Some landlords still do it the old-fashioned way – they collect rent in cash. It’s quick and simple, and might seem easy for small properties or tight-knit tenants. You count some bills and sign some fake signature and there you go.

But let’s be real—it’s 2025. Is accepting cash in rent still smart?

Nowadays, with digital rent collection tools springing up everywhere, the game has changed. They help us do things easier, faster, and most importantly safer. Whether you own one or 20 units, chances are you’ve thought about whether it’s time to make a change.

Cash may feel simple, but is it working for you?

In this blog post, we’ll run through it. The pros. The risks and why modern payment tool collection make it a breeze to accept payment. Let’s discuss what’s best for you – collecting rent in cash or digitally.

Pros of Accepting Rent in Cash

Let us discuss with the pros first. Collecting rent in cash can be beneficial and some landlords still benefit from this arrangement. Here’s why.

Immediate Payment, No Waiting

The moment you get rent in cash, the process is complete. No more having to wait three business days. Never experience the frustration of waiting for a bank transfer that hasn’t arrived yet. You can receive the cash in your hand right away. It is useful if your bills are approaching due, you need cash for repairs, or you just need immediate access to money. When we have cash, we have money we can use right now. No middleman. No delay. Landlords handling only a few rentals usually care most about getting things done rapidly.

No Processing Fees

Have you ever felt annoyed by having to pay credit card fees? Or the little fees that banks apply to ACH transfers? Such issues are not present when you collect rent in cash.

You can protect all the money your tenant provides. Every dollar. It really adds up the more time goes on, especially when you are running out of profit. Eliminating such extra costs seems like a great benefit for small landlords. Every month, you won’t lose 2–3% just to get your payment. It’s simple and the cash belongs completely to you.

Simplicity for Some Tenants

For many tenants, technology is not simple to access. A few individuals decide not to use credit cards. A number of people do not own a bank account. For people renting, the main choice is to pay rent in cash. This situation arises mostly in areas where not everyone is familiar with technology or has access to it. However, it’s also true that certain people believe in cash more than in digital alternatives. It’s based on their experiences.

Accepting the things they believe helps you find a common starting point with them. Doing this can enhance trust, help the landlord and tenant get along, and improve rent payment.

Risks of Accepting Cash Payments

Let’s face it—accepting rent in cash can be a real problem. Things that once were simple can now quickly turn into a problem. Here are the risks you face if you choose to take money in cash in 2025.

Security & Theft Risks

Cash is easily susceptible to theft and loss. As soon as your cash gets lost or stolen, you will not have it anymore. There’s no way to go back after making a transaction. If you have rent money or leave it in cash, you are only putting yourself at risk. There are also safety considerations, not only money issues. Troubles can occur when others realize you have a lot of money.

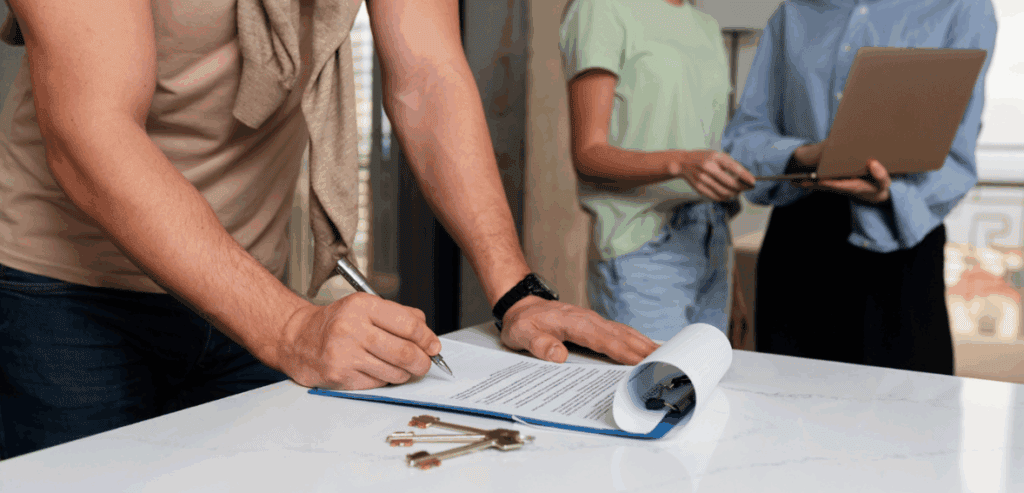

No Proof of Payment

Here’s where things get messy. Let’s say a tenant hands you cash. A month later, they claim they already paid. You say they didn’t. They say they did. Without a solid paper trail—like a digital receipt—you’ve got nothing to prove your side. And that’s a stressful place to be. Disputes over rent can spiral quickly, especially if there’s no clear documentation.

Tax Reporting Challenges

Handling taxes is not simple if you have a lot of cash. It is your responsibility to note down every payment you make. Skipped a few steps? That’s trouble. You are required by the IRS to have detailed information. If there is something wrong with the figures, it may lead to concerns. If you don’t keep track of amounts and records well, it can appear as if you are lying. You definitely don’t want that to happen during an audit.

Legal & Regulatory Red Flags

Depending on where you live, too much unreported cash can look suspicious. Some cities now require documented rent receipts. Others tie eviction protection and rent caps to proper paperwork. No record? You could lose your legal standing fast.

Why Digital Payments Are a Better Choice?

You won’t need to worry about cash, payments, or “you didn’t get my money” issues if you use digital. There are several cloud tools simplifying rental collection and financial reporting. They are safer, cleaner, and convenient for you. Here is why you should consider:

Built-In Payment Tracking

No more paper notebooks. You don’t have to guess anymore. You don’t have to track any details on your own, as digital platforms manage all the records for you. All payments are logged right away. A confirmation is sent to both you and your tenant. There’s no doubt about who sent money, when the transaction took place, or the amount transferred. When you have your rent in cash, you need to maintain records but that issue is resolved with digital payments.

Payment History Helps in Legal Disputes

Suppose we face difficulties that we didn’t expect while collecting rent in cash. Your tenant isn’t paying on time or is giving less money than the set amount. Showing proof of rent in cash can be quite complicated. But digital payments are not like this. You can review all your transactions with info like time, cost, and the documents received. If you need to face legal concerns, the information you have online can help and protect you. You can rely on the evidence.

Recurring Payments for Hassle-Free Collection

An outstanding feature is Auto-pay. The majority of digital rent platforms allow tenants to have payments made regularly. So, the rent gets paid on schedule, without you having to do a thing. It also makes sure your tenants meet their obligations. Those days of forgetting things and sending “Oops, I forgot!” texts are over. The platform commonly takes care of late fees, if you charge any.

How Payment Processors Simplify Rent Collection?

Payment processors are the tech behind your rent payments. Think Stripe, Square, or PayPal. They securely move money from your tenant’s account to yours.

But there are rental-specific tools too. Cozy, Avail, and RentRedi focus on landlords. They make rent collection easy and safe.

These platforms handle the money transfer so you don’t have to worry. No cash handling. No trips to the bank.

Options Tailored for Landlords

Some platforms go beyond payments. Rentec Direct, Buildium, and AppFolio combine rent collection with property management. Here are some property management trends for 2025 that can you need to keep an eye.

You can send invoices, track late fees, and manage leases all in one place.

This means less juggling between apps and spreadsheets. It’s all streamlined for landlords like you.

Faster Payments with Less Admin Work

No more counting rent in cash or chasing checks. Money goes straight into your account—sometimes the same day. That frees up your time and energy. You get paid faster and with less hassle. That’s a win-win.

Addressing Common Concerns About Digital Rent Payments

“What If My Tenant Doesn’t Use Digital Tools?”

Not everyone is tech-savvy. Some tenants might prefer rent in cash or checks.

Offer hybrid options like bank deposits, money orders, or apps like Venmo and Zelle.

You can also help by showing tenants how to use these tools. A little guidance goes a long way.

“Aren’t There Processing Fees?”

Yes, digital payments often have processing fees. But many landlords treat these fees as tax-deductible expenses. Some even include them in the lease or share them with tenants. The convenience usually outweighs the cost.

“Is It Safe?”

Digital platforms use bank-level encryption. They offer strong fraud protection. Carrying rent in cash puts you at risk, but these tools keep your money secure. You’re safer with digital payments than with piles of bills in your pocket.

Best Practices If You Still Accept Rent In Cash

Always Issue a Receipt

If you take rent in cash, always give a receipt. Use a numbered receipt book to keep things organized.

Make sure your tenant signs it, too. Keep a copy for yourself.

This simple step protects you both if questions come up later.

Store Cash in a Safe Place

Don’t leave cash lying around—especially not at home or in your car.

Keep it in a locked safe or secure box. Deposit the money into your business bank account as soon as possible.

The less cash you hold, the less risk you face.

Track Payments Digitally Too

Even with cash, you need a digital record. Use a spreadsheet or bookkeeping software.

Record dates, amounts, and tenant info to stay organized.

Good records make tax time easier and help avoid confusion.

Conclusion

Cash has some clear benefits. It’s quick, fee-free, and works for tenants without bank accounts.

But honestly, the risks often outweigh the perks. Safety, proof of payment, and legal headaches come with cash.

Digital payments bring peace of mind. They’re secure, fast, and professional.

For today’s landlords, going digital isn’t just a nice option—it’s a smart move.

If you want fewer hassles and more control, it’s time to make the switch.

Frequently Asked Questions

1. Is it legal to accept rent in cash?

Yes, it’s legal in most places. But check local laws. Some require receipts or digital records.

2. What’s the safest way to accept cash rent?

Always issue a signed receipt. Store cash securely and deposit it quickly into your bank.

3. How can I prove a tenant paid rent in cash?

Keep a receipt signed by the tenant. Also, maintain a payment log to back up your records.

4. Are digital rent payments secure?

Absolutely. They use encryption and fraud protection, making them safer than handling cash.

5. Can I charge tenants fees for using digital payments?

Some landlords do. Fees are often tax-deductible or split with tenants. Be clear in your lease terms.