by Rinki Pandey January 2, 2026

Managing property is never just collecting rent and handling maintenance. Behind every lease agreement, tenant interaction, and repair request sits a layer of risk that property managers must actively manage. From slip-and-fall incidents to fire damage, tenant lawsuits, natural disasters, and data breaches, the financial and legal exposure tied to rental properties is real and growing. This is why property management insurance and structured risk management for property managers are no longer optional; they are fundamental to running a stable, professional operation.

Many property managers assume insurance alone is enough. In reality, it is only part of a broader risk strategy. Without proper coverage selection, documentation, procedures, and tenant policies, even insured properties can suffer costly losses. This article explains how insurance and risk management work together, what coverage property managers truly need, and how proactive planning reduces exposure.

Property Management Insurance as the Foundation of Risk Protection

Property management insurance exists to protect both the physical asset and the people responsible for operating it. Unlike standard homeowner or landlord policies, property management insurance recognizes that managers face unique liabilities arising from their roles as decision-makers, intermediaries, and operators on behalf of owners.

At its core, insurance transfers financial risk. Instead of a property manager personally bearing the cost of a lawsuit, accident, or disaster, the insurer steps in to cover losses under the policy terms. However, coverage only works when policies are properly structured, limits are sufficient, and exclusions are understood.

Property managers must evaluate insurance not as a checkbox but as a strategic shield. Inadequate coverage can leave gaps that expose both the management company and property owners to significant losses. Strong insurance planning begins with understanding the risks, not simply purchasing the cheapest policy available.

Also read: Navigating Rent Control and Tenant Protection Laws in 2026

Understanding Risk Management for Property Managers Beyond Insurance

Insurance helps recover financially after incidents, while risk management aims to prevent incidents. Risk management systematically identifies, reduces, documents, and monitors risks across the property portfolio.

This includes operational risks such as poor maintenance practices, compliance risks tied to housing laws, tenant-related risks, and financial risks from vacancies or unpaid rent. Property managers who rely only on insurance often discover too late that certain losses were avoidable or, worse, excluded from coverage.

Effective risk management blends policies, training, inspections, documentation, and communication. Insurance should be the safety net, not the first defense. Combining these elements reduces claims, stabilizes premiums, and protects business viability.Insurance Coverage and How It Intersects With Management Risk

Most rental properties carry landlord insurance coverage, but many property managers misunderstand how it applies to their role. Landlord insurance primarily protects the property owner’s interest, not the property manager’s operational liability.

Landlord policies typically cover property damage, loss of rental income, and limited liability for physical premises. However, when a tenant or third party alleges negligence arising from management decisions, such as delayed repairs, unsafe conditions, or failure to act, the property manager may face separate liability exposure.

This distinction matters significantly because property managers cannot depend on the owner’s insurance to protect them from liability arising from their own management actions. While management agreements often define insurance responsibilities, gaps may appear without clear coordination between landlord policies and coverage specific to managed risks. Ensuring both are aligned is critical to avoiding confusion and coverage gaps during claims.

Property Manager Liability and Legal Exposure

Property manager liability arises from the decisions and actions taken while managing rental properties. This includes oversight of maintenance, tenant screening, lease enforcement, vendor selection, and compliance with local and federal laws.

Common liability scenarios include tenant injuries caused by unaddressed hazards, discrimination claims arising from leasing practices, wrongful eviction allegations, and failure to maintain habitable living conditions. Even when claims lack merit, legal defense costs alone can be substantial.

Professional liability insurance, often called errors and omissions coverage, is designed to protect property managers from claims arising from mistakes or omissions in professional duties. Without it, a single lawsuit can threaten personal assets and business continuity. Liability protection is not about expecting failure; it is about acknowledging that risk exists even with best practices in place.

Renters Insurance Requirement as a Risk-Sharing Tool

Renters’ insurance is one of the most effective yet underutilized tools for mitigating rental property risk. While renters’ insurance primarily protects tenants’ personal belongings, it also reduces exposure for property managers and owners.

When tenants carry renters insurance with liability coverage, incidents such as accidental fires, water damage, or injuries caused by tenant negligence may be covered under the tenant’s policy. This shifts responsibility away from the property manager and limits claims against the property’s insurance.

Requiring renters’ insurance also encourages tenants to take greater responsibility for their actions. Clear lease language, verification procedures, and ongoing compliance tracking strengthen this layer of risk protection. When properly implemented, renters’ insurance acts as a buffer between tenant behavior and management liability.

Rental Property Risk Mitigation Through Proactive Policies

Rental property risk mitigation goes beyond insurance documents. It is built through daily operational discipline. Regular inspections, documented maintenance schedules, vendor compliance checks, and consistent tenant communication all reduce the likelihood of claims.

For example, routine safety inspections can identify loose railings, faulty smoke detectors, or water leaks before they cause injury or damage. Maintenance documentation proves due diligence if a claim arises. Vendor insurance verification ensures contractors carry their own coverage, preventing liability from shifting to the property manager.

Risk mitigation also includes standardized procedures. When every property follows the same inspection, repair, and reporting protocols, risk becomes predictable and manageable rather than reactive and chaotic.

Aligning Insurance Strategy With Portfolio Size and Property Type

Insurance needs evolve as portfolios grow. A property manager overseeing a handful of single-family homes faces different risks than one managing large multifamily buildings or mixed-use properties. Policy limits, endorsements, and coverage types must align with portfolio scale and complexity.

For larger portfolios, umbrella liability coverage may be necessary. Special endorsements might be required for amenities like pools, elevators, or commercial tenants. Understanding these details ensures insurance keeps pace with business growth.

This alignment also signals professionalism to property owners. Managers who proactively review and adjust insurance strategies demonstrate competence, risk awareness, and long-term thinking qualities that owners value when entrusting assets to third-party management.

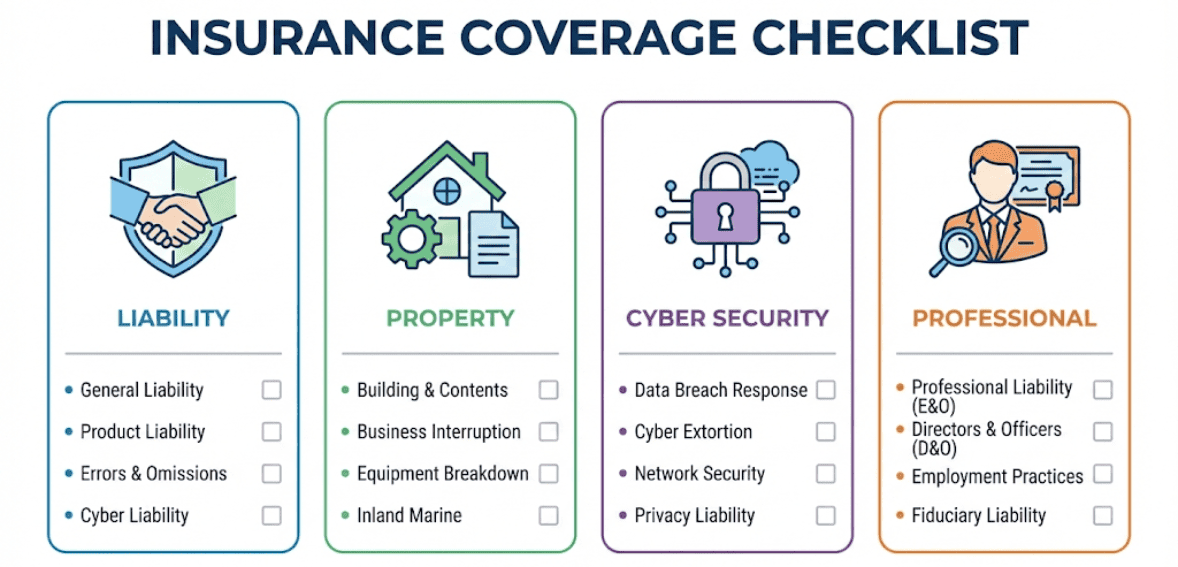

Specialized Insurance Coverage Every Property Manager Should Understand

As property portfolios grow, basic policies are no longer enough. Property managers often face risks beyond standard landlord insurance coverage, which is why specialized insurance layers are critical. These policies exist to address scenarios where traditional coverage stops short, such as management errors, employee actions, or large-scale liability claims.

One key area is professional liability coverage, also known as errors and omissions insurance. This protects property managers from claims by tenants, owners, or third parties for financial losses resulting from management decisions. Examples include failure to enforce lease terms consistently, mistakes in rent calculations, or missed compliance deadlines. Even when no wrongdoing occurs, legal defense costs alone can be devastating without this coverage.

Another important layer is cyber liability insurance. As property managers increasingly rely on digital systems for tenant data, rent payments, and maintenance records, exposure to data breaches and cyberattacks grows. Cyber insurance helps cover notification costs, legal expenses, and system recovery when sensitive tenant information is compromised. This form of protection has become essential as tenant data privacy expectations rise.

Risk Management for Property Managers in a Highly Regulated Environment

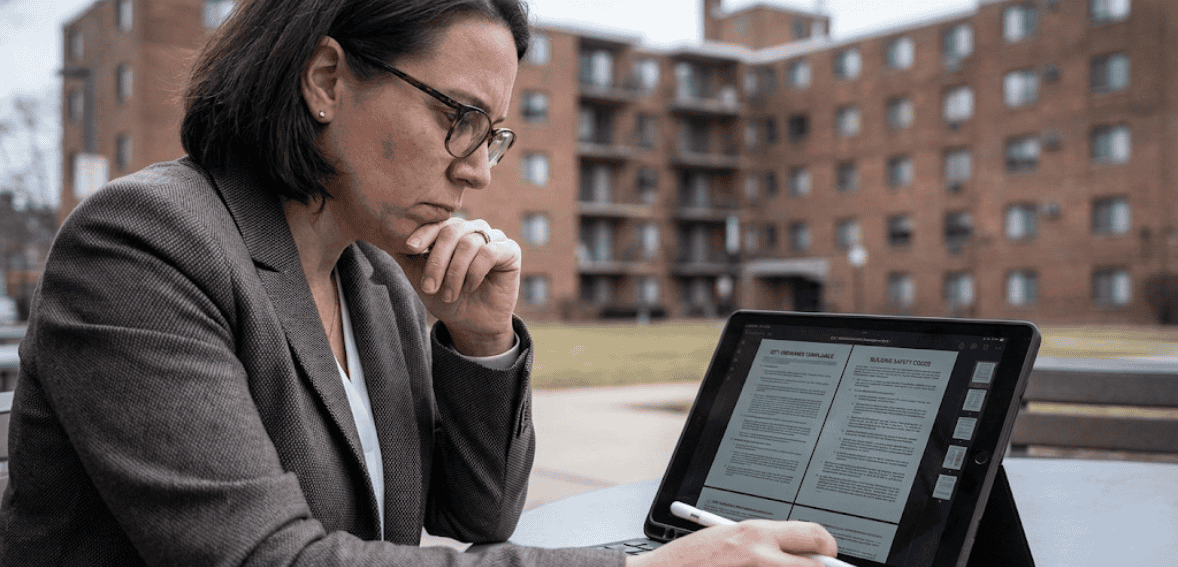

Modern property management operates within a complex web of laws and regulations. Fair housing rules, habitability standards, data privacy laws, and local tenant protections all create compliance-related risk. Effective risk management for property managers requires staying informed and translating legal requirements into daily operational practices.

Documentation plays a crucial role here. Keeping accurate records of inspections, maintenance requests, tenant communications, and policy enforcement provides evidence that management acted responsibly and consistently. This documentation often determines the outcome of disputes, audits, or lawsuits.

Training also reduces regulatory risk. Property managers who invest in ongoing education for staff and vendors are better positioned to avoid unintentional violations. Consistent procedures help ensure fair treatment of tenants, proper handling of complaints, and timely responses to issues that could escalate into legal action.

Vendor and Contractor Risk Management

Property managers frequently rely on third-party vendors for repairs, landscaping, cleaning, and specialized maintenance. While outsourcing work improves efficiency, it introduces additional risk. If a vendor causes property damage or injures someone on-site, liability can shift to the property manager if proper safeguards are not in place.

A strong risk management approach requires verifying vendor insurance before work begins. Vendors should carry their own liability coverage and workers’ compensation insurance. Certificates of insurance should be collected, reviewed, and stored regularly, not just at the time of contract signing.

Clear contracts also reduce risk. Written agreements should define responsibilities, safety expectations, and indemnification clauses. This clarity protects property managers from being held responsible for vendor errors and reinforces accountability across all service relationships.

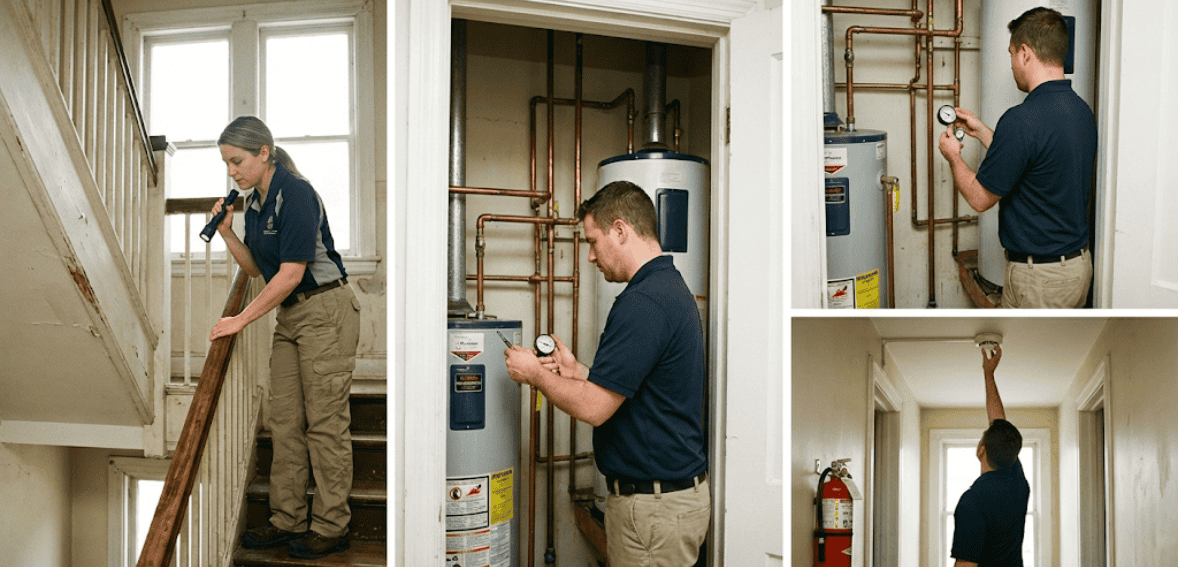

Claims Prevention Through Maintenance and Inspections

Many insurance claims stem from preventable issues. Slip-and-fall accidents, water damage, mold complaints, and fire hazards often stem from deferred maintenance or overlooked inspections. This is where proactive risk management delivers the greatest return.

Routine inspections identify small problems before they escalate. Loose handrails, cracked sidewalks, faulty wiring, or leaking pipes become expensive only when ignored. Addressing these issues promptly reduces both tenant complaints and insurance claims.

Maintenance tracking systems further reinforce this process. When property managers can demonstrate that issues were reported, scheduled, and resolved within reasonable timeframes, liability exposure drops significantly. Insurers also view proactive maintenance favorably, which can positively impact premiums over time.

The Role of Renters Insurance in Long-Term Risk Reduction

A well-enforced renters insurance requirement continues to play a vital role in protecting property managers. When tenants carry liability coverage, accidents caused by tenant actions are less likely to cause claims against the property’s insurance.

However, enforcement matters. Property managers must verify policies at move-in and monitor renewals to ensure coverage does not lapse. Clear communication helps tenants understand that renters insurance is not optional but a shared responsibility that protects everyone involved.

This requirement also supports smoother claims resolution. When tenant policies are in place, disputes over responsibility are resolved faster, reducing legal costs and operational disruption for property managers.

Insurance Reviews and Ongoing Risk Assessment

Insurance and risk management are not set-it-and-forget-it tasks. Properties evolve, portfolios expand, regulations change. Regular insurance reviews ensure coverage keeps pace with operational reality.

Annual policy reviews allow property managers to adjust limits, add endorsements, or remove unnecessary coverage. These reviews also provide opportunities to discuss claims trends and identify operational changes that could further reduce risk.

Risk assessments should accompany these reviews. Evaluating new amenities, renovations, tenant demographics, or geographic expansion helps identify emerging risks before they turn into losses. This proactive mindset separates reactive managers from strategic ones.

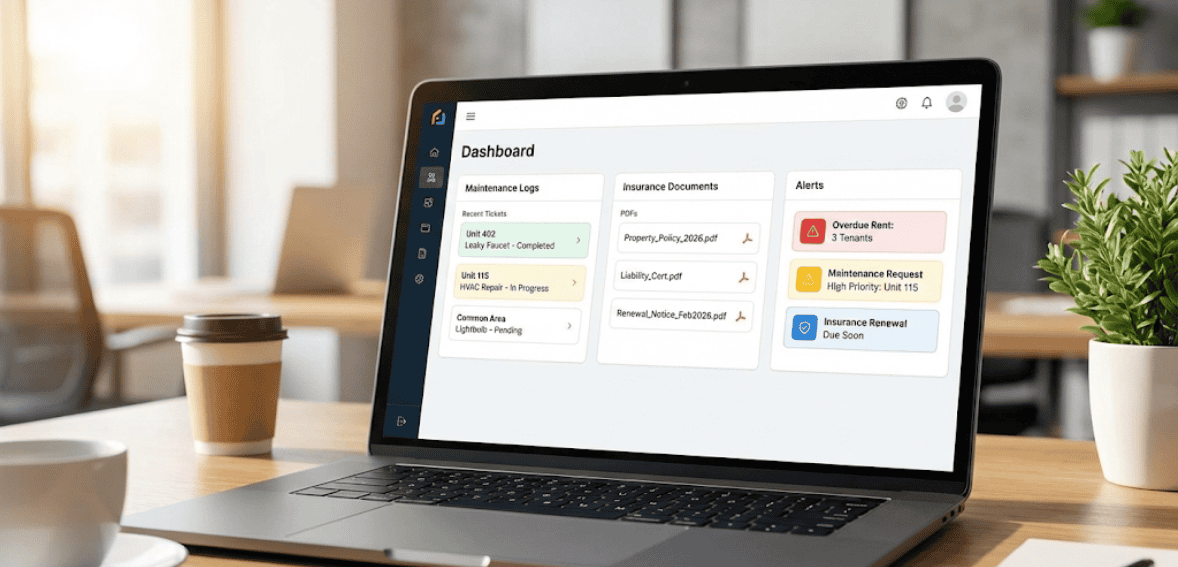

Using Technology to Strengthen Insurance and Risk Oversight

Technology has become a powerful ally in managing risk. Digital maintenance logs, inspection checklists, document storage, and communication records all support stronger insurance protection. When incidents occur, having immediate access to organized records speeds up claims handling and strengthens defense positions.

Automated reminders ensure inspections, policy renewals, and compliance tasks are not overlooked. Centralized systems reduce human error and improve consistency across properties. These tools don’t replace insurance, but they make insurance more effective by reducing claim frequency and improving documentation quality.

For property managers, technology transforms risk management from a reactive chore into a controlled, measurable process.

Why Strong Insurance and Risk Management Build Trust

Beyond financial protection, insurance and risk management influence reputation. Property owners want managers who protect assets intelligently. Tenants feel safer in well-maintained properties with clear policies. Insurers reward responsible operations with better terms.

Trust grows when stakeholders see risks are anticipated rather than ignored. Property managers who invest in strong insurance strategies and disciplined risk management position themselves as long-term partners rather than short-term administrators.

Conclusion

Insurance and risk management are inseparable pillars of successful property management. Property management insurance provides financial protection when things go wrong, while risk management for property managers reduces the likelihood that problems occur in the first place. Together, they safeguard properties, protect businesses, and support sustainable growth.

From selecting the right coverage to enforcing renters insurance, managing vendors, and leveraging technology, proactive planning makes the difference between stability and crisis. In an increasingly complex rental landscape, property managers who prioritize risk management don’t just survive; they thrive.

FAQs

Why is property management insurance different from landlord insurance?

Property management insurance covers the manager’s professional and operational liability, while landlord insurance primarily protects the property owner’s asset. Both are necessary but serve different roles.

Is renters’ insurance legally required?

In many areas, it is not legally required, but property managers can mandate it through lease agreements as a condition of tenancy to reduce liability exposure.

How often should insurance policies be reviewed?

At least annually, or whenever major changes occur, such as portfolio growth, renovations, or regulatory updates.

Can risk management reduce insurance costs?

Yes. According to a report from Axios, implementing proactive maintenance and providing strong documentation can lead to fewer claims, which may cause more favorable insurance premiums and coverage terms.

Does technology replace insurance?

No. Technology reinforces risk management and documentation, but insurance remains essential for financial protection when incidents occur.