by admin December 15, 2025

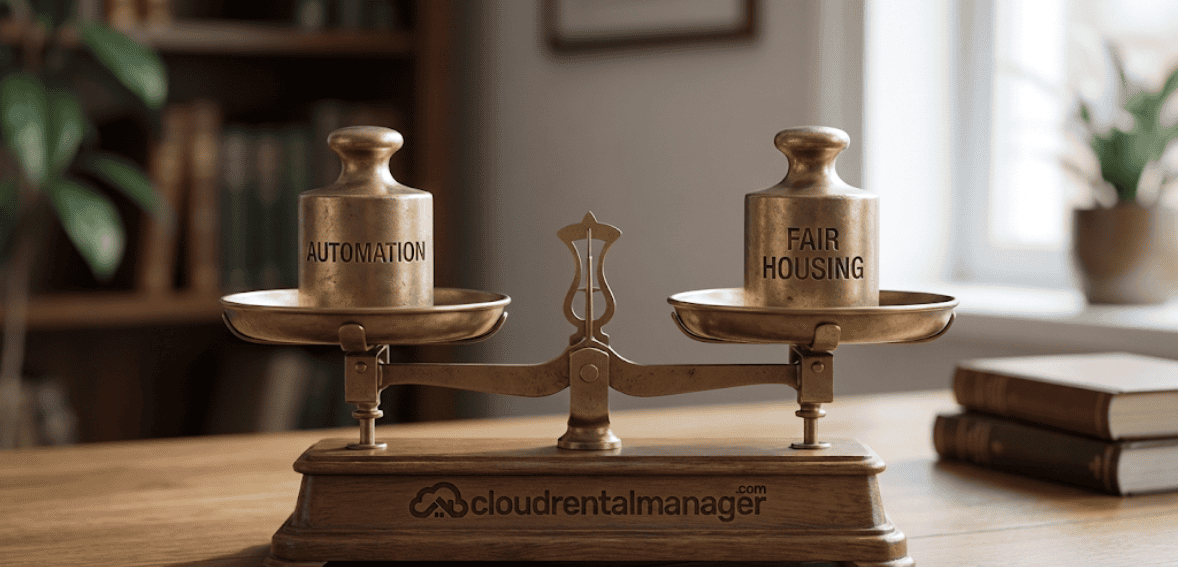

Tenant screening has shifted from manual paper applications and personal judgments to digital applications, automated background checks, and algorithm-driven tools. While this provides efficiency and consistency for managers and landlords in property management, it raises concerns about fairness, transparency, and access for tenants.

Fair housing laws prevent discrimination and require that housing decisions be based on legitimate, unbiased criteria. In the digital age, these protections extend to tenant screening software and AI-driven systems. The main challenge is ensuring technology aligns with fair housing principles, not just its use in screening.

This article explores fair housing in the digital age, focusing on how tenant screening software and AI-driven tools can support, rather than undermine, compliance. We’ll examine how modern screening works, where risks arise, and how property managers can confidently use technology while avoiding discriminatory practices.

The Evolution of Tenant Screening in a Digital World

Tenant screening has always existed, but the methods have evolved alongside technology. Historically, screening relied heavily on manual processes: landlords reviewed paper applications, called references, and made decisions based on limited information. While slower, these methods placed decision-making squarely in human hands.

Modern tenant screening software has largely replaced this manual effort. Today’s rental application screening tools can instantly evaluate credit history, criminal records, eviction filings, income verification, and identity checks. Some systems go further, using artificial intelligence to score applicants or flag “risk” based on large datasets.

From an operational standpoint, this evolution is a major improvement. Digital screening reduces processing time, improves record-keeping, and creates consistent workflows. However, consistency alone does not guarantee fairness. When technology automates decisions, it also amplifies any biases embedded in the data or logic behind the system.

Given these technological advances, it’s crucial to revisit the legal requirements that shape fair housing practices in tenant screening.

Understanding Fair Housing Obligations in Tenant Screening

Fair housing laws prohibit discrimination based on protected characteristics such as race, color, religion, sex, national origin, disability, and familial status. These protections apply at every stage of the rental process, including advertising, applications, screening, approvals, and denials.

These legal standards apply whether a human or an automated platform does screening. Property managers must ensure screening criteria are applied equally, with no protected group excluded without legitimate, business-related reasons.

One common misconception is that automation eliminates bias simply because decisions are not made by humans. In reality, algorithms are built by humans and trained on historical data. If past housing decisions reflected inequality or systemic bias, those patterns can be unintentionally carried forward into modern screening tools.

Property managers must understand both what their screening software does and how it functions.

Tenant Screening Software and Fair Housing Compliance

Tenant screening software can be a powerful ally in fair housing compliance when used correctly. The most effective systems are designed to standardize evaluation criteria and reduce subjective decision-making.

Consistent income verification, clear credit standards, and set rental history benchmarks help ensure all applicants are measured equally. Documenting and applying these rules evenly strengthens compliance.

However, problems arise when software outputs are treated as unquestionable decisions rather than decision-support tools. Automatically rejecting applicants without understanding the underlying reasons can pose risks, especially if the criteria disproportionately affect protected classes.

Best practice is to treat screening results as informational, not absolute. Property managers should retain oversight, review edge cases, and ensure that decisions are defensible based on legitimate business needs, such as the ability to pay rent or a history of lease compliance.

AI Tenant Screening Regulations and Emerging Concerns

Artificial intelligence has introduced new efficiencies and new complexities into tenant screening. AI-powered systems may evaluate applicants using predictive models that assess risk beyond traditional metrics like credit score or income ratio.

While these tools can improve accuracy in some areas, they also raise serious regulatory and ethical concerns. AI tenant screening regulations are still evolving, but regulators increasingly emphasize transparency, explainability, and accountability.

One major concern is opacity. If a system cannot clearly explain why an applicant was flagged or denied, it becomes difficult for property managers to ensure compliance with fair housing requirements. Another concern is proxy discrimination, where seemingly neutral factors (such as ZIP codes or employment patterns) indirectly correlate with protected characteristics.

As AI becomes more prevalent, property managers must ensure their screening tools align with fair housing requirements and withstand regulatory scrutiny.

Fair Housing and Algorithms: Where Risk Often Appears

Algorithms do not discriminate intentionally, but they can still produce discriminatory outcomes. This often happens in subtle ways that are difficult to detect without careful review.

Heavy emphasis on credit history can affect younger or unbanked applicants. Automated criminal checks may overlook the nature or timing of offenses, leading to unfair exclusions.

Fair housing and algorithms intersect most critically when screening tools lack flexibility or fail to allow contextual review. Systems that support individualized assessments, exception documentation, and human review are generally better aligned with compliance principles.

Property managers should avoid tools that promise “fully automated decisions” if those tools lack transparency or manual override options.

Avoiding Discrimination in Screening Through Policy and Process

Technology alone cannot ensure fair housing compliance. Strong internal policies and procedures remain essential, especially in a digital screening environment.

Clear written screening criteria should define acceptable income thresholds, rental history requirements, and credit standards. To stay compliant, apply these criteria uniformly to all applicants. Regularly review these standards to ensure they remain reasonable, up to date, and non-discriminatory.

Documentation is equally important. Use digital screening tools that enable secure record retention. Keep records of all screening decisions to demonstrate consistent application of criteria. When you deny applicants, provide accurate adverse action notices as part of your compliance process.

By combining consistent policies with well-configured technology, property managers can significantly reduce compliance risk while improving operational efficiency.

The Role of Transparency in Modern Tenant Screening

Transparency is a cornerstone of fair housing compliance in the digital age. Applicants increasingly expect to understand how decisions are made, especially when technology is involved.

Clear communication about screening criteria, application steps, and decision timelines builds trust and reduces confusion. When applicants know what standards they are being evaluated against, they are less likely to perceive bias or unfair treatment.

To best navigate these new challenges, property managers should actively review and refine their tenant screening processes. Evaluate current technologies for compliance, promote transparency in applicant interactions, and ensure staff are trained on both fair housing law and digital screening practices. By proactively prioritizing these actions, you can uphold compliance and foster trust in a rapidly changing digital landscape.

HUD Guidance and Regulatory Expectations for Digital Screening

As tenant screening tools become more sophisticated, regulators have made it clear that technology does not replace legal responsibility. In the United States, housing authorities consistently emphasize that fair housing laws apply whether people or software make decisions. This principle is especially relevant as artificial intelligence and automated screening systems become more common.

Regulatory guidance increasingly focuses on outcomes rather than intent. Even if a screening process is neutral on its face, it may still violate fair housing standards if it disproportionately excludes protected classes without a strong, legitimate business justification. This is why housing authorities encourage property managers to regularly review screening criteria and evaluate how technology-driven decisions affect applicants in practice.

Another key expectation is documentation. Digital tools must support recordkeeping that allows managers to demonstrate compliance. If a screening decision is challenged, the ability to demonstrate consistent application of criteria and clear reasoning for approvals or denials becomes critical. Technology should make this easier, not harder.

Managing Adverse Action Notices in a Digital Workflow

One area where compliance risk often arises is in the handling of adverse action notices. When an applicant is denied or approved with conditions based on screening results, certain disclosures are required by law. These notices explain why the decision was made and inform applicants of their rights to dispute inaccurate information.

Modern tenant screening software can automate parts of this process, but automation must be carefully configured. Notices must be accurate, timely, and aligned with the specific screening factors used. Generic or incomplete notices can create confusion and expose property managers to legal risk.

A compliant digital workflow ensures that adverse action notices are triggered correctly, include the appropriate disclosures, and are delivered in a reliable format. Equally important is ensuring that staff understand the process. Automation should support compliance, not obscure accountability.

Auditing Tenant Screening Systems for Fair Housing Alignment

One of the most effective ways to reduce risk in digital screening is through regular audits. Auditing does not require advanced technical expertise, but it does require intention and consistency.

An audit begins with reviewing screening criteria. Are income thresholds reasonable and consistently applied? Are credit standards aligned with legitimate business needs rather than arbitrary cutoffs? Are criminal background checks evaluated in the context of time elapsed and relevance to tenancy?

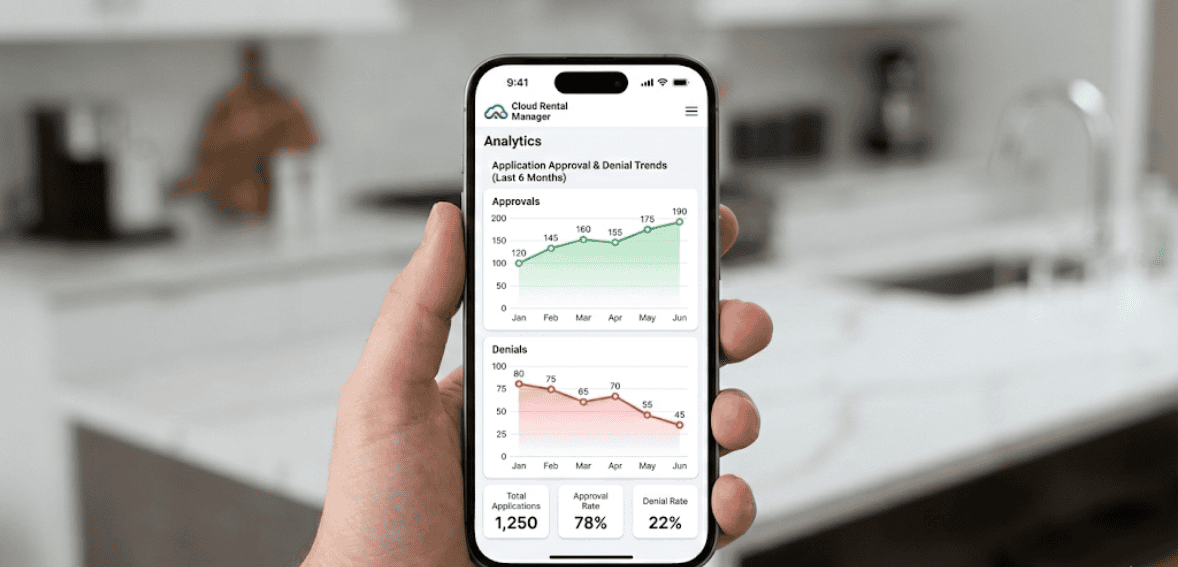

Beyond the criteria, audits should examine outcomes. If certain groups are being disproportionately screened out, it may signal a need to adjust criteria or introduce additional review steps. This is especially important when using AI-driven tools, where patterns may not be immediately obvious.

Audits also help reinforce accountability. They remind teams that technology is a tool, not a decision-maker, and that fair housing responsibility always rests with the property manager.

Balancing Efficiency and Individualized Review

One of the main advantages of digital screening is efficiency. Applications are processed faster, documentation is centralized, and decisions can be made faster. However, efficiency should never come at the expense of fairness.

Individualized review is a core concept in fair housing compliance. This means considering the full context of an applicant’s situation rather than relying solely on automated scores or flags. For example, a single negative mark on a credit report may not accurately reflect an applicant’s current ability to pay rent.

The best tenant screening software supports this balance by allowing manual review, notes, and exceptions where appropriate. This flexibility helps ensure that decisions remain fair, defensible, and aligned with housing laws.

Avoiding Over-Reliance on Risk Scores and Automation

Many modern screening platforms present results as risk scores or recommendation labels. While these tools can be helpful, they should never replace judgment.

Over-reliance on risk scores can create compliance issues, especially if the underlying methodology is unclear. Property managers should understand what factors contribute to these scores and how they align with established screening policies.

A strong compliance posture treats risk scores as one data point among many. Decisions should always be tied back to documented criteria and supported by clear reasoning that can be explained to applicants, regulators, or legal counsel if needed.

Training Teams for Fair Housing in a Tech-Driven Environment

Even the best technology cannot compensate for inadequate training. Staff members who handle applications, screening results, or applicant communication must understand fair housing principles and how they apply in a digital context.

Training should cover more than legal basics. Teams should understand how screening software works, its limitations, and when human review is required. They should also be trained on consistent communication, proper documentation, and respectful interactions with applicants.

Ongoing training is particularly important as software evolves. New features, AI enhancements, or workflow changes can introduce unintended compliance risks if teams are not prepared to use them correctly.

Choosing Tenant Screening Software with Compliance in Mind

Not all screening tools are equal. When evaluating tenant screening software, property managers should look beyond speed and cost to assess the software’s support for compliance.

Strong compliance-oriented platforms offer transparency into screening logic, flexibility in criteria configuration, and robust documentation capabilities. They support individualized reviews, maintain audit trails, and automatically generate compliant notices.

Equally important is vendor accountability. Providers should be willing to explain how their systems work and how they address fair housing concerns. While responsibility ultimately rests with the property manager, choosing the right technology partner makes compliance significantly easier.

The Future of Fair Housing in a Technology-First Industry

As digital screening continues to evolve, fair housing compliance will remain a dynamic challenge. Artificial intelligence, predictive analytics, and data-driven decision-making will likely become more sophisticated, not less.

The future of fair housing in the digital age will depend on thoughtful integration of technology with human oversight. Property managers who prioritize transparency, documentation, and regular review will be better positioned to navigate this landscape confidently.

Rather than viewing compliance as a burden, forward-thinking managers will see it as a framework that strengthens trust, reduces risk, and supports long-term success in an increasingly competitive rental market.

Conclusion: Technology as a Tool, Not a Decision Maker

Fair housing in the digital age is not about rejecting technology; it’s about using it responsibly. Tenant screening software and AI-driven tools can enhance efficiency, consistency, and recordkeeping when implemented thoughtfully.

Compliance requires more than automation. It demands clear policies, regular audits, staff training, and a commitment to fairness at every stage of the screening process. By keeping humans in the loop and maintaining transparency, property managers can confidently embrace digital screening while honoring the core principles of fair housing.

Technology should elevate decision-making, not replace accountability. When used correctly, it becomes a powerful ally in building fair, inclusive, and compliant rental communities.

FAQs

How does tenant screening software affect fair housing compliance?

Tenant screening software can support compliance by applying consistent criteria, but it must be configured carefully. Property managers remain responsible for ensuring outcomes do not unfairly impact protected groups.

Are AI-driven screening tools allowed under fair housing laws?

Yes, but they must follow fair housing requirements. Decisions must be explainable, non-discriminatory, and based on legitimate business criteria.

What is the biggest risk with automated tenant screening?

Over-reliance on automated decisions without human review. Algorithms can unintentionally replicate bias if not properly monitored.

Do fair housing rules apply to online rental applications?

Absolutely. Fair housing laws apply to all application methods, including digital and automated systems.

How can property managers reduce compliance risk with technology?

By using transparent screening criteria, conducting regular audits, training staff, and ensuring human oversight remains part of the decision-making process.