by Rinki Pandey December 3, 2025

In the modern rental landscape, efficiency is no longer a luxury, it’s a requirement for survival. Property managers and landlords today face rising operational costs, increasing tenant expectations, and higher pressure to maintain profitable properties while keeping overhead under control. In this environment, calculating the ROI of property management software is essential. Owners and managers need more than just a digital tool. They need a measurable return that justifies the investment and improves financial performance across their portfolio.

For many property managers, the turning point often comes when responsibilities begin to stretch beyond what manual processes can support: tracking rent payments across multiple tenants, following up on maintenance requests, resolving communication delays, and managing turnover timelines. When tasks multiply, spreadsheets and paper systems become bottlenecks. Email threads get lost, expired notices slip through cracks, and errors begin to cost real money. Property management software is designed to eliminate that friction but its value shouldn’t be measured solely by convenience. It should be quantified in precise financial results.

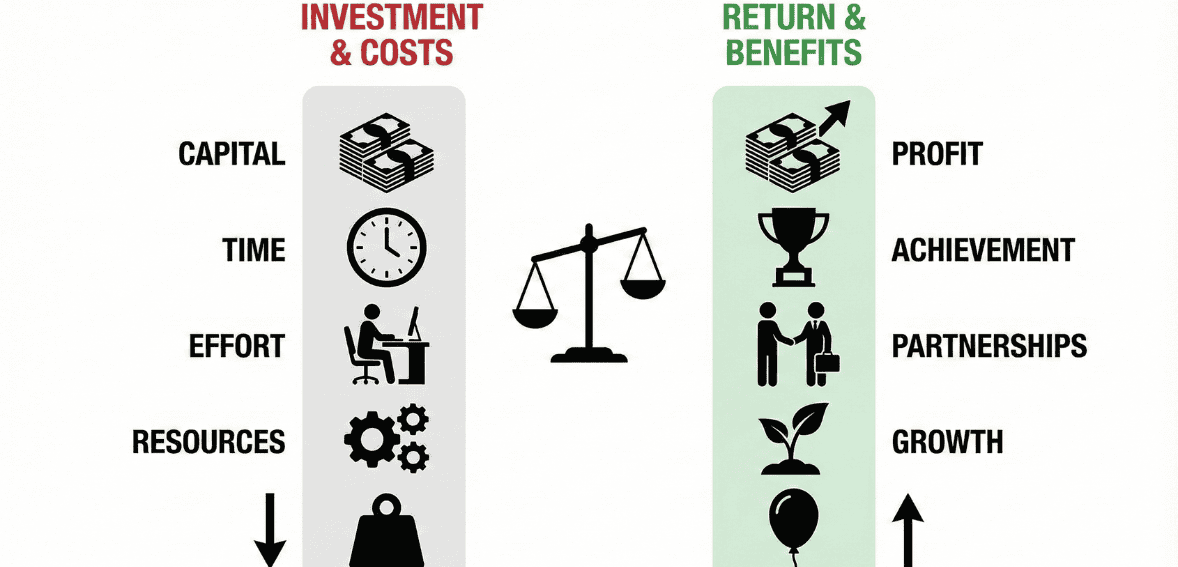

Understanding the return on investment means carefully balancing software costs with measurable gains, such as time savings, lower labor costs, fewer vacancies, faster rent collection, and reduced legal disputes. This article explores how to evaluate ROI using a straightforward financial approach and how to recognize both the direct and indirect benefits that property management software delivers. When you understand how to assign real numbers to efficiency improvements, adopting the right software becomes not just a technological upgrade, but a strategic financial decision.

Why ROI Calculation Matters for Property Managers

The decision to adopt new technology must be guided by analysis, not impulse. Some managers hesitate to invest in software because they worry about subscription fees, training time, or adoption challenges. Others assume that software is only helpful for large portfolios, when in reality, even small landlords gain significantly from automation.

The truth is that every minute spent on manual tasks is a hidden cost and those costs accumulate silently. Time spent entering spreadsheet data, chasing late payments, searching for documents, coordinating maintenance by phone, or repeatedly answering tenant questions represents labor value that could be allocated toward revenue-producing work. When calculated honestly, the cost of inefficiency often exceeds the price of software many times over.

That is why property management software ROI must be understood not only as a cost question but as an investment strategy. The right system becomes a long-term asset that increases financial predictability, stabilizes cash flow, and supports scalable growth. Knowing how to calculate ROI helps decision-makers determine when it’s time to move beyond manual management and how quickly the investment will repay itself.

Understanding the Total Cost of Software Investment

Before calculating returns, property managers must first understand the actual cost of implementing software. Evaluating cost means looking beyond the monthly subscription price and considering the whole financial picture. That includes user seats, setup time, onboarding labor, potential hardware updates, or temporary productivity adjustments during transition.

However, unlike fixed expenses such as rent or insurance, software costs typically decrease in relative weight over time as efficiency expands across the organization. While initial implementation may require effort, the long-term savings far outweigh the learning period. For example, many property managers discover that once the system is in place, the amount of manual administrative labor drops dramatically. The software automates repetitive tasks such as sending rent reminders, updating records, logging maintenance activity, and generating financial reports.

Understanding initial cost is important because the accuracy of ROI depends on honest inputs. But focusing solely on subscription price without considering total organizational impact leads to missed opportunities. Software isn’t just a tool; it’s a shift in how the business operates. The investment should be viewed with the same seriousness as upgrading equipment infrastructure, hiring staff, or renovating a unit except that this investment multiplies performance without increasing physical resources.

Measuring Time and Labor Efficiency Gains

One of the most critical areas of ROI evaluation lies in measuring how much time property managers and staff save by replacing manual work with digital automation. Time is the most valuable resource in property management, and inefficient processes drain it quickly. When employees spend hours tracking down late rent payments, coordinating maintenance via text messages, reconciling lease documents, or performing duplicate data entry, they have less time to focus on growth and tenant experience.

Calculating labor savings begins by estimating how long routine tasks currently take and comparing that to the time required once automation is introduced. Rent collection processes that once required hours of tracking and communication can now be instantaneous. Maintenance coordination shifts from phone calls to structured ticket systems. Financial reporting that was once compiled manually is now available in real-time dashboards. Even small time savings accumulate meaningfully when multiplied across each tenant and each month.

For example, if a property manager saves just 2 hours per week by automating rent reminders and processing, that adds up to more than 100 hours per year per staff member. When multiplied across a team, the value becomes even greater. Better yet, those hours can be reinvested in revenue-generating work, such as marketing units, retention improvements, or long-term growth planning. Labor efficiency, therefore, represents both a direct reduction in operating cost and an indirect boost to revenue expansion opportunities.

How Property Management Software Impacts Revenue Performance

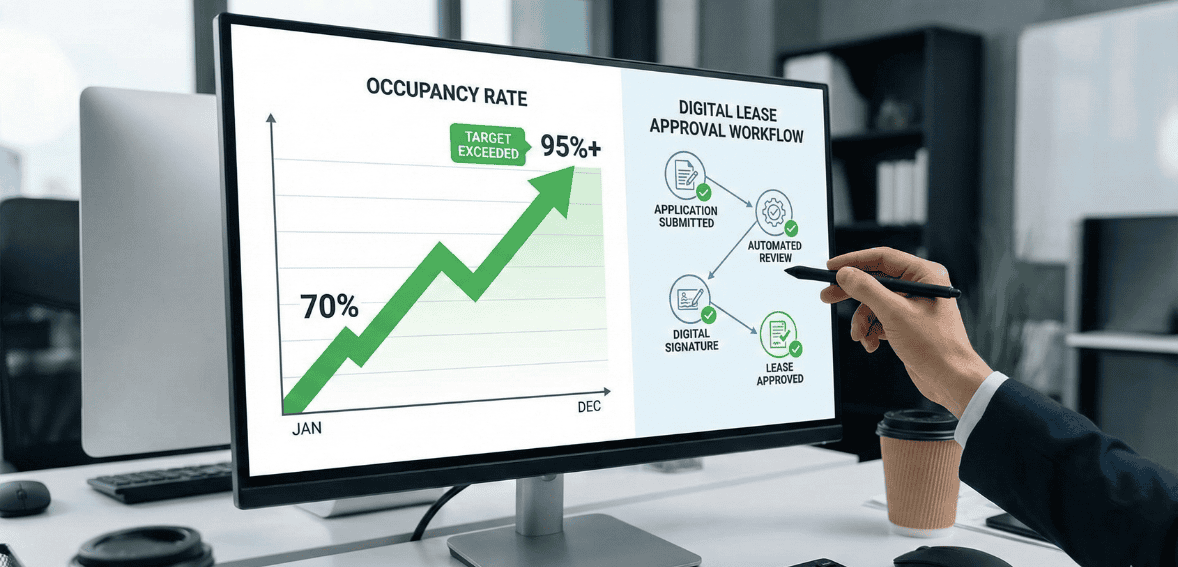

Calculating property management software ROI isn’t only about reducing expenses; it is also about increasing income. Digital systems influence revenue in multiple ways, beginning with reduced vacancy time. When rental listings receive immediate exposure through integrated marketing tools and applications, units can be processed and screened faster, and units turn over more quickly. Faster turnover means fewer days without rent and a stronger yearly yield.

Additionally, digital rent collection significantly improves on-time payments, reducing the number of outstanding accounts and the need for collection efforts. Automated online payment solutions provide tenants with convenient payment options, increasing reliability and minimizing delays.

Another area for revenue improvement is maintenance efficiency. Maintenance delays are a leading cause of tenant dissatisfaction and turnover. When work orders are centralized and tracked digitally, issues are resolved more quickly, service quality becomes consistent, and renters are more likely to stay longer. Lower turnover equals fewer marketing costs, fewer vacancies, and reduced time spent preparing units for new occupants.

Revenue expansion can also come through accurate fee billing and a structured accounting workflow. When software automatically tracks charges, landlords avoid overlooked late fees and missed billings that often occur in manual systems. For many property managers, these seemingly minor adjustments reveal thousands of dollars previously lost each year.

The Financial Value of Tenant Experience and Retention

Some of software’s most significant benefits are intangible but financially powerful. Resident satisfaction directly influences the bottom line by affecting renewals, referrals, and overall brand perception. Renters who receive quick responses, real-time updates, and well-organized communication tend to renew more frequently and participate positively in the community. Higher renewal rates reduce marketing spend, cleaning and renovation costs, vacancy days, and administrative work associated with processing new leases.

Poor communication, on the other hand, creates misunderstandings, frustration, and negative reviews all of which increase turnover. Every time a tenant leaves, costs multiply, and vacancy risk rises. When software consolidates communication into a unified system, messages are tracked, maintenance requests are recorded with transparency, and tenants feel respected and informed. This improved customer experience results in stronger relationships and predictable revenue, which are core assets in property investment.

Using Technology to Scale Without Expanding Staff Costs

One of the clearest indicators of ROI is the ability to grow a property portfolio without increasing payroll in proportion. Traditionally, managing more units required hiring more people. Scaling beyond a certain number became unsustainable. Software changes that equation. Automation allows a single manager to oversee significantly more units than was previously possible because most routine work no longer requires manual involvement.

When operations become scalable, the ability to expand without increased staffing becomes a competitive advantage. Growth becomes controlled rather than overwhelming, and profitability strengthens as revenue increases without mirrored expense growth. This is one of the strongest arguments for investing in digital platforms. They enable expansion without sacrificing quality or overloading teams.

How to Calculate Property Management Software ROI Using Real, Practical Formulas

Understanding the financial impact of software becomes much easier when broken down into measurable pieces. ROI isn’t an abstract concept, it’s a straightforward equation that compares what you gain against what you spend. The basic calculation almost everyone uses looks like this:

ROI = (Total Financial Benefits – Total Software Cost) ÷ Total Software Cost × 100%

To apply the formula realistically, managers need to assign values to the savings and improvements they experience after implementation. For example, if software eliminates 40 hours of manual work each month across an office team, those hours have a monetary value. Multiply those hours by the hourly labor rate, and you begin to see real returns. Similarly, if online payment reminders increase on-time rent and reduce collection workload, that benefit becomes part of the ROI. If vacancies are reduced by even 1 or 2 days per turnover due to faster leasing workflows, the recovered rental revenue should be counted too.

ROI becomes most meaningful when it is grounded in actual numbers from your operations, not generalized assumptions. Many property managers are surprised by how quickly returns accumulate when they intentionally track improvements. The moment they see that the software essentially “pays for itself,” decision-making shifts from hesitation to confidence. Calculation provides clarity, and clarity becomes strategy.

Measuring Indirect Returns and Hidden Financial Value

Beyond direct labor savings or faster payments, there are indirect advantages that hold significant financial weight, even if they are harder to quantify. For example, strong tenant communication and faster maintenance service build loyalty, increasing retention and reducing turnover costs. Turnovers are among the most expensive financial events in property management, as they involve lost rent, cleaning, repairs, advertising, showings, and screening. If software reduces turnover by simply improving communication quality, the financial outcome can be enormous.

Another indirect return comes from reducing errors. Manual data entry or undocumented approvals frequently lead to costly mistakes, missed charges, lost paperwork, misunderstandings between departments, or inaccurate reporting. Software centralizes information, creating transparency and accuracy. This lowers risk, protects against disputes, and ensures compliance. Mistakes quietly drain budgets, and eliminating them is a powerful form of ROI.

There is also reputational value. Word of mouth influences leasing decisions more than ever, and a digital presence often determines whether a prospective tenant applies. When a property is known for smooth service and organized processes, reputation turns into revenue. These softer benefits accumulate into real financial value over time, creating a stronger business foundation that compounds year after year.

Maximizing ROI After Implementing Property Management Software

Simply buying software does not automatically produce ROI. The return depends on how effectively the system is adopted and integrated into daily operations. Teams must learn to use automation features consistently rather than relying on outdated manual habits. Processes should be simplified, redundant work removed, and communication centralized on a single platform. The more fully the company commits to digital transformation, the greater the return.

One of the best strategies is to start small and expand quickly. For instance, begin by automating rent collection and maintenance tracking, then move into digital inspections, online lease renewals, and reporting. Each step frees additional time and reduces administrative strain. Training is equally important. When teams understand the value of new tools and feel confident using them, efficiency increases and resistance fades. Clear internal goals such as reducing collection time, decreasing vacancies, or improving tenant response speed also help maintain focus and measure success.

Another way to maximize ROI is to analyze software data to inform decisions. When performance metrics are visible response times, maintenance completion speeds, late payment frequency, lease renewal rates management can see exactly where improvement is needed. Digital visibility enhances accountability and ensures continuous development rather than complacency.

When Software Becomes an Investment Instead of an Expense

Many property managers initially worry about software pricing because they look at it as a cost. But once they view it through the lens of return through time savings, higher retention, lower vacancy loss, increased revenue control, reduced risk, and scalable growth the perspective shifts. It becomes clear that software is one of the few investments that simultaneously strengthens both the operational and financial sides of property management.

Instead of hiring additional staff when the portfolio grows, automation supports expansion. Instead of spending hours fixing problems, teams prevent them. Instead of reacting to emergencies, properties become proactively managed with predictable financial results. The long-term value continues to compound, benefiting not only current operations but also future planning.

The most successful property managers aren’t adopting software simply because others are. They’re choosing systems thoughtfully, calculating expected ROI, and using digital tools to stabilize business performance and increase profit margins. This future-focused approach separates modern leaders from those stuck in outdated models.

Conclusion

Calculating the ROI of property management software isn’t about guessing or hoping for improvement, it’s about understanding exactly how technology transforms performance and profitability. When measured correctly, property management software does far more than streamline tasks. It unlocks time, stabilizes finances, improves tenant relationships, reduces errors, creates growth capacity, and strengthens decision-making. The combination of financial and operational value is one of the most strategic moves a property manager can make.

Technology is not replacing human skill; it enhances it. It frees teams from repetitive strain and enables them to focus on meaningful work: retaining residents, improving communities, and building thriving rental portfolios. When ROI is calculated honestly, the conclusion becomes clear: modern property management is not complete without the tools that support efficiency, accuracy, and scalable growth. The question is no longer whether software is worth it, but how soon managers should adopt it to stay competitive.

Landlords relied heavily on instinct, experience, or basic bookkeeping to understand how their rental properties were performing. They looked at whether rent was paid on time, whether expenses seemed manageable, and whether the property remained occupied. And while intuition still plays a role, the modern rental industry has shifted toward a more reliable source: data. Today, the landlords who consistently outperform others are the ones who use property management KPIs to guides to maximizing rental ROI.

FAQs

How do I accurately calculate the ROI of property management software?

You calculate ROI by comparing the total financial gains from efficiency and revenue improvements with the total software cost using the formula: (net return ÷ total cost) × 100%. Include savings in labor hours, faster rent collection, reduced vacancy days, and fewer administrative errors.

What cost savings can property management software provide?

Software saves money by automating routine administrative tasks, reducing manual labor, eliminating duplicate work, and preventing costly mistakes. Improved organization and faster workflows also directly reduce operational expenses.

How soon can property management software begin paying for itself?

Many property managers achieve positive ROI within the first year, as improved efficiency and fewer vacancies quickly offset subscription costs. Even minor improvements in labor savings or rent collection consistency can produce a rapid financial return.

Does software increase revenue or only decrease expenses?

It does both. Software improves revenue by reducing turnover, speeding leasing, shortening vacancy timelines, improving renewal rates, and enhancing payment reliability. It also reduces expenses by lowering labor hours and admin workload.

What metrics should I track to monitor ROI over time?

Track administrative time savings, maintenance resolution speed, vacancy days per year, rent collection rates, renewal rates, and portfolio growth per employee. These indicators show whether the software is improving operational performance and profit.