by Rinki Pandey November 20, 2025

Keeping a rental property in good condition is one of the most critical responsibilities of any landlord. Tenants might see working appliances, a warm home in winter, functioning plumbing, and clean living spaces as everyday expectations. But behind the scenes, landlords must plan, prepare, and budget to make those expectations possible. A reasonable rental property maintenance budget isn’t just about repairing things when they break; it’s about creating a financial system that keeps the property healthy, safe, and profitable for years.

What makes maintenance planning so challenging is that no two years look alike. One year might be quiet with just a few minor repairs. The following year might bring a failing HVAC system, a leaking roof, or aging appliances that all decide to give up at once. Many landlords get caught off guard, not because the costs are unreasonable, but because they weren’t prepared for the timing. And when unexpected costs strike without warning, cash flow becomes unsteady, stress builds, and the rental business feels unpredictable.

This is precisely why building a substantial rental property maintenance budget is essential. It transforms unpredictable repairs into something manageable, something expected, something that can be planned for instead of worried about. Budgeting creates stability for the landlord, for the property, and for the long-term investment. A well-planned budget protects rental income, prevents financial surprises, and ensures that the property stays in good condition without draining the landlord’s savings or emergency funds.

The key to budgeting isn’t guessing it’s understanding. Understanding the types of maintenance a property needs. Understanding how much repairs usually cost. Understanding how a property’s age, location, and condition shape those costs. And most importantly, understanding how to set aside funds consistently so that major repairs don’t become financial emergencies.

Before diving into formulas or tools, landlords must understand the nature of maintenance itself, how different expenses behave and how each part of the property ages over time.

Understanding the Different Types of Maintenance Costs

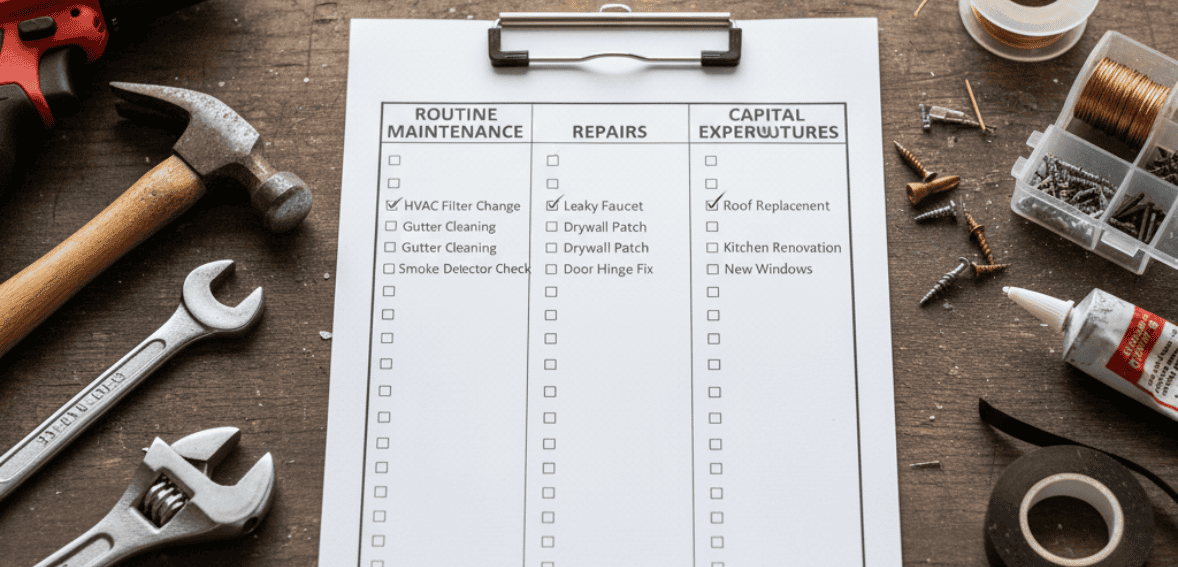

A rental property has three main categories of maintenance expenses, each affecting the maintenance budget differently: routine preventive maintenance, reactive repairs, and capital expenditures. Even though they all fall under “maintenance,” they serve different purposes and require different budgeting strategies.

Routine preventative maintenance is the everyday care that keeps the property running smoothly. These are tasks that prevent bigger problems like annual HVAC servicing, gutter cleaning, landscaping, pest prevention, replacing air filters, or flushing the water heater. These tasks might feel small, but they add up across the year. They also have a significant impact on reducing long-term repair costs. A landlord who spends a little each year on preventative care usually spends far less overall than one who waits until something breaks. Routine maintenance is predictable, which makes it easy to include in a yearly budget.

Reactive repairs are less predictable. These are the sudden issues: leaking faucets, broken door handles, malfunctioning appliances, busted pipes, or emergency plumbing calls. These happen when they happen sometimes at the worst possible moment. While many reactive repairs are minor, they can still cause financial stress if the landlord hasn’t prepared for them. That’s why a portion of the maintenance budget must always be flexible, ready to respond to whatever the property needs.

Finally, there are capital expenditures (CapEx) the big-ticket items. A roof might last 20–25 years, an HVAC system 12–15 years, appliances 7–12 years, and water heaters 8–12 years. These aren’t everyday repairs; they’re major replacements. And when one of those systems fails, costs can be significant. These expenses must be anticipated years in advance, which is why landlords often keep a separate CapEx reserve fund. This prevents panic when a major component reaches the end of its lifespan.

Understanding the rhythm of these expenses helps landlords build a smarter rental property maintenance budget. Some costs are recurring and predictable. Others are sudden but manageable with a cushion. And some require long-term saving. Together, they form a complete picture of what it actually takes to maintain a rental property responsibly.

Why Property Age, Type, and Location Change the Budget Completely

A rental property management isn’t a generic object; it has its own personality, its own quirks, and its own cost patterns. That’s why no single number works for every maintenance budget. Property age affects almost everything. An older property may have aging plumbing, electrical systems, roofs, siding, and appliances. While these homes often have character, they also entail higher property maintenance costs. Routine tasks might remain the same, but the number of reactive repairs and upcoming CapEx projects is usually higher.

Property type plays a role, too. A single-family home with a yard, driveway, and multiple systems will cost more to maintain than a small apartment. A multi-unit building may have shared systems that cost more to replace but spread costs across units. A condo might have lower individual maintenance costs but charge association fees, which would change the budgeting structure entirely.

Location influences maintenance in ways many landlords don’t expect. Homes in colder climates face snow, ice, frozen pipes, and strained HVAC systems. Homes in warmer climates face AC-heavy seasons, humidity, and pest issues. Homes in coastal areas are prone to salt corrosion. Homes in rainy climates may require frequent gutter cleaning and moisture control. Environmental factors directly affect landlord maintenance costs, so budgets should always reflect the property’s location.

The more a landlord understands these factors, the more accurate and realistic their budget becomes. It’s not about copying someone else’s formula, it’s about building a system that matches the property’s actual needs.

Budgeting Rules of Thumb: Helpful Guidelines, Not Fixed Rules

Because maintenance costs can vary, landlords often rely on budgeting guidelines to estimate expenses. These rules of thumb offer a starting point not a perfect calculation, but a reasonable estimate for forming a rental property maintenance budget.

One of the most common guidelines is the 1% rule, which suggests setting aside about 1% of the property’s value each year for maintenance. For a $300,000 property, that means roughly $3,000 annually. This is simple and effective for planning, especially for mid-aged properties in average condition.

Another method is budgeting $1 per square foot per year. A 1,200 sq. ft. home would therefore require about $1,200 annually. This method works exceptionally well when property values don’t reflect the actual cost of maintaining the building’s physical size.

Some landlords prefer using a percentage of rent. For example, budgeting 10–20% of annual rent toward maintenance. This method scales with income and helps landlords set aside funds naturally as rent increases.

The 50% rule is broader it suggests that half of rental income typically goes back into all operating expenses, including maintenance, taxes, insurance, and management. While not specific to maintenance, it helps landlords see the bigger financial picture and avoid underestimating costs.

The real value of these rules is not in choosing the “best” one but in comparing them. If one method estimates $2,000 per year and another estimates $4,000, it suggests the property needs a closer look. Most landlords refine their budgets after a couple of years of expense tracking, making these guidelines valid starting points rather than strict formulas.

How Regular Inspections Strengthen Your Budget

Inspections aren’t just about finding problems, they’re about preventing surprises. When landlords regularly check their properties, they understand how systems are aging and can predict when something will need to be replaced. This helps align the maintenance budget with the property’s real needs.

A quick seasonal inspection might reveal small leaks, worn seals, deteriorating caulking, or minor electrical issues before they turn into expensive repairs. Annual inspections from professionals, such as HVAC technicians or roofers, provide even deeper insights. These findings allow landlords to proactively adjust next year’s budget planning for upcoming expenses rather than reacting to emergencies.

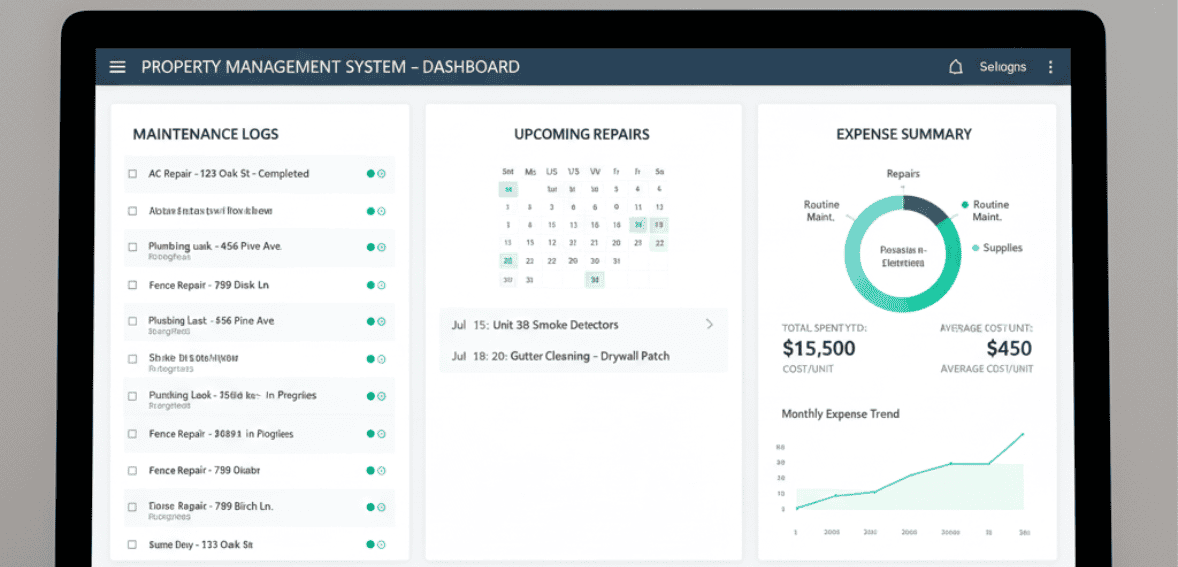

Cloud Rental Manager or any good management software can store inspection records, repair logs, and expense histories. Reviewing the past two or three years reveals natural patterns. The water heater may be nearing the end of its lifespan. Maybe the roof was patched three years in a row. An appliance is nearing the end of its useful life. This historical data becomes a powerful budgeting tool.

Using Past Expenses to Build a Smarter, More Accurate Budget

One of the most reliable ways to reinforce a rental property maintenance budget is to look backward before looking forward. Every property has a pattern: certain repairs happen often, certain systems age predictably, and specific problems always seem to resurface. When landlords review their historical expenses, they transform their budgeting from guesswork into strategy.

Even if a landlord hasn’t kept perfect records before, starting now makes a difference. A simple spreadsheet listing each maintenance expense, what it was for, how much it cost, and when it happened begins to reveal trends almost immediately. After a year or two, it becomes obvious where the money truly goes. Maybe plumbing calls are widespread. Landscaping costs may spike in summer. Maybe certain appliances are nearing the end of their life.

This historical data also helps separate routine maintenance from major future projects. If the roof was repaired five times in the last three years, it might be time to add roof replacement to the property maintenance expenses forecast. If the HVAC system needed multiple minor repairs, budgeting for a complete replacement in the next few years becomes easier to justify.

Cloud Rental Manager or similar software makes this process smoother. Every invoice, every repair ticket, every vendor cost can be logged automatically. When it’s time to plan next year’s budget, landlords review their expense reports, categorize spending, and set realistic goals for routine and significant costs. Historical data becomes the foundation for a more accurate, more confident maintenance budget.

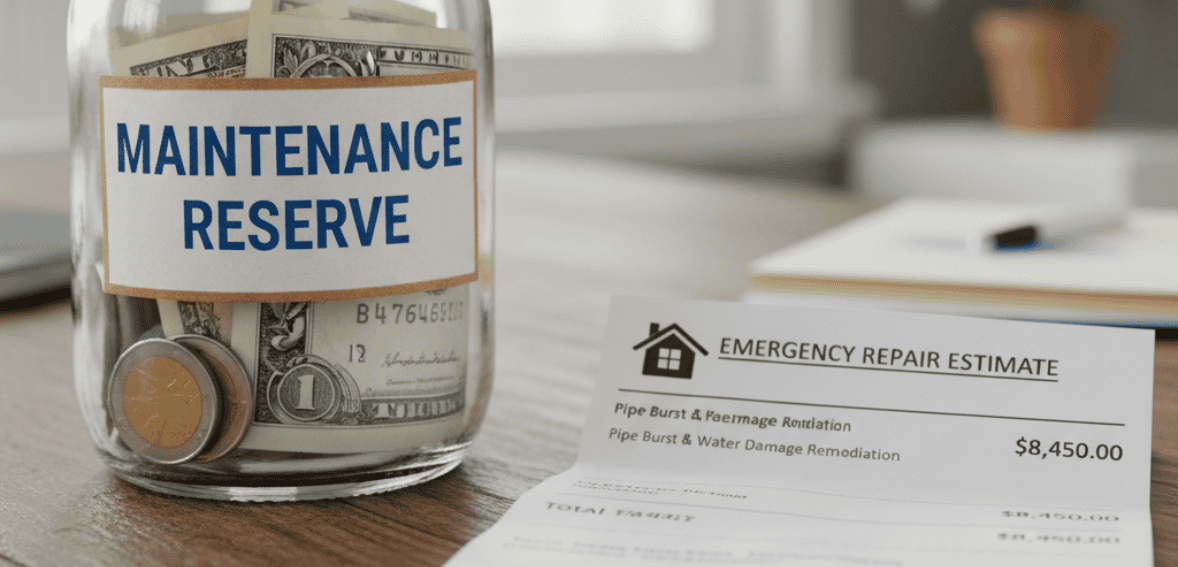

Why Setting Aside Reserve Funds Is the Heart of Budgeting

A budget without a reserve fund is just a list of numbers. Real budgeting requires preparation for the unexpected. No matter how careful a landlord is with routine maintenance, major repairs will always surprise someone who isn’t financially ready. A furnace can die without warning. A pipe can burst suddenly. A water heater can reach its limit and leak everywhere. These aren’t hypothetical events, they are inevitable realities of property ownership.

A strong reserve fund protects a landlord from panic. Instead of scrambling for emergency funds, taking on debt, or delaying repairs, the landlord uses the reserve they’ve already set aside. This keeps the property safe, prevents tenant inconvenience, and avoids financial stress.

How much should be in the reserve? It varies by property, but a good rule is to set aside money gradually throughout the year whether that’s 10% of rental income, a fixed amount monthly, or a percentage based on the property’s age. The key is consistency. A healthy reserve fund serves as the backbone of a responsible rental property maintenance budget, providing stability even when unexpected issues arise.

Innovative Tools and Strategies to Manage and Predict Maintenance

Even landlords who prefer manual tracking benefit from a little structure. Whether using a simple spreadsheet or multiple properties integrated into a software platform, organizing maintenance finances makes budgeting easier and more transparent.

Spreadsheets offer flexibility; they can track individual repairs, calculate averages, and create charts showing changes over time. Landlords who enjoy customizing their systems often prefer this method. But software provides structure that saves time. Cloud Rental Manager, for example, can track repairs by date and category, produce tax-season reports, and visualize spending across months or properties. For landlords managing multiple units, these automated systems reduce errors and ensure every expense is captured correctly.

Another significant advantage of using tools is their ability to predict. When historical data is organized, landlords can predict future expenses with greater accuracy. For instance, if the HVAC system is 13 years old, budgeting for a replacement in the next two years is reasonable. If the water heater is approaching 10 years old, it should be considered for replacement. If doors and windows are drafty, a future weatherproofing project may be necessary.

Maintenance should never be reactive alone; it should be a combination of responding to immediate issues and preparing for those you know are coming.

How Regular Maintenance Saves Money Long-Term

It might seem counterintuitive, but the more a landlord spends on preventative maintenance, the less they spend overall. A substantial rental property maintenance budget includes recurring tasks, as these small investments help prevent major breakdowns.

Changing air filters protects HVAC systems and prolongs their life. Cleaning gutters prevents water damage and foundation issues. Flushing water heaters extends their lifespan. Checking caulking and seals prevents moisture intrusion and mold. These tasks cost a fraction of the repairs they prevent.

Regular maintenance also shields landlords from emergency calls, which are always more expensive. A furnace tune-up in the fall costs far less than an emergency no-heat call in the middle of winter. Fixing a minor leak early prevents drywall damage, mold growth, or structural issues later. Even minor repairs matter because they preserve the home’s systems and reduce long-term spending.

Preventative care supports steady cash flow, fewer surprises, and healthier profits.

Budgeting for Multiple Properties Without Losing Track

When a landlord owns multiple properties, budgeting becomes more complex but also more predictable. While one property may have a quiet year, another could require numerous repairs. Having a combined maintenance fund helps balance these ups and downs.

However, each property should have its own expense tracking to remain fair and organized. Different properties age differently, have different climates, and require different types of care. One may have older systems, another might have carpets that need frequent replacement, and another might be in a climate with harsher winters.

Budgeting for repairs across multiple properties also allows landlords to leverage economies of scale. Contractors often give discounts for servicing several units at once. Landlords can purchase materials such as filters, paint, and everyday supplies in bulk, thereby reducing per-unit costs. Maintenance becomes more predictable and efficient when spread across a portfolio.

Good software makes multi-property budgeting much easier. When all expense histories and upcoming repairs are logged in a single platform, landlords can analyze patterns, identify which properties cost the most to maintain, and adjust rent or reserves accordingly.

Why Maintenance Budgeting Protects Your Investment

A rental property isn’t a passive asset. It requires care, attention, and financial planning. A well-built rental property maintenance budget protects the building itself, supports tenant satisfaction, preserves property value, and ensures the landlord can continue renting without financial strain.

Well-maintained properties attract better tenants, stay competitive in the rental market, reduce vacancy time, and command higher rents. Tenants appreciate landlords who promptly fix issues, invest in preventive maintenance, and treat the home as a priority. These tenants stay longer, reducing turnover costs and keeping income steady.

Budgeting for repairs and replacements also protects the property’s long-term value. A neglected home deteriorates quickly, minor issues spread, appliances fail prematurely, structural damage becomes costly, and the property’s market value drops. But a home that is consistently maintained retains its value, supports stable rental income, and remains a substantial investment.

Budgeting is not simply a financial exercise, it is a commitment to responsible ownership. And responsible ownership always pays off.

Conclusion

Creating a reliable rental property maintenance budget is one of the most intelligent financial decisions a landlord can make. Maintenance isn’t optional; it’s the foundation of tenant satisfaction, safety, property value, and long-term profitability. By understanding the different types of maintenance, applying budgeting methods, tracking historical expenses, using tools and software, and building strong reserve funds, landlords can approach repairs and replacements with confidence instead of stress.

A reasonable budget transforms maintenance from an unpredictable burden into a manageable, organized part of property management. It protects cash flow, prevents emergencies, and keeps the property in excellent condition year after year. Whether managing one unit or many, the landlords who plan always come out ahead.

Effective financial management with budgeting software is essential for sustainability and growth. Property Management Budgeting Software emerges as a crucial tool in this endeavor, providing managers and owners with the advanced capabilities to handle finances meticulously and strategically.

FAQs

How can I estimate annual maintenance costs for my rental property?

Use guidelines like the 1% rule, $1 per square foot, or 10–20% of annual rent, then adjust based on property age, local climate, and appliance lifespans.

What’s the difference between maintenance and capital expenditures?

Maintenance covers routine repairs and minor fixes. Capital expenditures are major replacements, such as roofs or HVAC systems, that occur every several years and require long-term planning.

How can I reduce unexpected repair costs?

Focus on preventative maintenance, perform regular inspections, build a strong reserve fund, and track past expenses to identify early warning signs.

How should I budget when managing multiple properties?

Track each property individually while maintaining a combined maintenance fund. Use software to organize expenses and create more accurate predictions across your portfolio.