The accidental landlord is no longer a rare situation. In 2026, it became one of the most common types of rental property among market participants. These are not people who planned to build a rental portfolio or study real estate management for years. These are people who rented out a home because of a job move, an inherited property, a slow housing market, or a life change they did not expect.

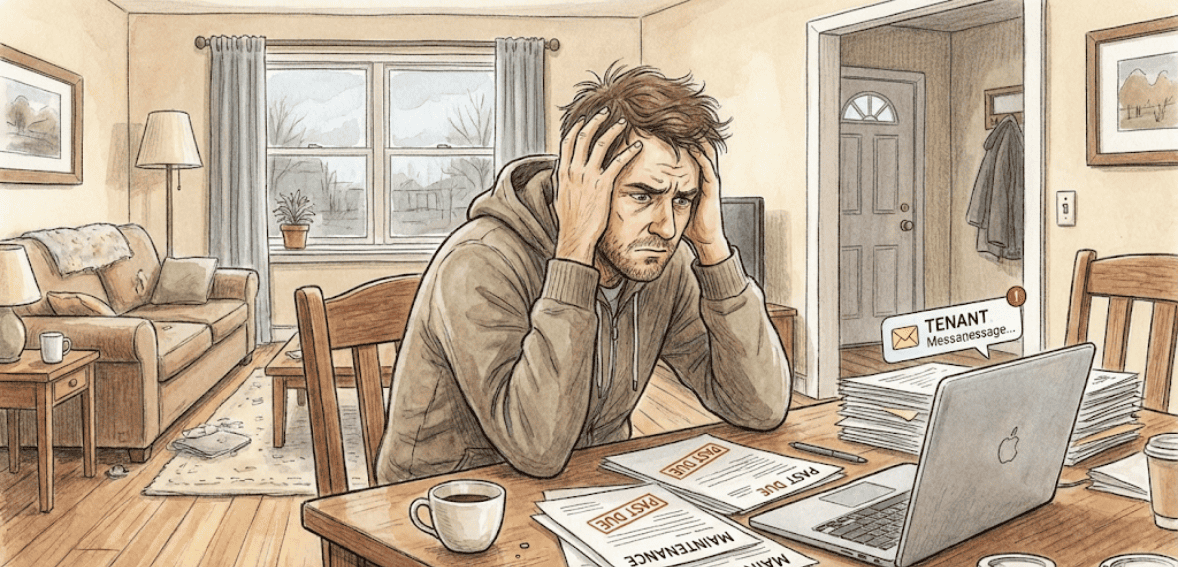

Many accidental landlords never planned to be landlords at all. They kept the property because selling did not make sense at the time. Or they thought renting would be simple. Find a tenant, collect rent, and that’s it. Then reality hits. Maintenance calls. Legal notices. Late payments. Tenant complaints. Suddenly, owning a rental feel like a second full-time job.

This shift has changed the landscape for property management services. Accidental landlords do not think like long-term investors. They worry more. They ask more questions. They are often emotionally attached to the property. And they usually do not understand the rules they are now responsible for following.

This is where property managers need to adapt. Traditional management approaches do not always work for accidental landlords. These owners need education, reassurance, and structure, not just rent collection. In this article, we will discuss why accidental landlords are increasing, the challenges they face, and how real estate management professionals can add real value rather than just offer basic services.

The Accidental Landlord Is Growing Faster Than Many Expected

The accidental landlord did not suddenly appear overnight. This trend has been building quietly for years. Economic uncertainty, remote work, delayed home sales, and rising interest rates have all played a role. Many rental property owners today did not plan to be in this position, but circumstances pushed them there.

Some owners moved for work and could not sell at a fair price. Others inherited property and were unwilling to sell. Some bought during a strong market and now find that selling would mean a loss. Renting became the temporary solution that turned into a long-term situation.

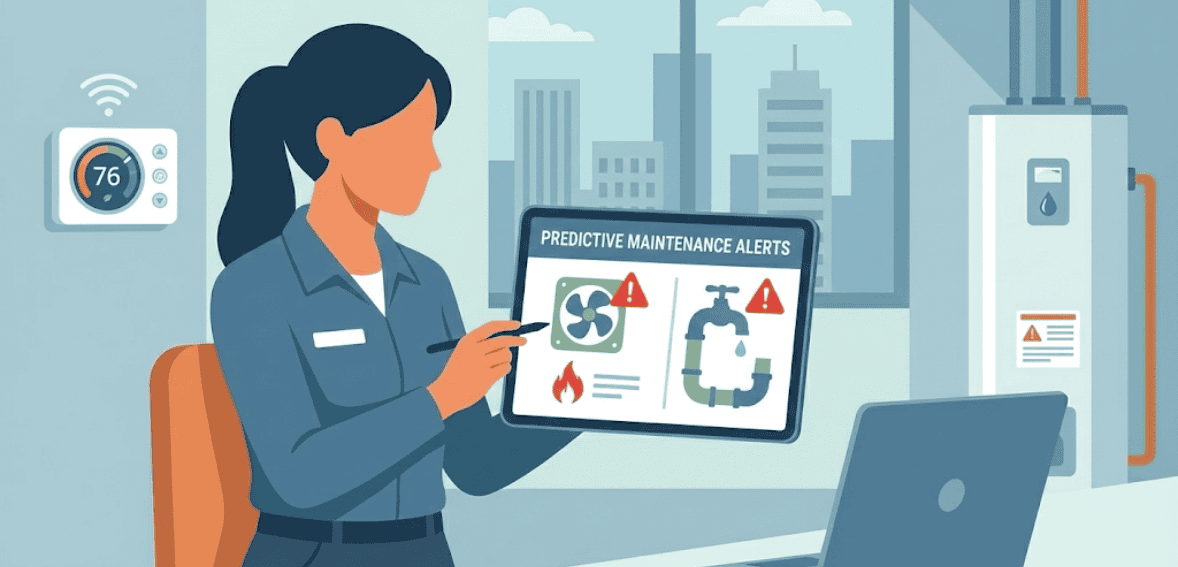

Unlike intentional investors, accidental landlords usually lack systems. They do not have vendor lists, maintenance plans, or legal knowledge. They may not even know the basics of landlord responsibilities. Real estate management suddenly feels overwhelming to them.

This is important for property managers to understand. Accidental landlords are not careless. They are inexperienced. And because they did not plan for this role, they often feel anxious about making mistakes. This anxiety shapes how they interact with property management services.

In 2026, this group continues to grow. Property managers who understand this shift position themselves better than those who treat all rental property owners the same.

Why Accidental Landlords Struggle with Real Estate Management

Real estate management is complex even for experienced investors. For accidental landlords, it can feel impossible. Laws, tenant rights, inspections, maintenance timelines, and financial tracking all land on their shoulders at once.

One major struggle is emotional attachment. Many accidental landlords are renting out what used to be their home. That makes tenant issues feel personal. Damage feels emotional, not just financial. This often leads to poor decisions, delayed repairs, or uncomfortable communication.

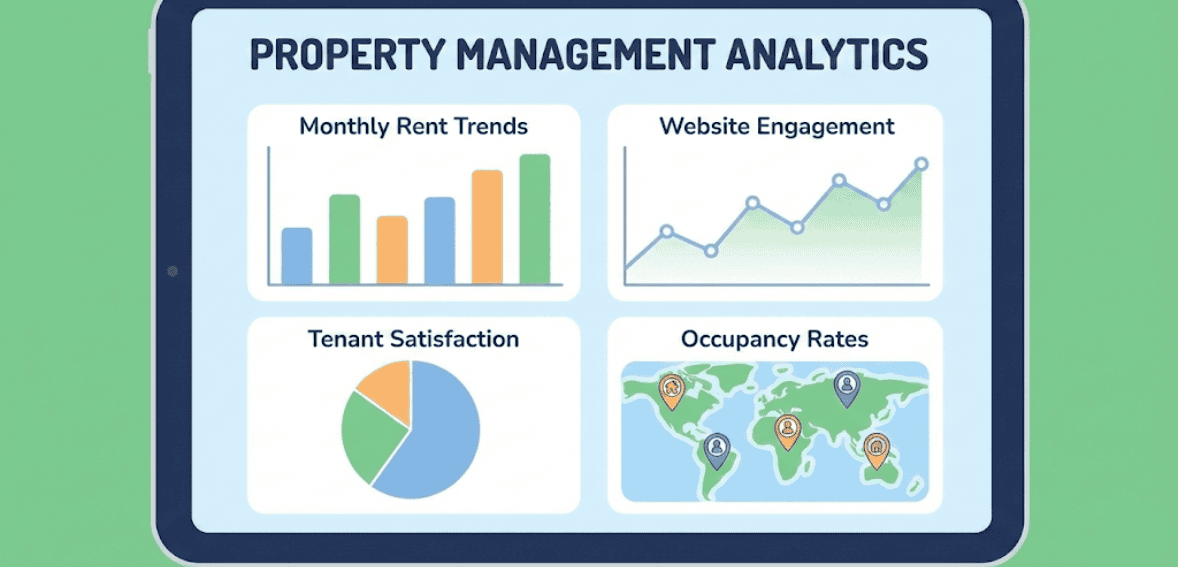

Another challenge is underestimating time and cost. Accidental landlords often assume rental income equals profit. They forget about vacancies, repairs, taxes, and compliance costs. When expenses appear, frustration follows.

Property management services often become a lifeline at this point. But only if those services are positioned correctly. Accidental landlords do not just need someone to collect rent. They need guidance, structure, and confidence.

Understanding these struggles helps property managers add value beyond visible tasks. It shifts the role from service provider to trusted partner.

The Gap Between Accidental Landlords and Professional Property Management

There is often a big gap between how accidental landlords think and how professional property management operates. Accidental landlords may want to approve every decision. They may hesitate on repairs. They may question fees without understanding the risk being managed.

This gap creates friction if not handled carefully. Property management services that focus solely on efficiency may come across as cold or dismissive. That pushes accidental landlords away instead of helping them adapt.

Real estate management professionals need to recognize this learning curve. Education becomes part of the service. Explaining why certain decisions matter, why compliance is important, and why proactive maintenance saves money builds trust over time.

According to Carter Jonas, while many accidental landlords did not originally plan to be long-term investors, they are now recognizing the value in expanding their property portfolios. Property managers who bridge this gap become indispensable.

How Property Managers Can Reframe Their Value for Accidental Landlords

For accidental landlords, value is not measured only in numbers. It is measured in peace of mind. Knowing that someone else is handling issues properly, legally, and professionally changes everything for these owners.

Property management services must focus on assurance as much as performance. Clear communication, regular updates, and patient explanations go a long way. Accidental landlords want to feel informed, not overwhelmed.

Real estate management also becomes educational. Teaching owners about timelines, legal requirements, and realistic expectations reduces conflict. Over time, accidental landlords either grow into confident rental property owners or decide to exit the market in a controlled way. In both cases, good management adds value.

The rise of the accidental landlord is not a problem for property managers. It is an opportunity. Those who adapt their approach will build stronger relationships and longer-term clients.

How Property Management Services Must Shift for the Accidental Landlord

Traditional property management services were built with experienced investors in mind. Owners who already understand cash flow, tenant law, and long-term planning. The accidental landlord does not fit that model. When property managers treat them the same way, frustration builds on both sides.

Accidental landlords need more explanation, not less. When a repair is recommended, they want to know why. When a tenant issue comes up, they want reassurance that things are being handled correctly. Silence makes them anxious. Short answers feel dismissive. Property management services need to slow down slightly and communicate more clearly.

This does not mean holding hands forever. It means recognizing that education is part of the service. Explaining processes early saves time later. Once accidental landlords understand how real estate management works, they stop micromanaging and start trusting the system.

Property managers who adapt their communication style keep these clients longer. Those who do not often lose them, even when the work itself is well done.

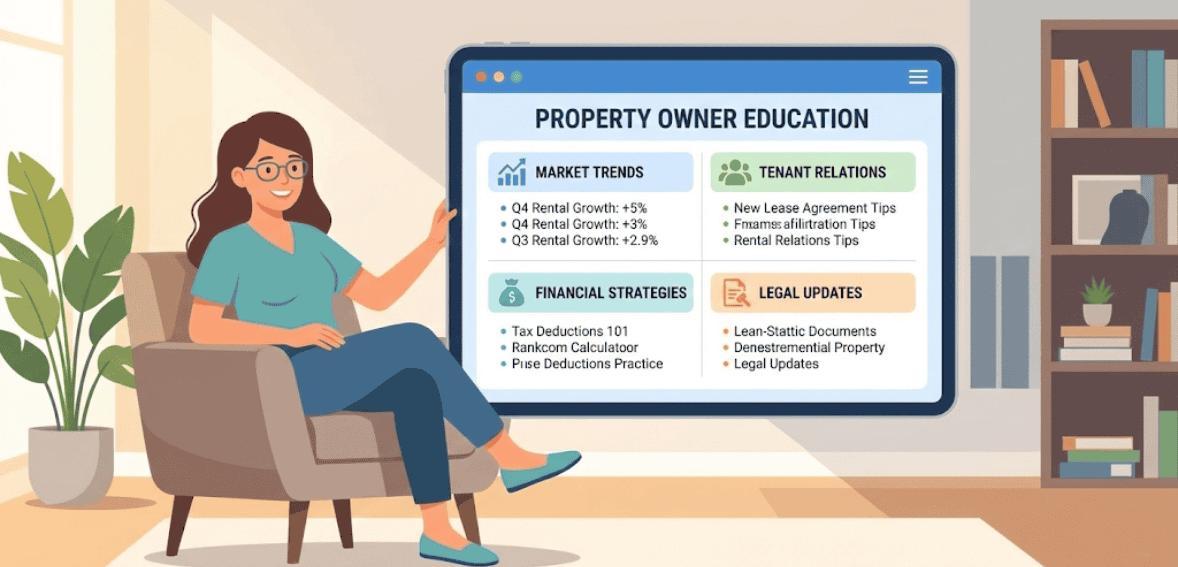

The Role of Education in Supporting Rental Property Owners

Education is one of the most underrated tools in real estate management. Accidental landlords are not asking questions because they want control. They ask because they feel exposed. They suddenly carry legal and financial responsibility they never planned for.

When property managers explain tenant laws, maintenance timelines, and realistic costs, something shifts. Fear turns into understanding. Resistance turns into cooperation. Rental property owners feel more confident in their decision-making.

Education also protects property managers. When owners understand why certain actions are taken, they are less likely to blame management when things go wrong. Expectations align. Conversations become easier.

In 2026, property management services that include education as part of onboarding and ongoing communication outperform those that do not. Accidental landlords do not want to become experts, but they want to understand enough to feel secure.

Why Accidental Landlords Redefine Value in Real Estate Management

For intentional investors, value often means returns, efficiency, and scale. For the accidental landlord, value feels different. It is emotional. It is about reducing stress, avoiding mistakes, and not feeling alone.

Real estate management for accidental landlords is as much about confidence as it is about performance. When owners sleep better knowing someone else is handling issues properly, value is delivered. When they stop worrying about legal notices or midnight repair calls, value is delivered.

This is why fee conversations feel different with accidental landlords. They may question costs more at first, but once the value is clear, price becomes less of an issue. Property managers who explain what problems they prevent, not just what tasks they complete, earn long-term trust.

The accidental landlord does not want perfection. They want stability.

Also read: From Landlord to Experience Manager: How Tech Is Redefining the Property Manager’s Role

How Property Managers Can Build Long-Term Relationships with Accidental Landlords

Not all accidental landlords will stay landlords forever. Some will sell once the market improves. Others will keep renting long-term. Property managers should not fear either outcome.

Strong relationships matter more than duration. When property management services properly support accidental landlords, those owners become referral sources. They recommend managers to friends, family, and coworkers who end up in similar situations.

Real estate management professionals who focus on relationships instead of transactions build reputation over time. Accidental landlords remember who helped them through stressful periods. That memory carries weight.

In many cases, accidental landlords eventually become intentional investors. When that happens, they already have a trusted property manager in place. That transition creates long-term growth opportunities.

Conclusion

The rise of the accidental landlord is reshaping property management in 2026. These rental property owners bring different fears, expectations, and needs than traditional investors. Property management services that adapt by focusing on education, communication, and reassurance add real value. Real estate management is no longer just about operations. It is about guidance, trust, and helping people navigate roles they never planned to take on. Property managers who understand this shift will not only survive but lead.

FAQs

What is an accidental landlord?

An accidental landlord is someone who rents out a property due to life circumstances rather than as part of long-term investment planning.

Why do accidental landlords struggle with property management?

They often lack experience, systems, and legal knowledge, and may feel emotionally attached to the property.

How can property managers add value for accidental landlords?

By offering education, clear communication, and structured support instead of just basic rent collection.

Do accidental landlords usually stay in the rental market long-term?

Some do, while others sell later, but good management helps them make informed decisions anyway.

Why is this trend important for property managers in 2026?

As the number of accidental landlords grows, adapting services strengthens client relationships.