Knowing when to replace your property management software is the key to keeping your business running efficiently. When your portfolio expands, older systems can slow down operations, cause errors, and frustrate tenants or employees. Being aware of the signs that your current software does not suffice anymore ensures you invest in a solution that increases efficiency, enhances communication, and is capable of long-term growth.

Old System vs Modern Property Management Software

| Feature | Old System | Modern Property Management Software |

| Booking Management | Manually tracking bookings across Airbnb, Vrbo, and Booking.com | Channel management that syncs calendars and avoids double bookings |

| Guest Communication | Guest messages scattered across multiple inboxes | Unified inbox with automated guest messaging and templates |

| Payments | Manual payment requests and tracking | Online guest payments with automated reminders and secure processing |

| Financial Management | Spreadsheets for expenses and revenue | Real-time financial reporting and owner dashboards |

| Maintenance Requests | Guests call, text, or email to report issues | Automated maintenance requests with vendor assignments and tracking |

| Accessibility | No mobile access, tied to your desktop | Mobile-friendly app that keeps managers, cleaners, and co-hosts connected |

| Integrations | Limited integrations with other tools | Centralized system connected to OTAs, smart locks, accounting, and cleaning apps |

| Cost Efficiency | Rising costs with no added features | Transparent pricing with automation and core features included |

Indications That You’ve Grown Out of Your Existing Property Management System

Communication With Owners and Guests Feels Cluttered

Effective communication lies at the core of every effective short-term rental business. But when you’re struggling back and forth between Airbnb, Vrbo, Booking.com, SMS messages, and email, communication can become strained. This wastes time and causes you and your customers a lot of stress. The modern property management software makes it easy by consolidating all your messages in a single inbox.

You can view all your conversations in one spot, send speedy replies, and even program responses to answer those frequent questions. Owners also have their very own portal to access bookings, revenue, and reports, to stay updated without endless follow-ups. With a unified system communication becomes effortless, saving hours each week while improving guest satisfaction and owner relationships.

Your Payment Process Needs an Upgrade

Chasing payments, sending invoices, and managing late fees manually can become a daily headache. If your current system still relies on manual tracking, it’s time for an upgrade. An updated property management software simplifies collecting payments fast and securely.

Visitors can pay online with credit cards, ACH transfers, or e-checks. You can also automatically send rent reminders and generate payment reports with no additional effort.Also with an integrated owner portal, property owners can view real-time payment information and statements. This transparency eliminates confusion and strengthens your trust with your clients.

You Don’t Have Clear Financial Insight

Operating a rental company with no proper financial information means chasing your destination blindly. If your software doesn’t provide you with real-time insight into income and expenses, you have no choice but to work with spreadsheets and guesswork.

Modern property management software has integrated accounting and reporting capabilities that reveal where your money’s coming from in real time. You can monitor revenue, expenses, taxes, and profits from a single dashboard, which allows you to make better and quicker business decisions. It’s simpler with these insights to predict income, spot trends, and remain in complete command of your finances.

Your System Isn’t Mobile-Ready

Sometimes guests arrive early, cleaners require instant updates, and even some bookings occur at odd times. If your software isn’t mobile-friendly, you’re one step behind.

A mobile-optimized property management platform allows you to do all this from your smartphone, you can confirm reservations, assign maintenance, message guests, and check reports all from the comfort of your mobile. Your staff can also use the same system from their devices, to ensure everyone is in sync.

Managing Various Types of Properties Becomes a Challenge

When your business expands, you’ll probably be working with a combination of various properties—apartments, villas, or even hotels. But not all platforms are designed to accommodate this type of variety. A dynamic property management platform will easily transition between property types.

It’ll allow you to adjust specific pricing, automate guest communication, and monitor performance for listings in one location. With an updated system, you can scale your business with confidence without requiring individual tools for each type of property.

Your Software Doesn’t Integrate with Other Tools

If you find yourself constantly struggling between various platforms for bookings, accounting, pricing, and cleaning, then your system isn’t working for you—it’s working against you.Today’s rental software is the central platform, integrating all your business operations in one platform.

It ties into OTAs, payment gateways, accounting platforms, and smart devices such as locks and thermostats for you to work seamlessly. This eliminates redundant work and lost data between systems.When all systems are integrated, you save time, minimize errors, and provide guests with a more streamlined experience from reservation to checkout.

Security and Compliance are Falling Behind

Each reservation contains sensitive information—credit card numbers, contact data, and IDs. Without adequate safeguarding, you expose yourself to loss of reputation and guest trust.

A protected, cloud-based property management solution shields information through encryption, secure payment processing, and rigorous access controls. It also allows you to meet local privacy and payment standards, keeping both you and your guests secure.

Increasing Costs without Actual Value

If your software is becoming increasingly pricey without introducing new functionality, it’s time to rethink. Paying for added-cost features such as automated messaging or reporting eats into profit.

Search for a platform that offers clear and transparent pricing and continuous updates. A great provider introduces new functionality to aid your growth, without any hidden fees to complicate scaling.

Why Upgrading Your Property Management System Is Worth It

An updated property management system streamlines the tasks of collecting rent, scheduling maintenance, and performing tenant screenings, allowing for more critical work to be accomplished. It will also make accounting easier by producing invoices, monitoring payments, and mailing monthly statements automatically. This reduces errors, accelerates cash collection, and conserves time spent on financial handling.

But outdated solutions can be restrictive as they are only accessible from one site, are more expensive to maintain, and are hard to scale as your company expands. A cloud-based property management system eliminates these issues. Data can be accessed anywhere, it is easy to integrate with other software such as payment processors, and it includes automatic data backup and updating, which saves time and money.

Another significant advantage of contemporary software is enhanced data reporting and management. Rather than merely storing data, newer systems take it one step further by analysing it to provide useful information. You can get in-depth reports on rent, maintenance requirements, and property performance to enable you to make better and quicker business decisions.

Improved systems also enhance tenant and employee satisfaction. Tenants can simply log in via online portals or mobile applications to see rent payment history, maintenance reports, or inspection schedules without being on-site. For employees, mobile access enables them to work effectively from anywhere, minimizing errors and enhancing productivity.

Security and compliance are other major advantages. Updated systems allow you to monitor tasks such as insurance renewals, smoke detector checks, and pool safety certifications, so you never fall behind deadlines. Cloud platforms also include robust data security in the form of encryption, authentication, and automatic backups, which protect sensitive tenant and property information.

Lastly, updating your property management software saves costs in the long term. Automation is time-saving, increases efficiency, and improves tenant retention. Most contemporary systems also feature AI driven management tools for predictive maintenance, so you can identify and repair issues before they become costly. Overall, a contemporary, cloud-based property management system can make your business quicker, wiser, and more sustainable.

Features You Should Look for in an Updated Property Management System

When updating a property management system, it’s essential to select one that not only meets your present requirements but also facilitates growth. One of the leading features to search for is the ability to obtain access to historical reconciliations. This enables you to quickly retrieve old bank statements and financial transactions without going through files, making it simpler to monitor performance and remain audit-ready.

Monthly financial statements are a necessity, too. The system must automatically generate detailed reports listing rent payments, expenses, balances, and charges for every unit. Customizing these reports means you will always have the correct and current financial information to suit your preferred format.

Tenant charge management is also critical. Seek out software that allows you to add distinct charges or credits to every tenant account with ease. This maintains accurate billing and promotes transparency for both tenants and owners. Effective payable management is a capability that can save you hours of labor. The top property management systems enable you to input invoices, automate payments, and even print checks from the platform.

Add built-in bill payment features—such as electronic funds transfers or automatic check mailing—to further simplify your workflow. For extra safety, ensure the system allows the assignment of a single point of contact (SPOC) for online payment processing. This guarantees that only approved users handle sensitive payment arrangements. Digital check image access is another helpful feature, providing clarity and effortless record-keeping for each transaction.

Finally, consider a system that stores all owner and tenant information in an organized and easily adaptable manner. Selecting a property management system with such functionalities will save you time, minimize errors, and help you manage your properties better—all from a single, centralized dashboard.

Types of Property Management Software

Property management software exists in various forms to suit different needs and sizes of properties.

- Residential PMS: Simplifies the management of apartments, houses, or complexes. It manages rent collection, communication with tenants, maintenance requests, payments to vendors, screening of tenants, and everyday tasks via web or mobile applications.

- Commercial PMS: Suitable for offices, shopping areas, industrial premises, and malls. It assists with administration, maintenance monitoring, and financial reporting.

- Community PMS: Handles common areas within communities such as condos or townhomes. It addresses amenities, rule enforcement, and community money issues.

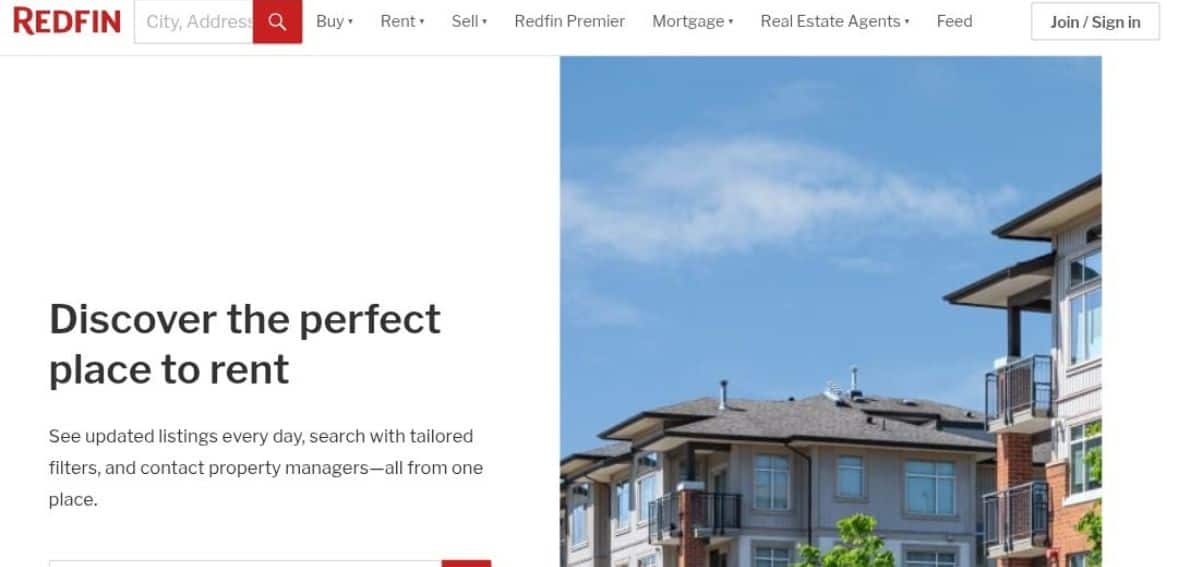

- Vacation Rental PMS: Ideal for short-term rentals, Airbnb, and holiday homes. It handles bookings, listings, guest messages, and property maintenance in one platform.

Integration with Other Systems

Having a property management software that integrates seamlessly with other systems makes it easier to handle properties. Integration enables various tools to exchange information, reducing time and errors. For instance, integration with accounting software guarantees complete financial data accuracy and transparency.

Integration with a CRM facilitates more efficient handling of tenant communications and relationships. Power BI tools can offer real-time dashboards for rapid insights and decision-making. Marketing platform integrations enable promotion of vacancies, and payment gateway connections enable easy online rent collection and security.

New Trends in Property Management Software

Property management software continues to improve with new technology, providing smarter and more effective ways of managing properties. Artificial intelligence and machine learning are utilized to forecast maintenance requirements, price optimization, and identify market trends before they occur. Not to forget Blockchain is assisting in the safety of lease transactions and agreements, making records more efficient and transparent.

Additionally big data provides bespoke property suggestions, providing tenants with a more intelligent search experience. Mobile apps enable managers to do tasks remotely, while virtual reality provides remote property tours, allowing prospective tenants to view spaces without visiting in person.

Conclusion

Upgrading your property management software can completely change the way you do business. A new system enhances efficiency, elevates tenant and staff satisfaction, and delivers improved financial insights. An investment in the correct software means easier operations, minimized errors, and a scalable solution that adapts to your expanding portfolio. Take the transition today and stay ahead in managing your properties with confidence.

FAQs

What are the signs that I should upgrade my property management software?

If your system is slow, not automated, or can’t handle multiple properties well, it’s time to upgrade.

Can multiple types of properties be managed with modern property management software?

Yes, most contemporary solutions enable you to manage residential, commercial, and vacation rentals all in one place.

Is cloud-based software better than server-based solutions?

Cloud-based software includes mobile access, real-time updates, and integration compared to conventional server-based systems.

Does an upgraded system assist in tenant communication?

Yes, it offers unified inboxes, automated messaging, and tenant and owner portals that facilitate smooth communication.

Will updating enhance financial management?

Yes, updated software offers real-time reporting, automated billing, and comprehensive insights to enhance accounting and tracking.