by admin December 20, 2025

For decades, rental pricing relied on instinct, habit, and rough comparisons. Owners checked nearby listings, added a small annual increase, and hoped the market cooperated. This worked in slower, more predictable markets. Today’s rental landscape is more dynamic. Demand shifts quickly. Tenant behavior depends on economic signals. Competition is visible for every online listing, not just the building next door.

Rent optimization software and dynamic pricing rentals now maximize income, maintain occupancy, and enable managers to use real-time data, trends, and analytics. Pricing decisions become proactive, letting managers anticipate rather than react to market changes.

Predictive analytics strengthens property management decision-making by clarifying how pricing affects demand, retention, and revenue. Used properly, data-driven pricing balances profitability and fairness for both owners and residents.

Why Traditional Rental Pricing Leaves Money on the Table

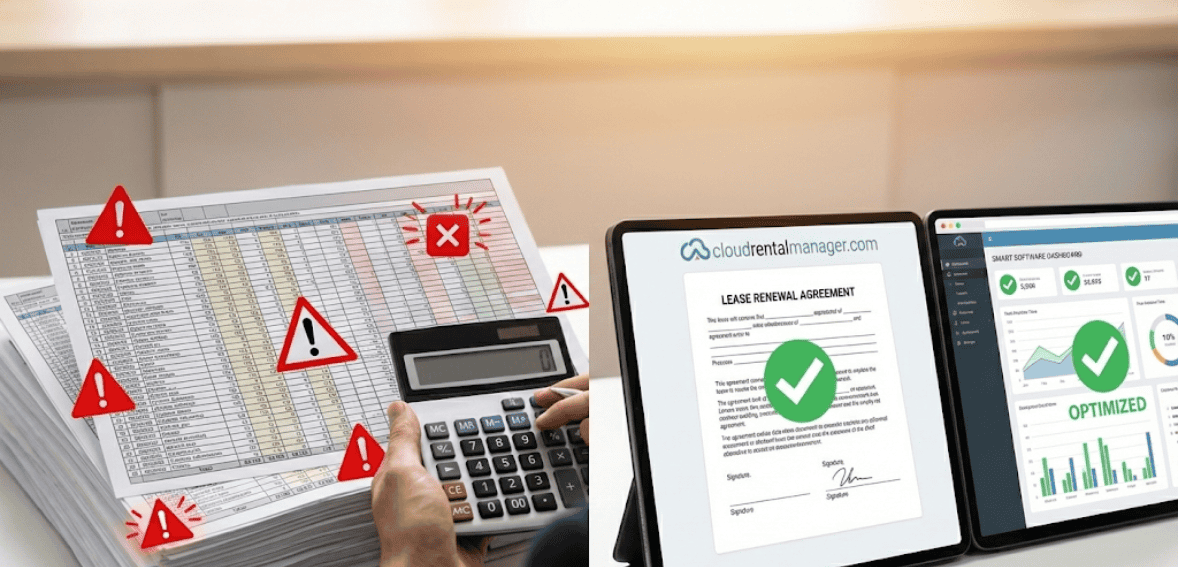

Many rental properties still use fixed pricing strategies that change little throughout the year. Rents are set at lease-up and adjusted annually, regardless of seasonal demand, vacancy, or competition. While this seems safe, it leads to missed revenue opportunities.

Static pricing ignores rental demand fluctuations. Some months see strong leasing activity; others, slower. Without adjustment, properties underprice during peak demand or overprice during slower periods, leading to vacancies.

Another problem with traditional pricing is slow reaction. By the time a manager notices increased vacancy or slower leasing, the damage is done. Rent cuts become reactive rather than strategic. Predictive analytics enables preemptive price changes using early signals—not just visible losses.

Dynamic pricing rentals are now essential in competitive markets. They enable rents to respond to actual conditions, ensuring income potential is not lost to outdated methods.

Understanding Predictive Analytics in Property Management

Predictive analytics uses historical and real-time data to forecast outcomes. Instead of asking “What happened last year?” it asks “What is likely to happen next?” This focus is crucial for pricing accuracy.

Predictive analytics looks for patterns across different data points. These include leasing velocity, vacancy duration, renewal rates, changes in market supply, and renter behavior. By analyzing these variables, the system estimates optimal rent levels for each unit at a given time.

Predictive analytics adapts as demand shifts. Pricing recommendations adjust accordingly, whether responding to market entrants or economic changes, to maintain occupancy.

This approach allows property managers to confidently make pricing decisions. The key benefits are more precise pricing, reduced revenue volatility, and improved portfolio performance, all grounded in evidence rather than guesswork.

How Rent Optimization Software Transforms Pricing Strategy

Rent optimization software is the operational engine for data-driven pricing. It collects, processes, and interprets rental market analytics. Managing this data manually would be nearly impossible. Instead of spreadsheets and scattered reports, pricing insights are centralized and actionable.

One of the most powerful aspects of this software is its ability to evaluate unit-level performance, which yields several benefits: identifying differences between units, recommending more accurate pricing, and avoiding blanket increases.

The software tracks tenant response to pricing changes. If a price adjustment slows inquiries or accelerates lease signings, the system learns and refines its models. Managers can balance rent growth and occupancy, giving owners more confidence in long-term revenue planning.

The Role of Rental Market Analytics in Smarter Pricing

Rental pricing does not exist in isolation. It is influenced by broader market forces, including employment trends, housing supply, interest rates, and migration patterns. Rental market analytics bring these external factors into pricing decisions.

By analyzing comparable properties, market absorption rates, and regional demand trends, managers gain a clearer picture of pricing. This prevents over-reliance on internal data alone. Internal data can be misleading without market context.

Market analytics also reveal competitive positioning. If similar properties are leasing faster at slightly different price points, pricing strategies can be adjusted proactively. This ensures rental income growth does not come at the cost of prolonged vacancies.

Combined with predictive analytics, market data produces several key benefits. It makes pricing decisions forward-looking, allows managers to anticipate demand, and helps maintain competitiveness.

Dynamic Pricing Rentals and Occupancy Balance

One common concern with dynamic pricing is the fear of destabilizing tenant relationships. However, when implemented thoughtfully, dynamic pricing for rentals actually supports long-term occupancy rather than threatens it.

Predictive analytics considers tenant sensitivity along with revenue goals. Pricing recommendations account for renewal probability to minimize unnecessary turnover. Instead of pushing rents everywhere, the system identifies where increases are sustainable and where stability is more valuable.

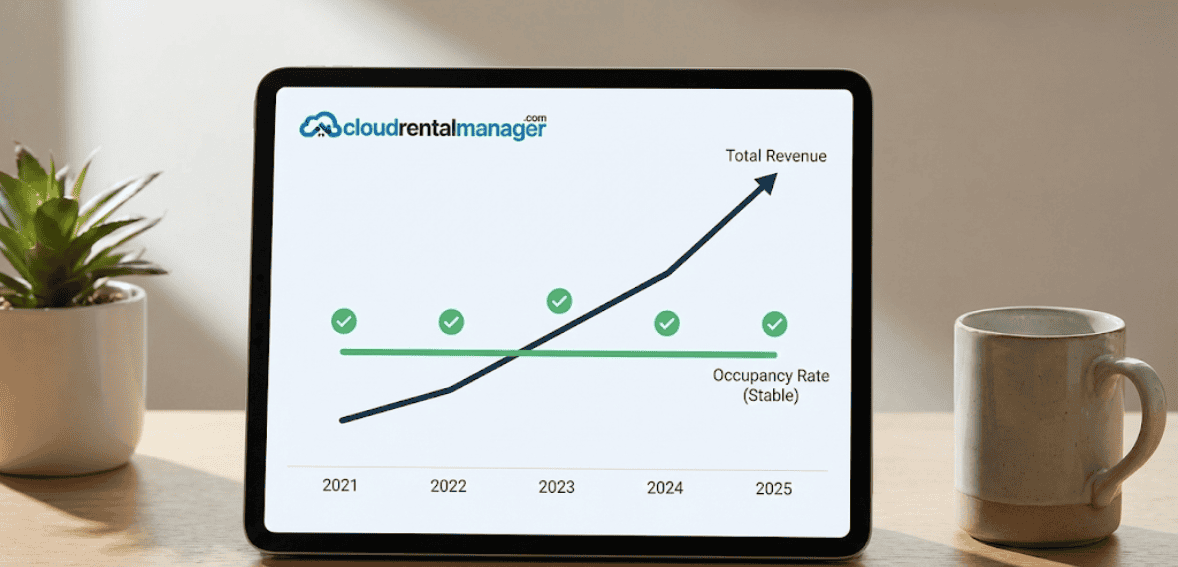

This balance is critical. High rents mean little if vacancy increases and leasing costs rise. Dynamic pricing helps avoid this trap by optimizing rent levels. The goal is to maximize net revenue, not just headline pricing. Over time, properties using dynamic pricing enjoy smoother cash flow, fewer disruptive vacancies, and a more predictable income stream, key advantages for long-term operational stability.

Setting Rent Prices Using Data Instead of Assumptions

One of the most impactful shifts in modern property management is moving away from assumption-based pricing. Data-driven management systems evaluate how long units stay vacant at different price points. They track how quickly leases are signed and how renewals respond to increases.

Managers set precise rents based on outcomes, not guesses.

Predictive analytics also accounts for timing. The benefits here include automatically adapting pricing to cycles, optimizing income, minimizing vacancies, and keeping offerings competitive year-round. This results in a pricing strategy that keeps pace with the market and maximizes income.

Revenue Management in Multifamily Portfolios

For large portfolios, multifamily revenue management is essential. Managing pricing for many units needs consistency, not uniformity. Predictive analytics allows portfolio-wide optimization while respecting unit-level differences.

By identifying patterns, managers tailor pricing strategies to each property. Some focus on occupancy, others on rent growth. Predictive analytics supports both, improving forecasting and investor confidence.

Long-Term Income Growth Versus Short-Term Rent Spikes

One misconception about data-driven pricing is that it only raises rents as quickly as possible. In reality, good rent optimization software targets sustainable income growth, not short-term spikes that damage occupancy and tenant trust.

Short-term rent spikes often look good on paper but carry hidden costs. Higher turnover means vacancy losses, more marketing expenses, unit attrition and administrative overhead. Predictive analytics helps property managers see these effects before making pricing decisions.

By analyzing renewal likelihood and tenant patterns, data-driven pricing often suggests modest, strategic increases to preserve long-term value. This prioritizes lifetime tenant value over aggressive pricing, ensuring stable revenue and strong tenant relationships. Predictive analytics optimizes the system, not just the next lease.

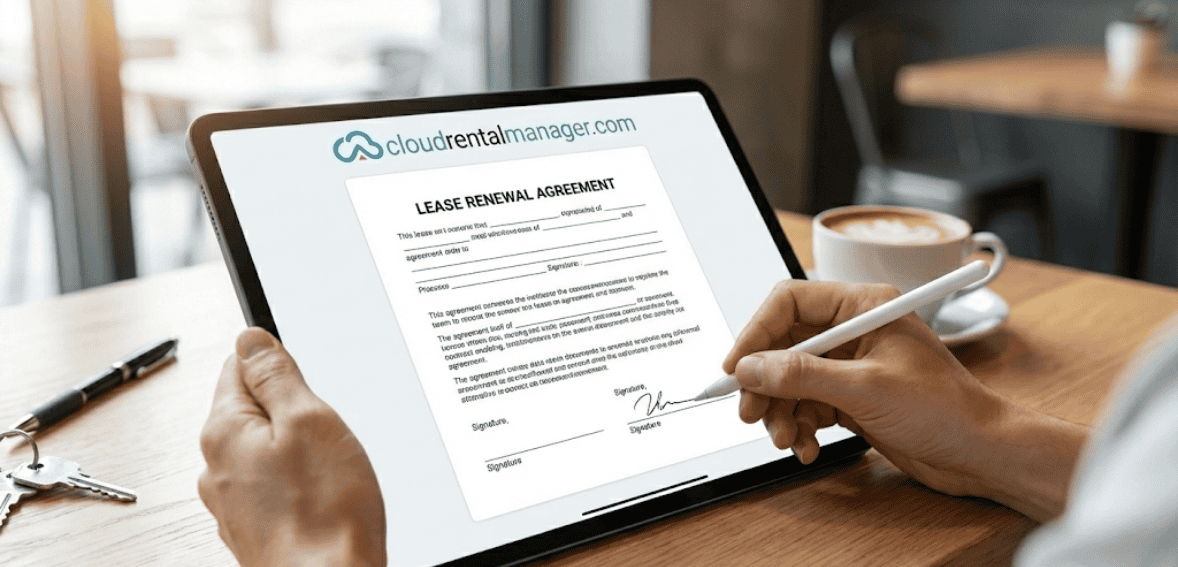

How Predictive Analytics Improves Lease Renewal Outcomes

Lease renewals drive profitability but are often overlooked in pricing. Predictive analytics integrates renewal behavior into recommendations, helping avoid unnecessary turnover.

Rather than applying uniform increases, the system evaluates each tenant’s likelihood of renewing. It looks at payment history, length of tenancy, unit type, and market alternatives. If data shows that a tenant is price-sensitive but stable, the system may suggest a moderate increase or a flat renewal rate.

This approach reduces friction at renewal time. Tenants feel treated fairly, not exploited by arbitrary increases. In turn, renewal acceptance rates improve, vacancy downtime shrinks, and overall revenue stability increases.

Dynamic rental pricing is not about charging the maximum rent. It is about charging the right rent for each situation.

Avoiding Common Mistakes in Data-Driven Pricing

While predictive analytics is powerful, it is not foolproof when used incorrectly. One common mistake is over-reliance on automation without human oversight. Data should inform decisions, not replace judgment.

Another mistake is focusing solely on competitor pricing without understanding demand signals. Matching or undercutting nearby properties may seem logical, but it ignores differences in amenities, tenant demographics, and operational efficiency.

Some managers also fail to consider communication. Sudden rent changes without explanation can confuse tenants and damage trust. Even when pricing is data-backed, transparency matters. Clear communication about renewal terms and market conditions helps maintain positive relationships.

The most successful pricing strategies blend analytics with experience, using data as a guide rather than a rigid rulebook.

Ethical and Fair Pricing in a Data-Driven World

As pricing becomes more sophisticated, ethical considerations become increasingly important. Predictive analytics must be used responsibly, especially in residential housing where affordability and fairness matter.

Ethical pricing avoids discriminatory outcomes and respects local regulations. Data-driven systems should focus on market conditions and unit attributes, rather than personal tenant characteristics. Responsible use ensures compliance while maintaining public trust.

Fair pricing also supports long-term business health. Tenants who feel respected are more likely to renew, refer others, and maintain their units well. Predictive analytics, when applied ethically, strengthens the relationship between profitability and fairness rather than creating tension between them.

Implementing Predictive Pricing Without Disrupting Operations

Transitioning to data-driven pricing does not require an overnight overhaul. Successful implementation happens gradually, with clear goals and measured adoption.

Most managers start with analytics for insights rather than automatic changes. This allows teams to compare recommended pricing against existing strategies and build confidence in the system. Over time, as accuracy is proven, automation can increase.

Training is also essential. Teams need to understand how pricing recommendations are generated and how to explain them to tenants and owners. When staff trust the system, adoption becomes smoother and resistance fades.

Implementation works best when pricing analytics are integrated into daily workflows rather than treated as a separate process.

Using Predictive Analytics to Plan for Market Shifts

Markets do not change overnight, but they do change quickly. Predictive analytics excels at detecting early signals of shifting demand, allowing managers to adapt before problems appear.

For example, rising vacancy trends in a submarket may signal oversupply. Analytics can recommend proactive pricing adjustments to maintain occupancy. Conversely, increasing inquiry volume may indicate an opportunity for strategic rent growth.

This forward-looking capability transforms pricing from a reactive task into a strategic planning tool. Managers gain the ability to forecast performance and adjust course early, protecting revenue during uncertain conditions.

The Competitive Advantage of Data-Driven Pricing

In today’s rental market, competitive advantage rarely comes from location alone. It comes from operational intelligence. Properties that use predictive analytics consistently outperform those that rely on manual pricing methods.

Data-driven pricing improves leasing speed, reduces vacancy loss, stabilizes renewals, and enhances owner confidence. Over time, these advantages compound, creating stronger portfolios that are better positioned to weather market volatility.

Predictive analytics does not eliminate risk, but it significantly reduces uncertainty. For property managers and owners focused on long-term success, that clarity is invaluable.

Conclusion

Maximizing rental income is no longer about guessing what the market will tolerate. It is about understanding what the market is signaling and responding accurately. Rent optimization software and dynamic pricing for rentals, powered by predictive analytics, offer a smarter, more sustainable approach to pricing.

By combining rental market analytics with real-time performance data, property managers can set rents that balance income growth with occupancy stability. Predictive analytics replaces reactive decision-making with strategic foresight, helping properties thrive in competitive, fluctuating markets.

Ultimately, data-driven pricing is not about charging more; it is about charging better. When pricing aligns with demand, tenant behavior, and long-term goals, rental. Ultimately, data-driven pricing is not about charging more; it is about charging better.

Rent optimization software uses data and predictive analytics to recommend rental prices that maximize revenue while maintaining healthy occupancy levels.

FAQs

How does dynamic pricing for rentals work?

Dynamic pricing adjusts rent based on real-time market conditions, demand patterns, and unit performance rather than fixed annual increases.

Is predictive analytics only for large properties?

No. Predictive analytics can benefit properties of all sizes by improving pricing accuracy and reducing vacancy-related losses.

Does data-driven pricing increase tenant turnover?

When used correctly, it often reduces turnover by aligning rent increases with tenant sensitivity and renewal likelihood.

How often should rental prices be adjusted?

Pricing frequency depends on market volatility, but predictive systems continuously monitor conditions and recommend changes when needed.