ease of use and affordability, particularly for those managing multiple business or personal accounts. The reviewer highlights the cloud backup feature and excellent customer service, but notes the lack of a password vault recovery option.

Pros: Ease of use, affordable, supports multiple accounts, excellent customer service.

Cons: No option to recover password vault.

Reason for Choosing Quicken: It’s an improved version of the old Quicken software.

Reason for Switching: More affordable than competitors.

Review 2: Disappointing Customer Support

This review expresses deep dissatisfaction with Quicken’s support for bill pay services. Despite using Quicken since 1993, the reviewer experienced a frustrating two-month process to set up online bill pay, facing multiple obstacles with customer support.

Pros: Long history of effective use for business finances and tax preparation.

Cons: Poor customer service, delays in bill pay setup, unclear communication about required documents.

Conclusion: The reviewer is considering abandoning Quicken due to poor service.

Review 3: A New Way to Budget

The reviewer had initial difficulties using Quicken but appreciated its customer support. Over time, they found it transformative for business accounting.

Pros: Streamlined business accounting, comprehensive financial tools.

Cons: Steep learning curve.

Conclusion: After overcoming initial challenges, Quicken has become an essential tool.

Review 4: Great Program for Office Use

After testing Quicken in their office, the reviewer adopted it across their business due to its ease of use and adaptability.

Pros: Easy to self-learn and teach to others, smooth setup, and data conversion.

Cons: None reported.

Reason for Choosing Quicken: Easier to learn than alternatives.

Review 5: Simple, Effective for Small Businesses

Quicken is described as an ideal solution for small businesses due to its simplicity and essential features. However, the reviewer warns that it may not be suitable for larger enterprises.

Pros: Simple, straightforward, suited for small businesses.

Cons: Not suitable for mid-sized or larger businesses.

Reason for Choosing Quicken: Ease of use and exactly the features needed.

Review 6: Dislikes Monthly Fees

The reviewer enjoys Quicken but is frustrated by the subscription model for connecting bank accounts.

Pros: Easy to use, helpful for accounting needs.

Cons: Monthly fees for automatic bank connections are a burden for small businesses.

Reason for Choosing Quicken: Initially chosen for its affordability and free bank connections, but switched due to fees.

Review 7: Quicken Home & Business – Good but Could Be Great

The reviewer appreciates Quicken’s ability to manage finances but criticizes its outdated interface and cloud features.

Pros: Manages finances in one tool.

Cons: Dated interface and unreliable cloud functionality.

Review 8: Easier to Learn than QuickBooks

This review highlights Quicken’s simplicity, particularly for tracking expenses across multiple accounts, though it lacks certain business features.

Pros: Easy account updates, effective for multiple accounts.

Cons: Lacks profit and loss statements for businesses.

Reason for Switching: Simpler than QuickBooks for expense tracking.

Review 9: Business Malpractice

The reviewer feels wronged by Quicken’s switch to a subscription model after they had initially purchased the software.

Pros: Helps with weekly tax record keeping.

Cons: Forced subscription model after initial purchase, lack of transparency.

Review 10: Goodbye Quicken Due to Subscription

After 20 years of using Quicken for checkbook management, the reviewer switched to another software due to the intrusive subscription renewal reminders.

Pros: Simple for checkbook management.

Cons: Annoying renewal prompts.

Review 11: Reliable Connections After Many Years

This long-time user appreciates Quicken’s improved connection with financial institutions but finds the subscription expensive and customer service lacking.

Pros: Consistent connection to financial institutions, good reporting capabilities, effective cloud sync.

Cons: Expensive subscription, slow customer service.

Review 12: Easiest Management for Small Businesses

This review highlights Quicken’s ease of use for small business management, though it lacks advanced accounting features like payroll.

Pros: Double-entry system without complexities, easy to use.

Cons: No payroll or accounts receivable/payable systems.

Review 13: Powerful and Easy to Use

The reviewer appreciates Quicken as a full accounting system without the complexity of QuickBooks, though the lack of intuitive customization is a drawback.

Pros: Comprehensive accounting for small businesses.

Cons: Customization can be difficult.

Review 14: Disappointed

The reviewer is frustrated by Quicken’s inability to print 1099 forms, which they consider unacceptable.

Pros: Easy to download transactions.

Cons: Inability to print necessary forms like 1099-NEC or MISC.

Review 15: Good Alternative to Excel, Beware of Bugs

The reviewer finds Quicken to be an affordable alternative to Excel for property management but warns about bugs in the software.

Pros: Affordable, helps manage tenants and expenses effectively.

Cons: Bugs can affect the experience.

Positive Feedback:

Ease of use: One of the primary highlights in user reviews is the software’s ease of use. Landlords appreciate how user-friendly the interface is, even for those who may not be technologically savvy. Managing rental properties can be a complex task, and Quicken’s simple design helps streamline that process.

Comprehensive financial tracking: Many users praise the software for its ability to manage both personal and rental property finances in one platform. This makes it easier for users to have a consolidated view of their overall financial health.

Affordability: Compared to other property management software tools, Quicken is often highlighted for its affordability. Small landlords, in particular, find Quicken an accessible option for keeping their rental finances in order without breaking the bank.

Negative Feedback:

Limited scalability: While Quicken is effective for small portfolios, some users report that it lacks features necessary for managing larger property portfolios. As a result, landlords with a growing number of properties may outgrow Quicken’s capabilities and need to seek more scalable alternatives.

Lack of cloud-based features: Another point of criticism is the lack of real-time cloud-based access. Although Quicken has introduced mobile access, users still feel that the software is somewhat limited in terms of remote access and collaboration compared to fully cloud-based property management systems.

Compatibility issues: Some users have reported issues with exporting data or integrating with other software systems. While Quicken is well-optimized for tax reporting, a few users have mentioned difficulties when attempting to use data across multiple platforms or applications.

How Quicken Compares to Competitors?

When it comes to property management software, there are numerous options in the market. Quicken’s key advantage is its dual-purpose use—offering both personal financial management and rental property management. This makes it stand out from competitors like Buildium and AppFolio, which are designed exclusively for property management.

Pros of Quicken over Competitors:

Affordability: Quicken is priced much lower than most full-scale property management systems. It’s ideal for landlords with a handful of properties who do not need an expansive set of features.

Personal finance tools: Unlike competitors that are strictly property-focused, Quicken offers tools that help users manage their personal finances alongside their rental properties, making it ideal for part-time landlords.

Cons of Quicken over Competitors:

Feature set: While Quicken covers the basics well, it lacks some of the advanced features found in more comprehensive property management systems like Tenant Portal, Maintenance Tracking, or Online Payment Integration offered by competitors like Buildium and TenantCloud.

Cloud capabilities: Competitors like AppFolio offer cloud-based, real-time collaboration features that allow property managers to work remotely and across multiple devices seamlessly. Quicken’s lack of a fully cloud-based option can be a disadvantage for those who need to manage their properties on the go.

Pricing and Availability

Quicken Home & Business, which includes the Rental Property Management feature, typically costs around $99.99 per year. While this is a relatively low price point compared to dedicated property management software, it is important to consider the trade-offs in terms of scalability and advanced functionality.

For landlords who need more extensive property management tools, it may be worth considering alternatives like Cozy (which offers free basic services but charges for payment processing and credit reports) or Buildium (which starts at $50 per month but includes more advanced features like tenant screening and a tenant portal).

Conclusion

Quicken Property Management Software Reviews reveal a versatile yet affordable solution for landlords managing a few rental units. With features like expense and income tracking, tenant management, and financial reporting, Quicken offers essential tools for managing rental properties while also catering to personal finances. Although praised for its ease of use and comprehensive financial tracking, some users find its scalability limited, making it less suitable for larger property portfolios.

Additionally, the lack of advanced property management features, such as tenant portals and online payment integration, is noted in reviews. Despite these limitations, Quicken remains an ideal choice for small landlords seeking an affordable, user-friendly software for managing both personal and rental finances.

Frequently Asked Questions

Yes, Quicken is known for its intuitive, user-friendly design, making it easy for landlords, even those without extensive tech skills. The software simplifies tasks like tracking expenses, managing tenant information, and generating financial reports, making property management more straightforward.

Yes, Quicken’s mobile app allows users to access financial data, track expenses, and update account balances on the go. The app syncs with the desktop version via the cloud, making it convenient for property managers who need to manage their rental properties remotely or on-site.

Yes, Quicken enables users to categorize and tag rental property expenses, such as maintenance, repairs, and utilities. These expenses can be tracked for individual properties, providing accurate financial data. This feature is especially useful during tax season or when preparing reports for property performance assessments.