by Rinki Pandey January 6, 2026

Rent collection has always been one of the most time-sensitive and stress-prone responsibilities in property management. Late payments, manual follow-ups, check handling, and reconciliation errors don’t just slow operations; they directly affect cash flow and owner confidence. As the rental industry modernizes, fintech solutions are reshaping how landlords and property managers collect rent, making the process faster, more predictable, and far less labor-intensive.

Fintech-powered rent collection systems replace outdated methods with digital payments, automated debits, real-time tracking, and smart reminders. Instead of reacting to missed payments, managers can proactively design rent workflows that reduce friction for tenants while protecting revenue. This shift isn’t about convenience alone; it’s about operational resilience, financial visibility, and scalability.

This article explores how fintech is transforming rent collection, starting with the limitations of traditional methods and moving into the practical advantages of modern digital systems.

Why Streamlining Rent Collection with Fintech Has Become Essential

Streamlining rent collection with fintech is no longer a “nice to have” feature; it has become essential to running a financially healthy rental operation. Traditional rent-collection methods were designed for a slower, smaller-scale environment. Paper checks, cash drop-offs, and manual bank deposits simply cannot keep up with modern rental portfolios, especially when tenants expect digital-first experiences.

From a financial standpoint, delayed rent directly impacts cash flow predictability. Mortgage payments, vendor invoices, maintenance expenses, and owner disbursements all depend on timely rent receipts. When rent arrives late or, worse, requires repeated follow-ups, the entire financial ecosystem becomes reactive rather than planned.

Fintech solutions introduce structure and automation into rent collection. Digital payment systems allow rent to be scheduled, processed, tracked, and recorded without human intervention. This eliminates ambiguity around payment status and creates a consistent monthly rhythm. Managers no longer wonder who has paid and who hasn’t; the system provides real-time clarity.

From the tenant’s perspective, fintech simplifies compliance. Instead of remembering due dates or mailing checks, renters can rely on automated debits, saved payment methods, and reminders. This reduces accidental late payments and friction in landlord-tenant relationships. When paying rent becomes effortless, on-time payment rates naturally improve.

Most importantly, fintech-based rent collection scales. Whether managing ten units or ten thousand, the same automated workflows apply. This scalability makes fintech foundational for any property management business planning to grow.

The Hidden Costs of Traditional Rent Collection Methods

Many property managers underestimate the true cost of traditional rent collection. While paper checks and manual transfers may appear inexpensive on the surface, they carry high hidden costs in time, labor, errors, and tenant dissatisfaction.

Manual rent collection requires physical handling, receiving checks, endorsing deposits, visiting banks, and reconciling statements. Each step consumes staff time that could be redirected toward leasing, tenant support, or asset optimization. Over a year, these small inefficiencies add up to hundreds of lost hours.

Manual systems also exhibit a higher error rate. Misapplied payments, data entry mistakes, and reconciliation gaps are common when rent is processed outside an integrated digital workflow. These errors lead to disputes, delayed owner reports, and compliance risks during audits.

Traditional methods also increase delinquency risk. Tenants paying by check are more likely to miss deadlines due to mail delays, forgotten schedules, or insufficient funds at the time of deposit. Once rent becomes late, managers must shift into collection mode, sending reminders, making calls, and documenting communications.

Another overlooked cost is tenant experience. Rent payments are among the most frequent interactions tenants have with property management. When the process feels outdated or inconvenient, it negatively shapes the tenant’s perception of professionalism and efficiency. Over time, this can affect retention and renewal decisions.

Fintech removes these inefficiencies by centralizing payments, automating records, and reducing dependency on human intervention. What once required multiple steps and manual oversight becomes a streamlined, predictable workflow.

Also read: Automating Rent Collection: How Cloud Software Reduces Late Payments

Online Rent Payments: The Foundation of Fintech-Driven Collection

Online rent payments form the backbone of modern rent collection systems. At their core, they enable tenants to pay rent digitally via secure portals using bank transfers, debit cards, or credit cards. This simple shift fundamentally changes how rent moves through a property management operation.

One of the immediate benefits of online rent payments is speed. Digital transactions eliminate mailing delays and reduce processing time. Funds are initiated instantly, and payment confirmations are recorded in real time. This accelerates cash availability and improves financial forecasting.

Online systems also enhance transparency. Both tenants and managers can see payment histories, timestamps, and receipts without relying on emails or paper trails. This shared visibility reduces disputes and builds trust. When questions arise, the data is readily available and verifiable.

From an operational standpoint, online rent payments integrate directly with accounting workflows. Payments are automatically posted to tenant ledgers, categorized correctly, and reflected in financial reports. This eliminates the need for duplicate data entry and reduces reconciliation errors.

Security is another critical advantage. Fintech platforms use encryption, authentication protocols, and secure payment gateways to protect sensitive financial data. Compared to handling physical checks or storing banking information offline, online payments significantly reduce the risk of fraud and data loss.

Importantly, online rent payment systems are adaptable. Tenants can choose payment methods that align with their preferences, while managers maintain consistent oversight. This flexibility supports diverse renter demographics without complicating internal processes.

Auto-Debits and Recurring Payments: Creating Predictable Cash Flow

Auto-debits represent the most powerful tool in fintech-enabled rent collection. By allowing tenants to authorize recurring payments, property managers transform rent from a monthly task into an automated financial event.

With auto-debits, rent is pulled from the tenant’s selected account on a predetermined date. This eliminates reliance on memory, manual action, or last-minute scrambling. Once set up, payments occur consistently unless interrupted by insufficient funds or changes in authorization.

For property managers, auto-debits dramatically improve cash flow predictability. Rent arrives on schedule, making it easier to plan owner distributions, maintenance budgets, and reserve funding. Instead of monitoring collections daily, managers can focus on higher-value activities.

Auto-debits also reduce late payments. Many delinquencies occur not because of inability to pay, but because of forgetfulness or poor timing. Automated payments remove these variables. Tenants are more likely to stay current when the process is invisible and effortless.

Another advantage is reduced administrative workload. Automated systems handle payment initiation, confirmation, posting, and receipts without staff involvement. Exceptions, such as failed payments, are automatically flagged, allowing managers to intervene only when necessary.

From a relationship standpoint, auto-debits lower tension. Rent collection becomes a system-driven process rather than a personal interaction. This minimizes uncomfortable conversations and maintains a more professional, neutral landlord-tenant dynamic.

When implemented thoughtfully, auto-debits benefit all parties. Tenants enjoy convenience and consistency, while managers gain reliability and efficiency, making recurring payments a cornerstone of modern rent collection.

Smart Payment Reminders and Notifications That Reduce Delinquencies

Even with online payments and auto-debits in place, communication remains a critical layer of successful rent collection. Smart payment reminders powered by fintech systems act as gentle nudges that prevent missed payments before they happen, rather than reacting after rent becomes overdue.

Modern rent collection platforms allow managers to schedule reminders before the due date. Tenants receive notifications via email, text, or app alerts to remind them of upcoming payments. These reminders are not intrusive; instead, they function like calendar prompts that help tenants stay organized. When reminders are consistent and automated, they reduce the likelihood of accidental late payments without creating tension.

What makes fintech reminders especially effective is their timing and personalization. Notifications can be triggered at key moments before rent is due, on the due date, and immediately after a missed payment. The tone remains neutral and professional, preserving tenant relationships while reinforcing expectations.

From an operational perspective, automated reminders replace manual follow-up work. Property managers no longer need to track who to contact or when to contact them. The system does this automatically, ensuring consistency across the portfolio. This uniform approach also helps with compliance, as every tenant receives the same notices under the same conditions.

Over time, reminders create behavioral consistency. Tenants expect and rely on them, which improves payment habits and reduces chronic delinquency. In this way, communication becomes a preventative tool rather than a corrective one.

Handling Failed Payments, Partial Payments, and Exceptions Smoothly

No rent collection system is complete without a plan for exceptions. Even the most automated fintech workflows must handle failed payments, partial payments, and unexpected disruptions efficiently and fairly.

When a payment fails due to insufficient funds or authorization issues, fintech systems immediately flag the problem. This real-time visibility allows managers to act quickly, notifying tenants before the situation escalates. Instead of discovering missed rent days later, managers can address the issue while there is still time to resolve it.

Some systems allow tenants to retry failed payments automatically or update payment methods without manager involvement. This self-service approach reduces back-and-forth communication and empowers tenants to fix issues independently. It also speeds up resolution, minimizing cash flow disruptions.

Partial payments can be more complex, especially in jurisdictions with strict tenant protection laws. Fintech tools help by clearly tracking balances, outstanding amounts, and payment histories. This transparency ensures that any follow-up actions are documented and consistent with local regulations.

Importantly, handling exceptions through a system rather than personal judgment reduces emotional friction. When policies are enforced automatically and evenly, tenants are less likely to feel singled out or unfairly treated. This consistency protects both the manager-tenant relationship and the manager.

A well-designed fintech rent collection system doesn’t assume perfection; it anticipates issues and resolves them with clarity and structure.

Compliance, Fees, and Tenant Protections in Digital Rent Collection

As rent collection becomes more automated, compliance and tenant protections become even more important. Fintech systems must align with local laws regarding fees, payment methods, notices, and dispute resolution.

One major advantage of fintech-based rent collection is built-in compliance safeguards. Payment rules, grace periods, and late fee limits can be configured according to jurisdictional requirements. Once set, these rules are applied automatically, reducing the risk of human error.

Transparency plays a key role here. Tenants can clearly see due dates, fees, and payment histories within their portal. This openness reduces disputes and supports fair housing practices by ensuring everyone receives the same information and treatment.

Digital records also simplify audits and legal inquiries. Every payment, reminder, and notice is timestamped and stored securely. If questions arise, managers can produce accurate records without relying on memory or scattered paperwork.

Another compliance benefit is flexibility in payment methods. Many jurisdictions require landlords to offer reasonable payment options. Fintech platforms accommodate this by supporting multiple digital methods while maintaining consistent internal workflows.

When used responsibly, fintech enhances, not replaces, ethical property management. Automation supports fairness, consistency, and accountability across all rent collection activities.

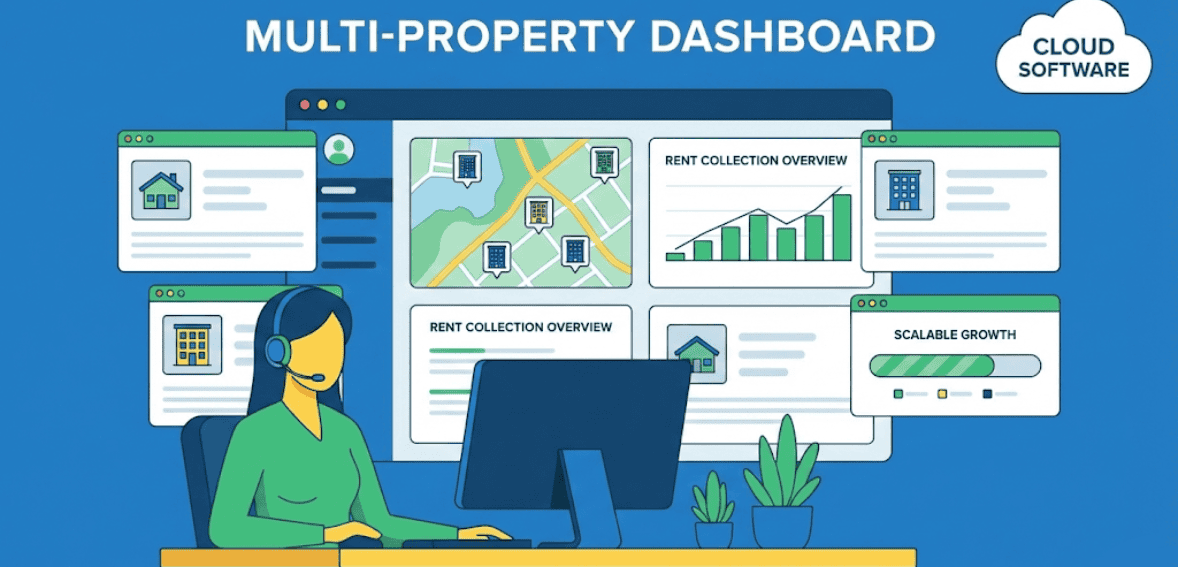

Scaling Rent Collection Across Portfolios Without Adding Workload

One of the strongest arguments for fintech-driven rent collection is scalability. As portfolios grow, manual systems quickly become unmanageable. Fintech allows property managers to scale rent operations without scaling stress.

Whether managing a handful of units or hundreds, the same automated workflows apply. Payment schedules, reminders, and reporting are replicated across properties with minimal configuration. This uniformity reduces complexity and prevents operational bottlenecks.

For growing businesses, scalability also means consistency. Owners expect predictable cash flow and accurate reporting regardless of portfolio size. Fintech systems deliver this by standardizing rent-collection processes and improving financial visibility.

Staff efficiency improves as well. Teams spend less time processing payments and more time on strategic work such as leasing, maintenance planning, and tenant engagement. This shift supports growth without increasing headcount at the same pace.

Scalable rent collection also supports geographic expansion. Managers overseeing properties across multiple locations can rely on centralized systems rather than juggling local processes. This flexibility is especially valuable for remote and multi-state portfolios.

In essence, fintech transforms rent collection from a limiting factor into a growth enabler.

The Future of Rent Collection: Where Fintech Is Headed Next

Rent collection continues to evolve alongside financial technology. The future points toward even deeper integration, smarter automation, and more tenant-centric experiences.

Predictive analytics may soon help identify payment risk before delinquency occurs. Integrated financial insights could allow managers to proactively offer payment plans or reminders based on behavior patterns.

Seamless integrations with accounting, reporting, and budgeting tools will further reduce manual oversight. Rent data will automatically flow into broader financial systems, enabling real-time decision-making.

Tenant expectations will continue to shape innovation. As digital-native renters enter the market, demand for frictionless, mobile-first payment experiences will grow. Fintech will meet these expectations while maintaining compliance and security.

Ultimately, rent collection will become less visible but more reliable, an automated backbone supporting the entire rental operation.

Conclusion: Turning Rent Collection into a Strategic Advantage

Rent collection no longer has to be a reactive, stressful process. Fintech solutions transform it into a predictable, transparent, and scalable system that benefits tenants, managers, and owners alike.

By adopting online payments, auto-debits, smart reminders, and automated exception handling, property managers gain control over cash flow while reducing administrative burden. Compliance becomes easier, disputes become rarer, and tenant relationships improve.

In a competitive rental landscape, efficient rent collection is not just operational hygiene; it is a strategic advantage. Fintech provides the tools to achieve that advantage with confidence and consistency.

FAQs

How does fintech improve rent collection efficiency?

Fintech automates payments, reminders, and records, reducing manual work and late payments while improving cash flow predictability.

Are online rent payments secure for tenants?

Yes. Modern fintech systems use encryption and secure gateways to better protect sensitive financial information than traditional methods.

Do auto-debits reduce tenant control?

No. Tenants authorize payments and can update or cancel them as needed, maintaining flexibility while enjoying convenience.

Can fintech systems handle multiple properties?

Absolutely. They are designed to scale across portfolios by applying consistent rent-collection rules regardless of size or location.

Is fintech rent collection suitable for small landlords?

Yes. Even small portfolios benefit from automation, reduced errors, and improved tenant experience.